Shares of Salesforce (CRM) are roaring on Thursday, up nearly 12% at last check. At the session highs, the stock was up 16% as investors cheered the software company’s latest earnings report.

Based on the results, it’s not hard to see why. Salesforce grew its revenue 14.3% year over year, while beating earnings and sales expectations.

Don't Miss: EV Stocks Stumble as Nio, Rivian Earnings Disappoint. What's Next?

The company generated operating cash flow for the year of $7.1 billion, “the highest cash flow in our company’s history and one of the highest cash flows of any enterprise software company our size,” according to Chief Executive Marc Benioff.

Finally, management’s first-quarter and full-year revenue outlook topped expectations, while its full-year earnings outlook also came in ahead of analysts’ expectations.

It’s no wonder investors are cheering the results and one would think the company’s multiple activist investors would be pleased.

Trading Salesforce Stock on Earnings

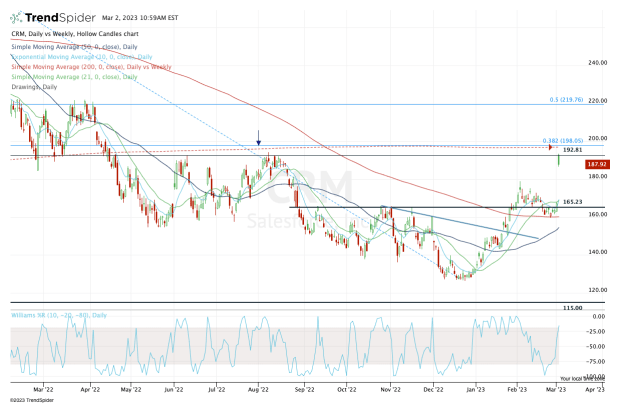

Chart courtesy of TrendSpider.com

Salesforce shares opened near the session high and promptly dipped. Where it faded from is no surprise, at least not to those who use technical analysis.

After reclaiming the key $165 area ahead of the earnings report, there were concerns about whether the stock could continue higher.

Don't Miss: Kohl's Chart: 7% Dividend Yield Can't Buoy the Stock

Well, not only is it continuing higher, it’s ripping to the upside and hitting 2023 highs. That said, it ran right into the $192 level, which was a key support/resistance level from 2022.

Despite today’s mild fade, the bulls are still in control.

As long as the stock holds up above the $178 to $180 area and the 10-day moving average, then it’s very hard to be a seller of this stock.

On the upside, a push through the $193 to $194 zone opens the door to the $198 to $200 area. That’s where Salesforce stock finds the 200-week moving average and the 38.2% retracement.

Above $200 and the $220 mark could eventually be in play.

For now, the bulls are firmly in control of Salesforce stock after its earnings results.