The big food court in the sky, or maybe it's a downtown entertainment district, features a lot of restaurants that once had a big following. You may not remember them all, but some brands that were once huge, fell into irrelevancy and then went away.

Howard Johnson's, for example, used to be a staple of a road trip. If you couldn't find a HoJo's, perhaps you would stop at a Big Boy, another chain that was once prominent.

Related: Red Lobster files for bankruptcy — what it means for your next seafood dinner

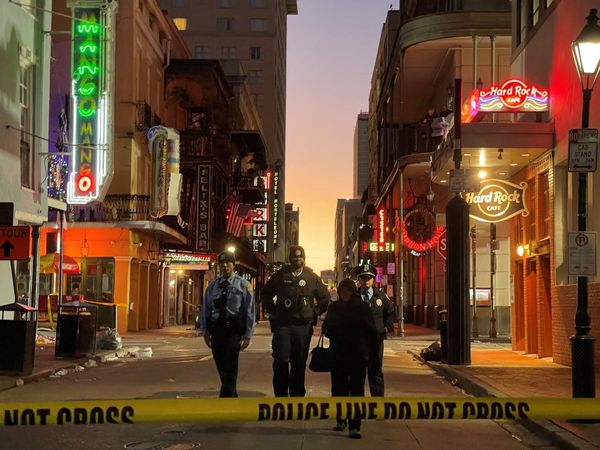

Sometimes there are restaurant chains that maybe were never that well-liked but were still a big deal. Fashion Cafe and the Official All-Star Cafe were meant to reproduce the magic of the Hard Rock Cafe or Planet Hollywood but they never caught on.

Big names and huge publicity don't guarantee success for a restaurant chain. Kenny Rogers Roasters had the backing of the country music giant, and it was featured in a "Seinfeld" episode. It also had pretty good chicken, but that was not enough to keep it operating.

Restaurants go out of business for a lot of reasons, and right now, a beloved national chain appears to be headed for a Chapter 11 bankruptcy filing.

Red Lobster is struggling

Signs of an impending Red Lobster Chapter 11 bankruptcy filing first appeared in March when Red Lobster appointed Jonathan Tibus as its CEO. Tibus is a managing director at Alvarez & Marsal, a company known for corporate restructuring.

The noise got louder earlier this month when the chain abruptly closed at least 48 locations with no notice. That seems Sarah Foss, Global Head of Legal at Debtwire, a service of ION Analytics, shared why a Chapter 11 filing could help Red Lobster.

“Reports have circulated that Florida-based seafood restaurant chain Red Lobster is considering a Chapter 11 bankruptcy to alleviate pressures from high rent and labor costs," she said.

Basically, a Chapter 11 filing would let the struggling restaurant chain go to its landlords and negotiate better deals. Many would likely be willing to negotiate because the large number of retail bankruptcies filed this year has made finding new tenants harder.

It's hard to see how filing for bankruptcy would impact the chain's labor costs, but it could be an opportunity to negotiate better deals with outside vendors.

Red Lobster may have made its situation worse

The decision to close 48 locations without notice may make a Chapter 11 bankruptcy filing more challenging, according to Foss.

Related: Popular fried chicken chain files Chapter 11 bankruptcy

"By shutting its doors without any advance warning to its employees that the company was shutting down, Red Lobster could face litigation related to purported failures to properly notify employees of closures or layoffs under the Worker Adjustment and Retraining Notification (WARN) Act. The federal WARN Act requires companies with 100 or more full-time employees to provide at least 60 days of notice for planned mass layoffs or closings," she shared.

That creates a wild card where a bankruptcy court judge could force the company to pay severance to the workers who were laid off without notice. It's a situation that could make it harder for Red Lobster to find funding to support a turnaround.

Foss noted that many states also have WARN laws, but she still believes that a Chapter 11 bankruptcy filing makes sense for the chain.

"Despite the potential for litigation, Chapter 11 can be a useful tool for a restaurant or retail chain facing financial distress as it allows a debtor to renegotiate and reject burdensome leases and contracts, which are often a major financial strain on a distressed company in these sectors. Although Red Lobster’s path through bankruptcy is unclear, the company, which is a subsidiary of Thai Union Group, is likely considering both a sale as well as its standalone restructuring options," she added.

Thai Union has been trying to unload the chain for some time, news reports have said. The chain, founded in 1968, did about $2.2 billion in domestic business in 2023, down 8% from 2022, The Wall Street Journal reported.

Red Lobster is a casual dining business, a category that has seen business shrink as consumers pull back on discretionary spending, The Journal said.

It has had multiple owners, including General Mills (GIS) and Darden Restaurants (DRI) .

Update: Red Lobster formally filed for Chapter 11 bankruptcy protection in the Middle District of Florida on May 20. The company has between $1-10 billion in assets and the same range of liabilities.

The company said that is has more than 100,000 creditors, but reports that it will have funds available for unsecured creditors.

Related: 3 big-name mall retailers closing stores after bankruptcy filing