The Government's steps to make food prices more internationally competitive won't be enough – it needs to open up the wholesale chain and force supermarkets to sell stores, says a new Westpac NZ report.

Investment portfolio managers may not be feeling the sharp end of the cost-of-living crisis as much as some, but even they are taken aback at supermarket checkout prices.

One Auckland fund manager, who has returned from working in the City of London, was prompted by this week's record food price inflation to run the numbers comparing a small shop at UK budget supermarket Aldi, with Countdown in New Zealand. He calculates Countdown to be 66 percent more expensive.

Half a dozen eggs cost him $6.20 here; at Aldi it would work out at $NZ2.58. A tube of toothpaste that costs $3 here would cost NZ$1.24 at the London supermarket. A kilo of carrots that costs $3.19 here would cost just NZ$1.20 back in the UK.

"I don't think it would be that different if you picked a more expensive UK supermarket," he says. "Do you think Kiwis realise the extent to which they're overpaying?"

READ MORE: * Surging food prices are a risk to managing down inflation * The Detail: The price pain of supermarket shopping * Supermarket promotions cost less but we pay for it with our health

"It’s particularly shocking what they are charging for fresh fruit and vegetables and it’s clear that it’s a lot to do with the crazy margins the supermarkets are adding to their prices. It is far too expensive to feed a family with fresh, healthy food in New Zealand.

"We all end up paying a big price, both at the checkout and through our taxes, while a few dozen supermarket owners make outsized profits. There is no point in tinkering. The Government should think about providing incentives for a large established international player to expand across from Australia – the obvious one being Aldi. It’s literally a public health issue."

His comparison is pertinent, because Aldi entered the Australian market in 2001 and now has 570 stores employing more than 13,500 staff.

Australian grocery shopping data last month, compiled and analysed by accounting firm PwC, suggests the arrival of the new supermarket has driven AU$3.1bn in annual savings to consumers, as other brands lower their prices to compete.

The industry, sanctioned by regulators, has actively pursued economies of scale through mergers and acquisitions since the early 1980s. The impact has been to give the duopoly the kind of control that makes it much easier to set prices at the checkout till." – Paul Clark, Westpac NZ

On this side of the Tasman, by contrast, this week's Stats NZ food price index shows the price of the weekly shop has increased 12.5 percent in the past year – the fastest rate of increase since GST was introduced in 1986.

The Commerce Commission noted that it is difficult to compare price levels between countries, but nevertheless concluded that grocery prices in New Zealand are high by international standards. OECD and ICP data indicated that groceries prices in New Zealand were the fifth highest in the OECD.

And Numbeo’s Grocery Index, which compares grocery prices by country, places New Zealand 17th most expensive out of 140 countries this year.

Comparing the rise in checkout prices with what supermarkets pay farmers and other producers (up 10 percent) shows that grocery stores are hiking their checkout prices more than what they're paying suppliers.

Foodstuffs, whose members operate New World, Pak'nSave and Four Square supermarkets, supplies its price data to Infometrics for the Grocery Supplier Cost Index. Foodstuffs managing director Chris Quin acknowledges their retail prices are going up "slightly" faster than suppliers', but says it has a tough battle to recruit skilled workers like Class 5 truck drivers, and to freight supplies through floods and storms.

"Weather remains the wild card in terms of domestic inflation this year. The weather in Auckland earlier this week is evidence of this and we’re still seeing some of the flow-on effects of Cyclone Gabrielle."

The lack of competition between Foodstuffs and Woolworths caused the Government to order a Commerce Commission inquiry, and to act on its key recommendations. These include a code of conduct, banning anti-competitive property and lease covenants, and requiring them to begin supplying other smaller retailers at competitive prices – under threat of the big stick of regulation.

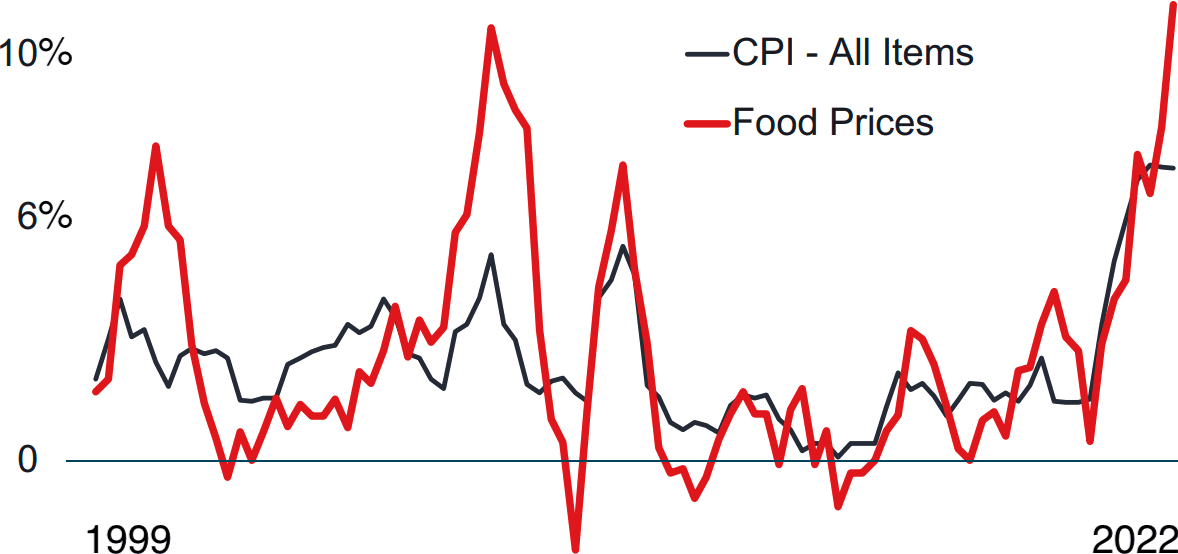

Food price vs headline inflation

According to a new report from Westpac, though, that's not going to be enough to make the change that New Zealanders need in a living costs crisis.

"Our view is that the reforms do not go far enough to effectively stimulate competition," writes Paul Clarke, an industry economist with the bank.

"We acknowledge that breaking up the existing retail hegemony is complex, fraught with unintended consequences and may impose short term costs on customers. The industry, sanctioned by regulators, has actively pursued economies of scale through mergers and acquisitions (and hence horizontal and vertical integration) since the early 1980s.

"The impact has been to give the duopoly the kind of control that makes it much easier to set prices at the checkout till.

"This consolidation process needs to be reversed if Government is looking to improve the lot of the average Kiwi over the longer term."

The report recommends the Government set out a strategy road map that identifies the key milestones that need to be achieved to level the competitive playing field. That would need to be backed up by appropriate legislation: "The sector will not unbundle voluntarily."

Westpac's report argued that the first step is the vertical separation of the supply chain – creating a clean break between manufacturers and wholesalers, and then between wholesalers and retailers.

"That means that the duopoly will have to choose where it wants to operate and sell off those parts that it doesn’t," it says.

The second step is horizontal separation at the retail level. Both Foodstuffs and Woolworths NZ would be forced to sell off some of their individual retail brands to independent retailers, possibly extending as far as the selling off specific outlets.

"Again, that assumes the existence of buyers, who may be put off by the big structural changes occurring within the sector. While that is a big assumption, new entrants may be enticed by attractive returns that are on offer."

Finally, the Government must create the conditions to encourage online grocery shopping. "Digitalisation is fundamentally changing how goods destined for retail are supplied and how retailers and consumers interact with each other," the report says. "The idea of supplier ecosystems that dropship directly to customers on behalf of online retail is already here, and there is no reason why, with some modifications, that cannot be extended to grocery shopping.

It cites the exampled of online supermarket Supie, which it says is clearly making waves. "Other new entrants are needed."