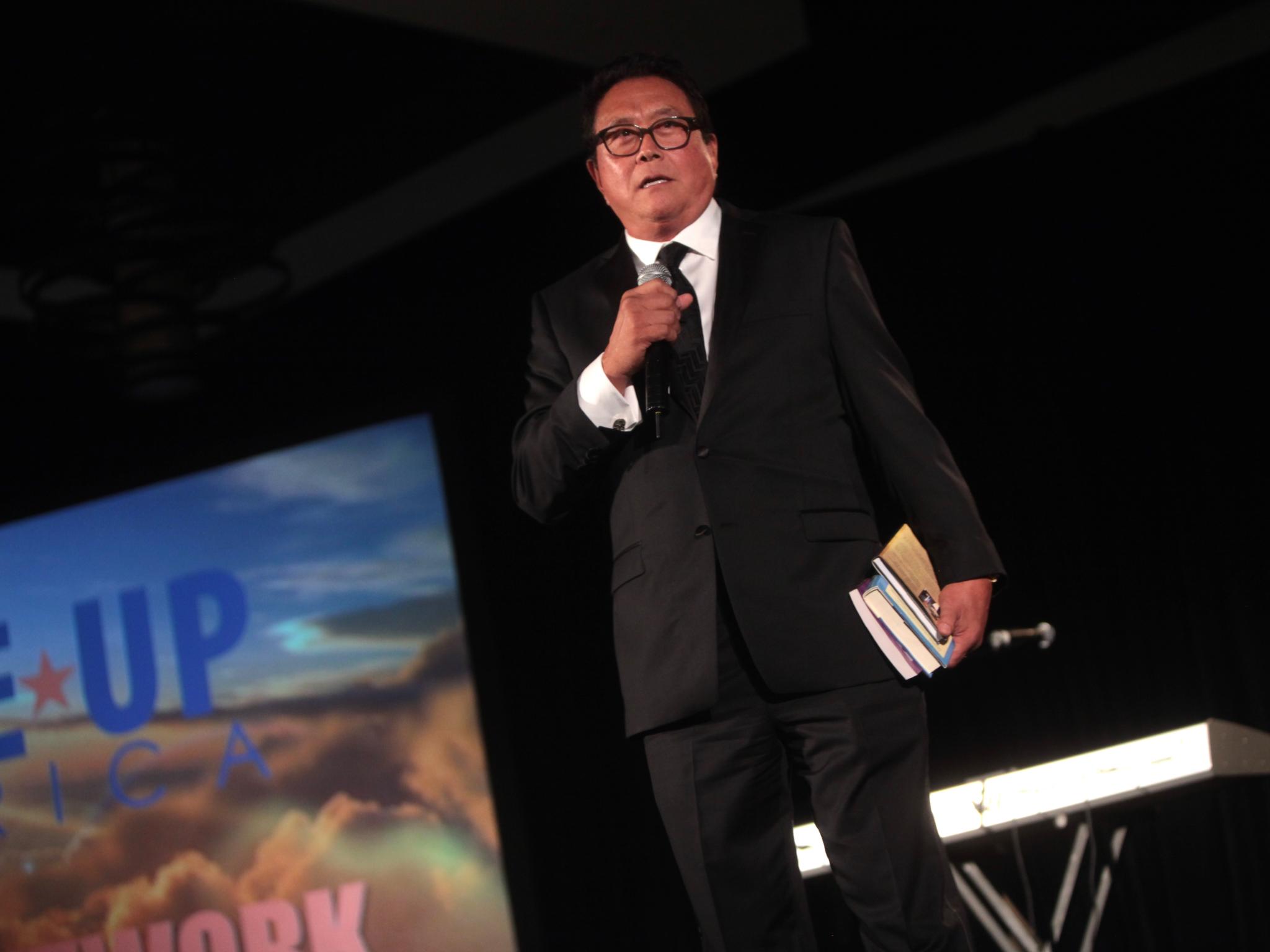

The recent market malaise has hit financial assets across the board. "Rich Dad, Poor Dad" author Robert Kiyosaki, however, has been recommending buying silver, gold and Bitcoin (CRYPTO: BTC) amid the market and economic turmoil.

What Happened: The best-selling author on Tuesday reaffirmed his call for silver going to $100-$500. To support his point, he threw in an anecdote. He said he was informed by his gold and silver dealer that he could not buy gold or silver coins as the mint would not sell him anymore.

This signaled the end of the “FAKE $,” Kiyosaki said in the tweet.

“Get some. Protect yourself,” he added.

END is HERE. Called Jerry Williams my trusted gold and silver dealer. He said “I can’t get gold or silver coins. The mint will not sell me anymore.” To me this means the end of FAKE $ is here. As stated in earlier tweet silver going to $100 to $500. Get some. Protect your self

— therealkiyosaki (@theRealKiyosaki) September 20, 2022

This is in line with his stance last week when he called for accumulating silver as the metal's price was moving sidewards even as stocks, bonds, mutual funds, ETFs and real estate were crashing.

He expects silver to stay at $20 for three to five years and then climb to $100 to $500.

See Also: What is a commodity

Why It's Important: One can invest in silver through different avenues such as:

- Physical silver, either as bullion or coin

- Silver futures

- Exchange-traded funds that own silver or silver-specific ETFs

- Silver-mining stocks

Spot silver is currently trading at $19.368 an ounce and the following are the returns if it rallies to $100-$500 over three to five years as Kiyosaki predicts:

- A $1,000 invested now in silver would fetch 51.63 ounces of the metal. This investment will grow to $5,163 if silver hits the lower bound of the estimate and $25,815 if it soars to $500.

- In a three to five year investment horizon, an investor can generate a return of 416%-2482%.

Price Action: The iShares Silver Trust (NYSE:SLV) ended Wednesday’s session 1.86% higher at $18.06, according to Benzinga Pro data. The gain came amid the broader market downturn following Wednesday’s Fed decision. The SLV, however, is down about 15% year-to-date.

Photo: Courtesy of Wikimedia Commons