NEW YORK—Despite recent turmoil in the banking sector that has roiled the financial markets, S&P Global Ratings have revised upwards their economic growth and ad forecasts based on a prediction that the expected economic recession in Q2 2023 and Q3 will be shallower than expected.

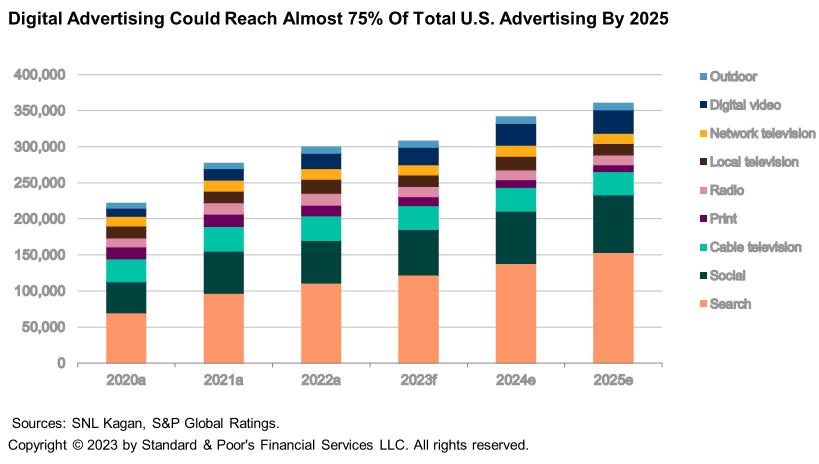

The new ad forecasts also include the prediction that digital advertising could pass a significant milestone in 2025 by accounting for three quarters of all U.S. advertising.

“We believe visibility into current advertising trends is limited as advertisers remain cautious on the outlook for consumer spending and continue to make spending decisions closer to airtime,” said Naveen Sarma, senior director, U.S. Media & Telecom, S&P Global Ratings. “In our opinion, the U.S. advertising ecosystem is behaving exactly as one would expect it would act if it believed that we were heading into a macroeconomic recession.”

S&P Global Ratings is reporting that its economists updated their expectations for U.S. GDP growth to 0.7% in 2023 and 1.2% in 2024, expecting a very shallow recession during 23Q2 and 23Q3. As a result, S&P raised its 2023 U.S. ad forecast by 20 basis points to 2.8% reflecting that any recession in 2023 will be shallower than previously expected.

It also raised its estimates for radio and local TV to a decline of 10% for radio and a decline of 17.1% for local TV in 2023.

The new ad forecasts are:

- “2023 National TV Advertising Forecasts: expects a decline of 4.4%; cable network to decline 4% due to rapidly declining audience ratings putting downward pressure on inventory prices; broadcast TV to decline 5.2% due to the lack of Olympics in 2023" S&P reported.

- "2024 National TV Advertising Expectations: modest rebound by 1.7% as broadcast TV will grow 7.7%, benefitting from the 2024 Summer Olympics; cable networks will see a 1% decline in advertising due to continued weakening audience ratings; National TV will increasingly become a tale of have's and have-not's, specifically those broadcast and cable networks that have a strong stable of sports, particularly the NFL, and news, especially in a Presidential election year;"

- "2023 Local TV Advertising Forecasts: will continue to perform better than national advertising given its focus on the bottom of the funnel campaigns;"

- "2023 Radio Advertising Forecasts: we raised our forecast by 500 bp to a 10% decline given our expectations for a shallower recession;"

- "Outdoor Advertising: we raised our 2023 forecast by 200 bp to 5%. Over the long term, we believe outdoor advertising remains an attractive way to reach consumers given its captive audience of drivers, commuters, and pedestrians - especially, with digital billboards allowing companies to quickly book business;"

- "Digital Ad Growth Expectations are unchanged for 2023 at 9.0%; we expect 2024 growth to be slightly higher at 10.5%. We believe that digital advertising is a leading indicator of economic activity therefore, we expect improvement ahead of other forms of advertising;"

- "2023 advertising should benefit from the return of auto advertising, as inventories return to normal, manufacturers launch new EV models, and from consumer travel advertising,” S&P reported.