/Regeneron%20Pharmaceuticals%2C%20Inc_%20pharmaceuticals%20by-%20okskaz%20via%20iStock.jpg)

Tarrytown, New York-based Regeneron Pharmaceuticals, Inc. (REGN) discovers, invents, develops, manufactures, and commercializes medicines for treating various diseases. Valued at $81.6 billion by market cap, the company's portfolio boasts nine marketed drugs - Eylea, Dupixent, Praluent, Kevzara, Evkeeza, Libtayo, Inmazeb, Arcalyst, and Zaltrap. The biotechnology company is expected to announce its fiscal fourth-quarter earnings for 2025 before the market opens on Friday, Jan. 30.

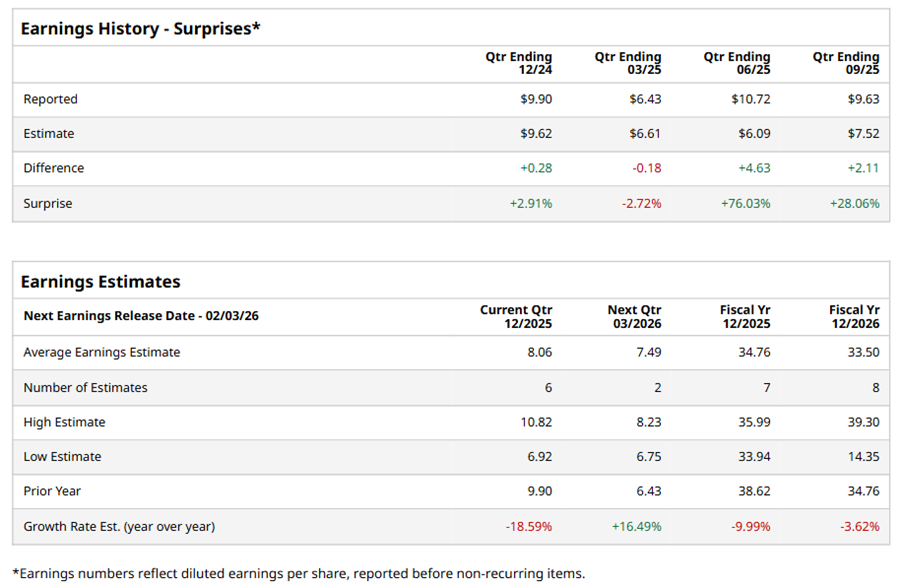

Ahead of the event, analysts expect REGN to report a profit of $8.06 per share on a diluted basis, down 18.6% from $9.90 per share in the year-ago quarter. The company beat the consensus estimates in three of the last four quarters while missing the forecast on another occasion.

For the full year, analysts expect REGN to report EPS of $34.76, down 10% from $38.62 in fiscal 2024. Its EPS is expected to decline 3.6% year over year to $33.50 in fiscal 2026.

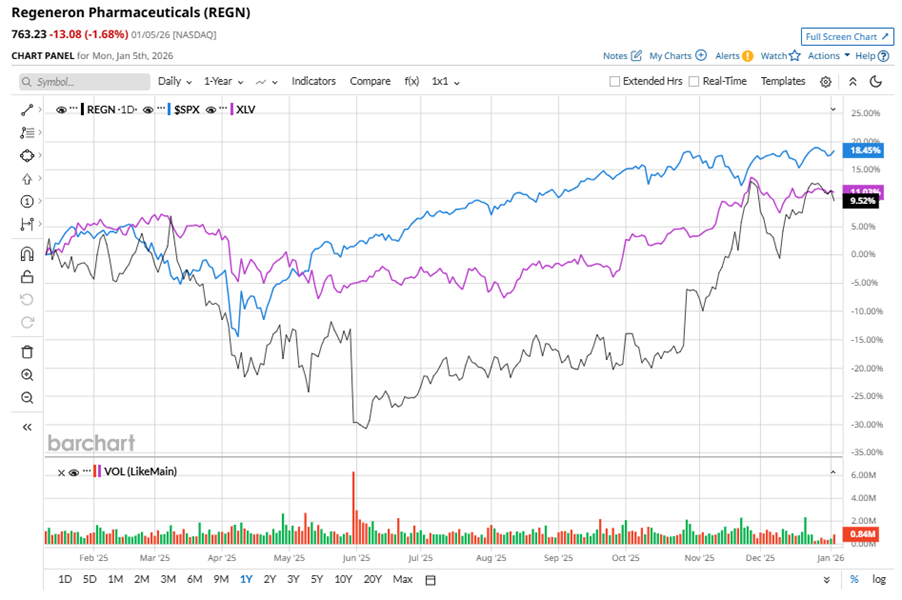

REGN stock has underperformed the S&P 500 Index’s ($SPX) 16.2% gains over the past 52 weeks, with shares up 6.3% during this period. Similarly, it underperformed the Health Care Select Sector SPDR Fund’s (XLV) 11.6% returns over the same time frame.

REGN's underperformance stems from challenges such as increased scrutiny of drug pricing, regulatory uncertainty, and competition from well-resourced pharmaceutical giants, all of which could hinder growth.

On Oct. 28, REGN shares jumped 11.8% after reporting its Q3 results. Its adjusted EPS of $11.83 beat Wall Street expectations of $9.44. The company’s revenue was $3.8 billion, beating Wall Street's $3.6 billion forecast.

Analysts’ consensus opinion on REGN stock is moderately bullish, with a “Moderate Buy” rating overall. Out of 27 analysts covering the stock, 17 advise a “Strong Buy” rating, two suggest a “Moderate Buy,” seven give a “Hold,” and one recommends a “Moderate Sell.” REGN’s average analyst price target is $797.92, indicating a potential upside of 4.5% from the current levels.