According to the Wall Street Journal, the Department of Justice (DOJ) has told the PGA Tour of its plan to conduct a review of the proposed merger with the Public Investment Fund (PIF) of Saudi Arabia, which bankrolls LIV Golf.

A "framework agreement" to combine the commercial assets of the PGA Tour, DP World Tour and the PIF into a new, for-profit entity was announced last week. Few were involved in brokering the deal the PGA Tour said would "unify the game of golf" following the launch of LIV Golf that created division in the male ranks and led to a war of words that spilled into the courtrooms.

The PGA Tour announcement also included news that an "end to all pending litigation between the participating parties" had been agreed.

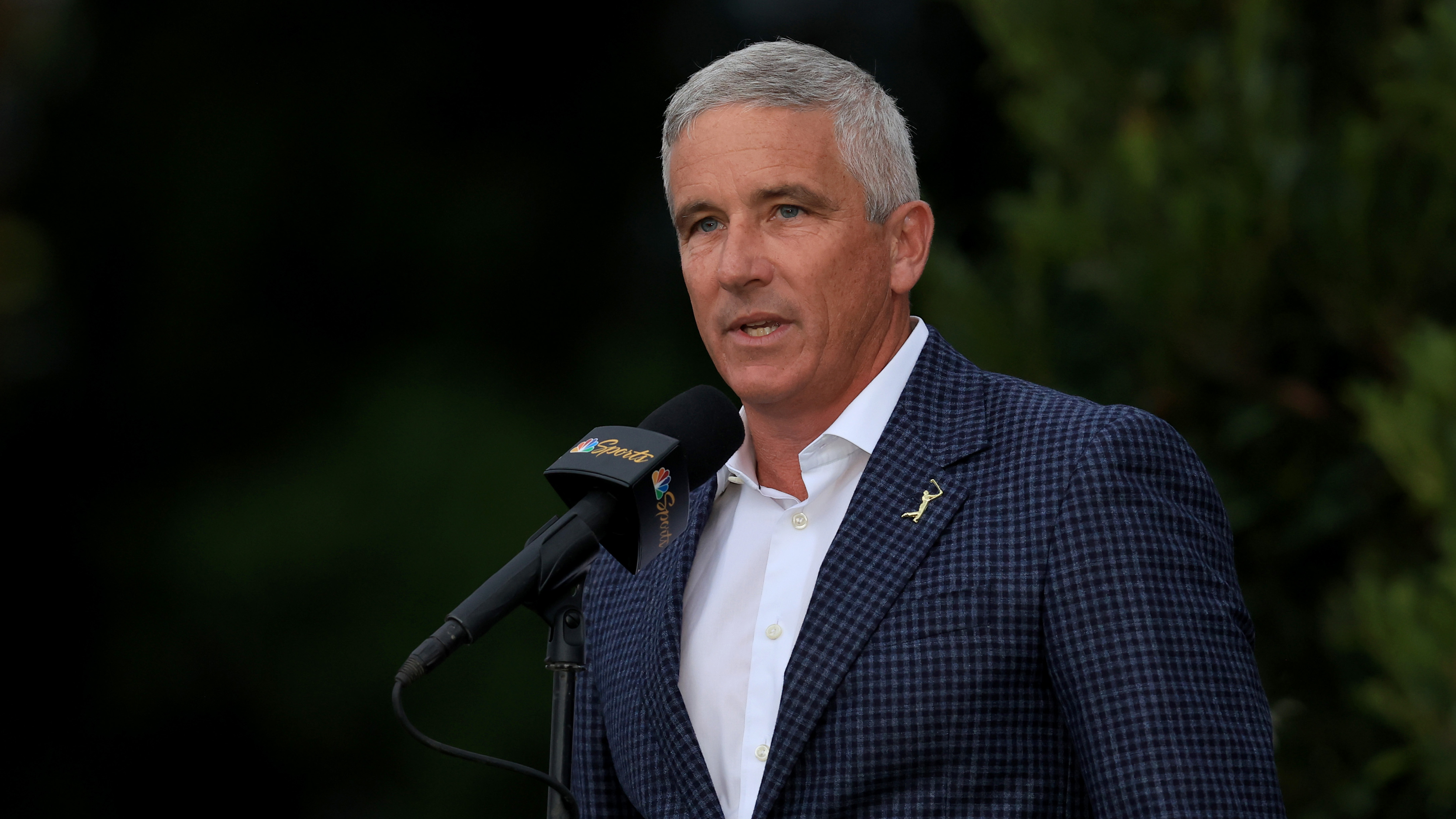

However, the legality of the deal has since come under scrutiny. The US Senate has opened an investigation into the merger, with letters sent to PGA Tour commissioner Jay Monahan and LIV Golf CEO Greg Norman requesting access to a wide range of information dating back to October 2021.

Among the list of demands, US Senator Richard Blumenthal asked for all communications between the PGA Tour, LIV Golf and the PIF during the period in question, as well as details of how the new entity will be structured and how the PGA Tour plans to maintain its tax-exempt status.

Now the Justice Department, which was already investigating claims made by LIV Golf that the PGA Tour had engaged in anticompetitive behaviour, is also set to review the planned merger.

Andrew Beaton and Louise Radnofsky of the Wall Street Journal reported that "people familiar with the matter" have revealed that the PGA Tour has been told of the DOJ's intention to scrutinise the deal for "antitrust concerns".