A little bit of history. In October 2022, the Standard & Poor's 500 Index was staggered by six straight days of losses, ending on Oct. 12 with the index at 3,577.

The loss was 5.64%, not huge as short-term losses go. But since Jan. 3, 2022, the market had fallen more than 25% as the Federal Reserve was waging a major campaign to remove inflation from the American economy.

Don't miss the move: Subscribe to TheStreet's free daily newsletter

The Oct. 12 close proved the lowest the index would decline during the Fed's campaign, even though the Fed would continue to raise its key federal funds rate until July 2023, when it reached 5.25% to 5.5%.

Related: Tesla fumbled the perfect opportunity to surprise its EV rivals

The reason: Smart money sensed the interest-rate increases would end, and it was time to prepare for it.

The S&P 500's gain in the two years since that 2022 bottom: 62.6%.

The question now, as the S&P 500 and the Dow Jones Industrial Average hit new highs on Friday and third-quarter 2024 earnings are coming in, is this: How strong is the rally?

S&P 500 produces big returns on the back of lower rates

The past week's performance suggested the rally is plenty strong.

The S&P 500 closed above 5,800 for the first time. The Dow Jones Industrial Average ended at a record 42,864; two days produced daily gains of more than 400 points. The Nasdaq was up 1.1%, but a few stocks suggested breakouts.

Best of all, the indexes have risen for five straight weeks despite worries about broadening the war in the Middle East and the ongoing tensions of the Presidential election.

Plenty of analysts and pundits believe the rally has more to run, citing among other things:

- The Fed has vowed to continue to cut interest rates.

- The rate on a 30-year mortgage was above 8% at its peak in October 2023; it's now at 6.6% and could be headed lower.

- The economy has not fallen into recession as many economists and bankers had predicted a year ago.

- The national unemployment rate was 4.1%, according to the Labor Department's Oct. 4 jobs report.

"Strategists and economists are in a bind, and they're about to tell clients they must be fully invested, leading to an explosive new leg higher in the bull market," Jon Markman, who runs a Seattle money-management firm, wrote on Friday.

Some very big earnings reports this week

The week ahead has earnings coming from giant and important companies including:

- UnitedHealth Group (UNH) .

- Johnson & Johnson (JNJ) .

- Dutch chip equipment company ASML Holding (ASML) .

- Taiwan Semiconductor (TSM) , which makes the chips Nvidia (NVDA) , Arm Holdings (ARM) and others design

- Investment houses Goldman Sachs (GS) and Morgan Stanley (MS) .

- Airlines United Airlines (UAL) and Alaska Air Group (ALK) .

FactSet, the business analytics company, is projecting a 7% year-over-year rise in third-quarter earnings.

That would be the fifth straight quarter of year-over-year earnings growth, the company said.

The economy asserts itself later this week

The big economic reports come on Thursday and Friday:

- Initial jobless claims, expected at about245,000, down slightly from this week's 258,000. Thursday.

- U.S. retail sales, expected to show a 0.3% gain. Thursday.

- Industrial production, showing a decline because of the strike at Boeing Co.BA. Thursday

- Capacity utilization, which measures how much of industry's potential is actually used. Thursday

- Home builder confidence, which may decline because rising mortgage rates since the Fed cut its key interest rate in September. Thursday.

- Housing starts and building permits, key economic indicators because the nation suffers from a housing shortage and because construction is so sensitive to interest rates. Friday.

The external risks the stock market faces now

There are external worries that have affected markets increasingly in the last few weeks.

The rising Middle East tensions. It's been a year since the terrorist group Hamas invaded southern Israel from Gaza, killing 1,200 in Israel.

Reports suggest Israel's retaliation has now killed upwards of 42,000. The conflict has seen Iran twice launch missiles at Israel and threaten the use of nuclear weapons. Israel has lately attacked southern Lebanon, where Hezbollah is based.

Related: Walmart battle with its biggest rival comes to a crossroads

The Presidential election. It's unclear who is ahead in the race between Kamala Harris and former President Trump. But it is bitter and filled with massive disinformation. Court battles after Nov. 5 look certain.

Rebuilding in Florida and other states. Hurricanes Helene and Milton caused heavy damage and deadly flooding in Florida, Georgia, South Carolina, and North Carolina. It will take time to start the rebuilding. When it happens, the recovery will actually boost the overall U.S. economy.

The one internal market force to watch this week

Frenzied speculation in tech stocks broke out in 2023 as the emergence of artificial intelligence made Nvidia and other tech companies household names.

More Wall Street Analysts:

- Analysts update Meta stock price target with Q3 earnings in focus

- Analysts update outlook for Nvidia's Blackwell chips amid AI boom

- Analyst reboots Reddit stock price target ahead of earnings

The stocks jumped in 2023 and again in 2024 until, finally, the Nasdaq and S&P 500 were so pricey that their relative strength index levels, which measure how fast markets are moving, soared into the 80s. And smart money got out.

RSI is a powerful sell-and-buy signal. Above 75 and certainly by 80, RSI suggests a stock is about to slump. Below 30 and certainly by 25, it says a stock may be a buy.

Nvidia's RSI topped 81 in June, and its shares slumped more than 11% by August. So did a lot of other stock stocks.

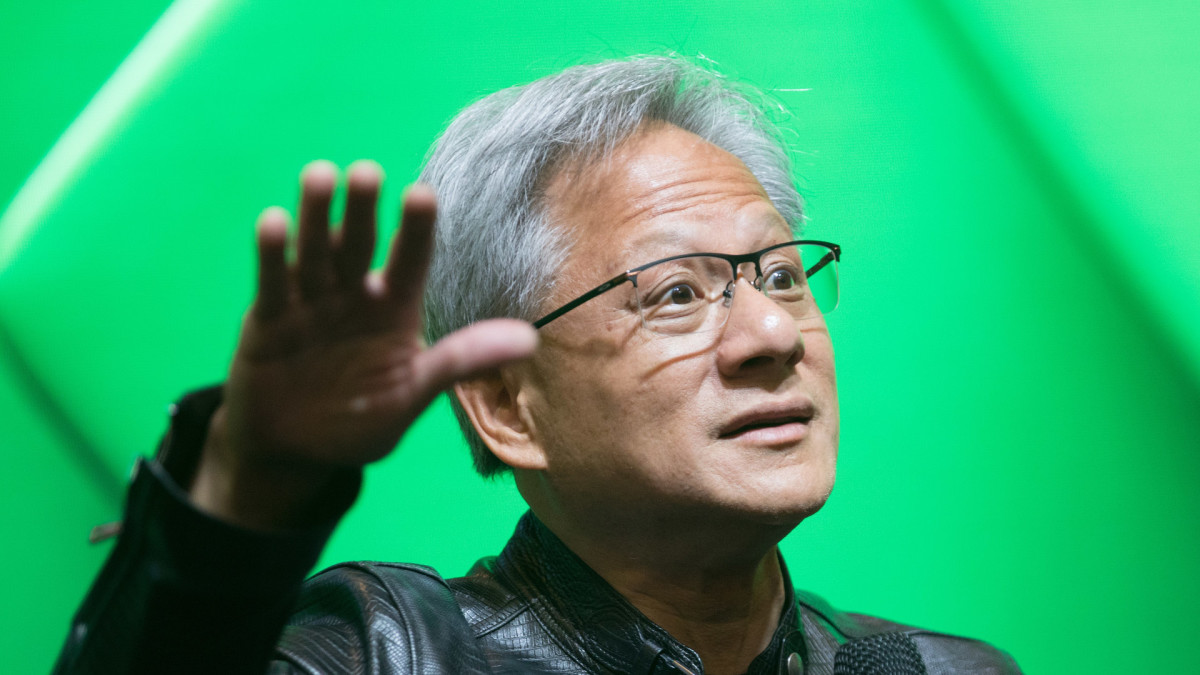

The shares are surging again, up 12% since mid-July, especially after CEO Jensen Huang told CNBC that demand for the company's new Blackwell graphics processing unit was "insane."

So insane that, recently, Morgan Stanley (MS) suggested Nvidia could deliver 450,000 Blackwell units in the fourth quarter generating some $10 billion in sales.

But watch out. Nvidia's RSI was at 68 on Friday, not overbought — but getting closer.

Related: Veteran fund manager sees world of pain coming for stocks