Mortgage holders should not expect any relief for the foreseeable future, Reserve Bank governor Michele Bullock says, after leaving interest rates on hold.

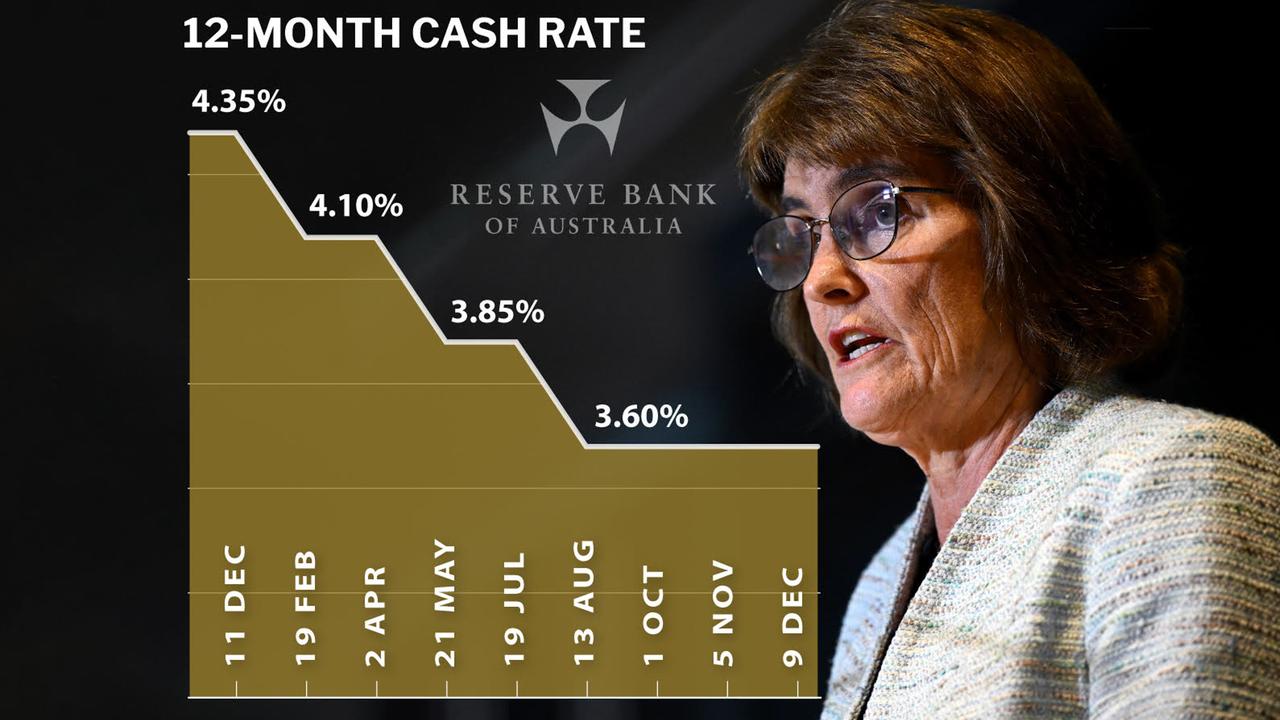

In a widely-anticipated, unanimous decision, the central bank's monetary policy board kept the cash rate steady at 3.6 per cent for a third-straight meeting on Tuesday.

The return of inflation in the second half of 2025 scuppered hopes of more cuts, following 75 basis points of easing since February.

In its accompanying statement, the board reiterated it would maintain its cautious approach, with recent data suggesting the risks to inflation had tilted to the upside.

While Ms Bullock said there was no discussion in the meeting of a cut, the board did talk about what circumstances could cause it to hike rates in 2026.

As expected, the private sector was taking over from the public sector as the driving force of the economy, while the labour market remained a little tight in the RBA's estimation, she told reporters after the meeting.

Given the RBA had not raised interest rates as high as central banks in peer economies, it meant it couldn't lower them very far before they would start pushing up inflation again.

"I don't think there are interest rate cuts in the horizon for the foreseeable future," Ms Bullock said.

"The question is: is it just an extended hold from here, or is it a possibility of a rate rise?

"I couldn't put a probability on those, but I think they're the two things that the board will be looking closely at coming into the new year."

If inflationary pressures continue to build, some analysts say the bank could be forced to raise interest rates as soon as February.

"Should inflation numbers published in January show a continued rise, the possibility of an interest rate hike at the February meeting remains on the table to ensure inflation returns to target in a reasonable time frame," economist at Monash University Isaac Gross said.

The outlook for households and businesses has soured markedly from a few months ago, when bonds traders were pricing in one or two more cuts.

Business confidence plummeted to its lowest level since April, according to NAB's monthly business survey on Tuesday.

Weaker profitability and trading caused business conditions to retreat three index points but, despite the fall in activity, capacity utilisation climbed to its highest level in 18 months.

How much excess capacity there is in the economy is a key question the RBA will have to answer before its next rates meeting.

Unless the supply capacity of the economy picks up, for instance through a jump in productivity, there won't be room for the economy to grow more strongly without pushing up inflation, Ms Bullock said.

Recent inflation data showed the consumer price index rose to 3.8 per cent in the 12 months to October, while underlying inflation climbed to 3.3 per cent - both above the RBA's two to three per cent target range.

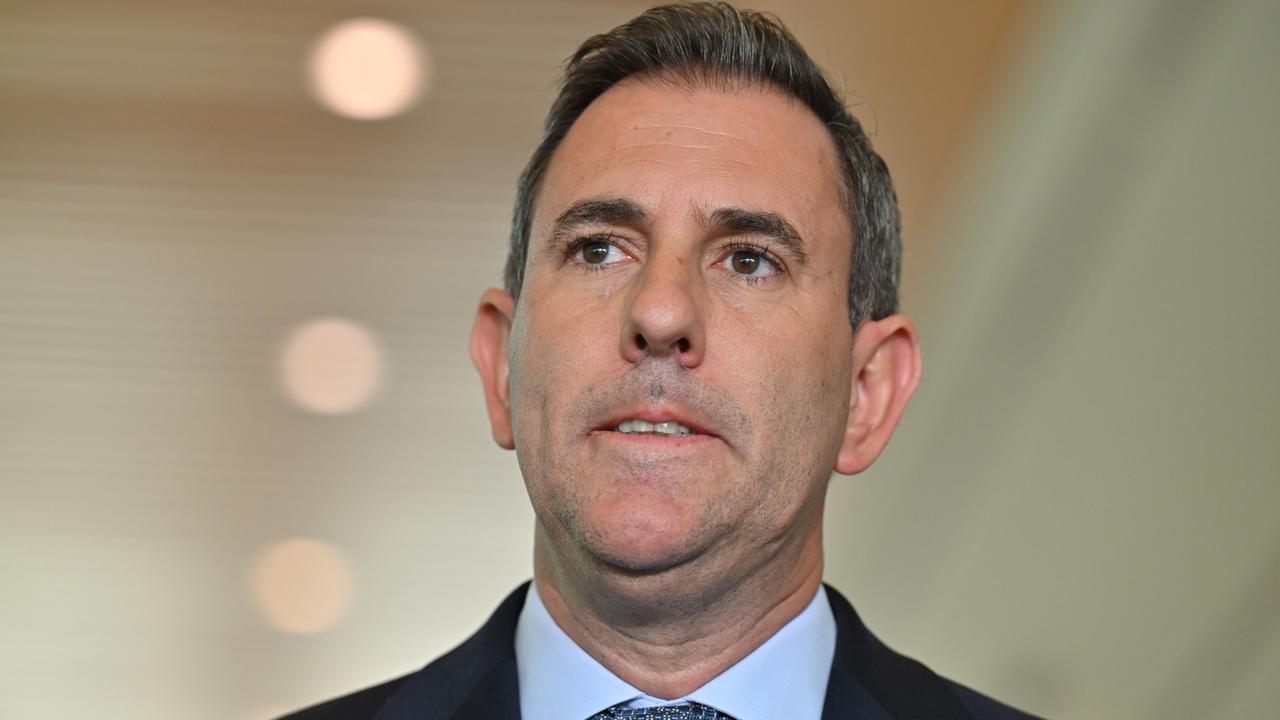

Treasurer Jim Chalmers latched onto the RBA's comments about the private sector driving the economic recovery.

"From time to time you'll hear some absolute rubbish from our political opponents who say that the bank is focused on public spending," he told reporters.

"The Reserve Bank hasn't actually said that public spending has been a factor in their decisions throughout this whole year."

Shadow treasurer Ted O'Brien said the lack of further rate relief was a direct consequence of Dr Chalmers' "spending spree" and failure to grow the economic pie.