Bridgewater’s Ray Dalio this morning made some stark comments regarding the state of the stock market.

Dalio is the founder and co-chief investment officer of Bridgewater Associates, the world’s biggest hedge-fund manager.

Among his comments, Dalio said inflation would stay above what people and the Federal Reserve want, saying “my guesstimate is that it will be around 4.5% to 5% long term, barring shocks.”

If that pans out and rates go higher — as they are forecast to do — Dalio says equity prices could fall another 20%.

Rate-hike bets have been cranking higher since the monthly inflation report came in higher than expected earlier this week.

Dalio is a respected investor who has his finger on the pulse of several markets. While that doesn’t mean we are guaranteed to see a 20% dip, it does mean we should use some caution here.

Let’s look at what the charts are telling us now.

Trading the S&P 500

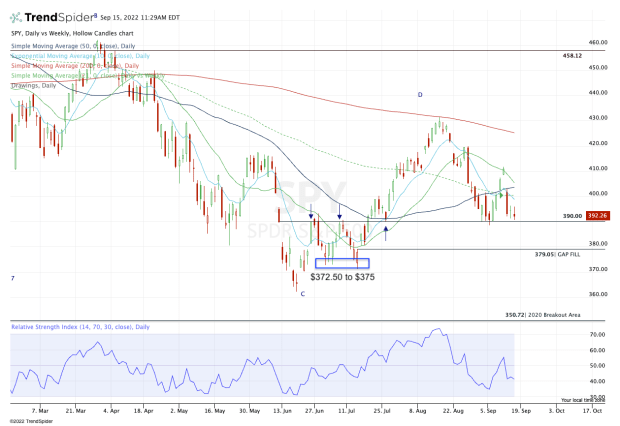

Chart courtesy of TrendSpider.com

The daily chart above is not that inspiring.

The SPDR S&P 500 ETF Trust (SPY) had a disastrous day on Tuesday, falling more than 4%. It was the S&P 500’s worst session since June 2020.

For now, it’s holding the $390 area and is above last week’s low at $388.42.

But the SPY sports a two-day low of $391.12, which is the low from yesterday’s somewhat pitiful bounce following the beating the index took on Tuesday.

I say these things not to strike fear but simply to remind traders that stocks are in a bear market and are teetering on support.

Is it possible that support holds and we rotate higher? Yes, it’s possible — but not likely.

If the SPY can clear $396.20 and close above it, we could see a push back to $400 or higher (for the S&P, that’s roughly 4,000).

As for what happens on a break below $388.42 — last week’s low — that opens up the gap-fill level down near $379. Just below that area and the $372.50 to $375 zone becomes a possibility.

Where Could Stocks Fall To?

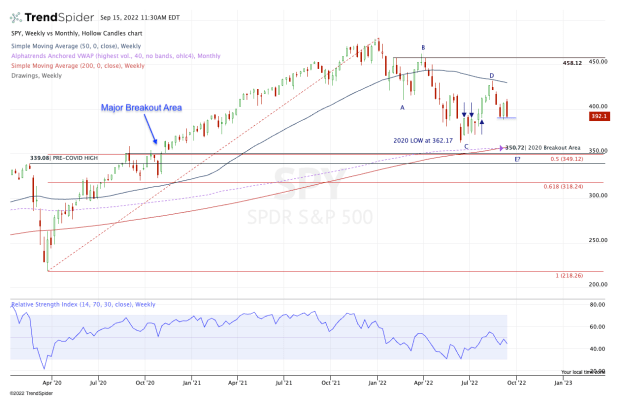

Chart courtesy of TrendSpider.com

Zooming out a bit with the weekly chart, we have an area that I have had circled on my charts for months. This does not mean we will necessarily get there. And if we do get there, it does not necessarily mean it will be the low or that it will hold as support.

As traders, we must keep an open mind and adapt to the market.

If the $390 area gives way, the $350 zone really starts to draw in one’s attention. In that zone, we find:

- The 50-month and 200-week moving averages

- The 50% retracement from the all-time high down to the Covid low

- The monthly VWAP measure

- The 2020 breakout area

Again, there’s no guarantee that we even retest the current 2022 low near $362 or that if we do, we test this area of interest I just mentioned. But it should be a potential outcome that traders keep note of.

For what it’s worth, a test of the $350 area would get us an 11% pullback from yesterday’s close.

If we’re talking about a 20% fall from current levels, that puts us around $315 on the SPY.

Interestingly enough, that would put us near the 61.8% retracement, but about 34% off the all-time high.