/Qualcomm%2C%20Inc_%20logo%20on%20pc%20and%20website%20on%20phone-by%20T_Schneider%20via%20Shutterstock.jpg)

Qualcomm (QCOM) shares closed down nearly 9% on Feb. 5, after the multinational issued weaker-than-expected Q2 guidance, citing memory shortages as artificial intelligence (AI) continues to drive supply away from smart phones. The post-earnings dip crashed QCOM’s relative strength index (14-day) to about 21, indicating extremely oversold conditions that often invite bargain hunters and short-term traders, resulting in a near-term rebound.

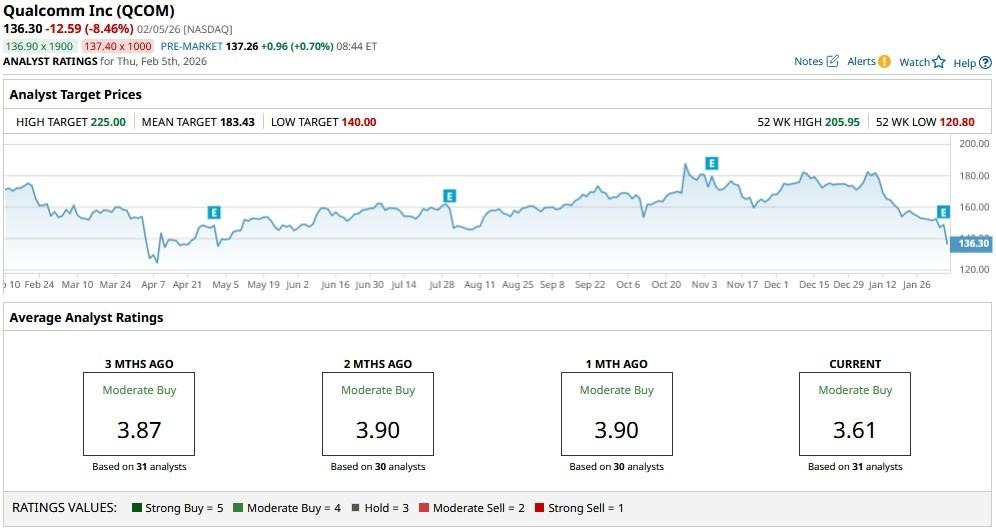

At the time of writing, Qualcomm stock is down about 25% versus its year-to-date high.

Is Qualcomm Stock Still Worth Owning?

Long-term investors should consider buying QCOM stock on the pullback since its muted outlook stems from temporary supply-side friction only — not a structural decline in consumer demand.

Moreover, the semiconductor giant’s Automotive and PC segments are growing at an exceptional pace (61% and 36%, respectively, in Q2), which position it well to navigate smartphones weakness over the next few quarters.

What’s also worth mentioning is that Qualcomm is now trading at a forward price-to-earnings (P/E) of about 15x, which makes it notably cheap for a company riding the AI tailwinds.

A healthy dividend yield of 2.61% means the Nasdaq-listed firm is even more attractive for income-focused investors.

Bernstein Sees Massive Upside in QCOM Shares

Qualcomm shares are worth owning because the company’s Edge AI and data center initiatives are beginning to scale as well.

As Bernstein analyst Stacy Rasgon put in a post-earnings research note, “We think the story is still worth a look as the narrative grows cleaner through the year.”

Bernstein reiterated its “Outperform” rating and $200 price target this morning, indicating this AI stock could soar more than 45% from current levels.

In short, the expected memory shortage doesn’t warrant selling QCOM as it isn’t just a smartphone company anymore, but a proper Edge AI and computing powerhouse.

Qualcomm Remains a Buy-Rated Stock Among Wall Street Firms

Other Wall Street firms agree with Bernstein’s bullish view on Qualcomm as well.

The consensus rating on QCOM shares remain at “Moderate Buy,” with the mean target of about $183 indicating potential upside of more than 30% from current levels.