The plea agreement between the U.S. Justice Department and Boeing Co. (NYSE:BA) regarding the company’s involvement in two fatal 737 Max jetliner crashes has been dismissed by a federal court. The rejection was due to the proposed monitor provision, which has sparked a debate on the need for a complete overhaul of the system.

What Happened: The plea deal, which would have led to Boeing admitting to a single felony count of conspiracy to defraud the government, was dismissed due to concerns with the monitor provision. This provision would have assigned an independent compliance monitor to supervise Boeing’s transition into a law-abiding corporation.

The court’s dismissal was not influenced by the potential effect on Boeing as a government contractor, the expected response of shareholders to over $1 billion in fines and legal costs, or the vehement opposition from the families of crash victims. Rather, the court had reservations about the proposed selection criteria for the monitor.

However, according to Hui Chen, a former Justice Department prosecutor, and Todd Haugh, an associate professor of business law and ethics at Indiana University, the issue runs deeper. They argue in an opinion piece for The Washington Post on Thursday that the monitorship system is fundamentally flawed and in urgent need of reform.

“We contend, however, that the problem is much larger: The monitorship system is fundamentally broken and in dire need of reform.”

Chen and Haugh believe that the current system of corporate monitors, which has been increasingly utilized by federal prosecutors over the past two decades, is riddled with misaligned incentives. This, they argue, has weakened the ability of monitorships to achieve their primary goal of reducing corporate misconduct in the long term.

The lack of transparency in the selection process, the exorbitant fees paid to monitor firms, and the absence of clear standards for assessing the effectiveness of a monitorship are all cited as contributing factors to the broken system.

“The system is so broken that there isn't even a clear standard for judging whether a monitorship has worked. There will be no way, at the end of its monitorship, to objectively determine whether Boeing has become more ethical and able to better prevent misconduct.”

The authors propose three key steps for reform: increased transparency in the selection of monitors, a shift in monitor compensation towards a model that incentivizes outcomes, and the implementation of consistent, measurable methodologies to guide monitors’ work and assess their outcomes.

Why It Matters: The rejection of the plea deal comes at a time when Boeing has been facing significant challenges. The company recently announced plans to lay off over 2,500 workers in the U.S. as part of a broader workforce reduction strategy.

Boeing’s labor issues have also been in the spotlight, with the company’s striking machinists voting on a new contract proposal that includes a 38% wage increase over four years. The rejection of the plea deal and the subsequent call for a reform of the monitorship system adds to the company’s challenges, raising questions about its ability to navigate these turbulent times.

Price Action: Boeing’s stock ended Thursday at $156.67, down 1.02% for the day, with an additional 0.05% dip in after-hours trading. Year-to-date, the stock has fallen 37.77%.

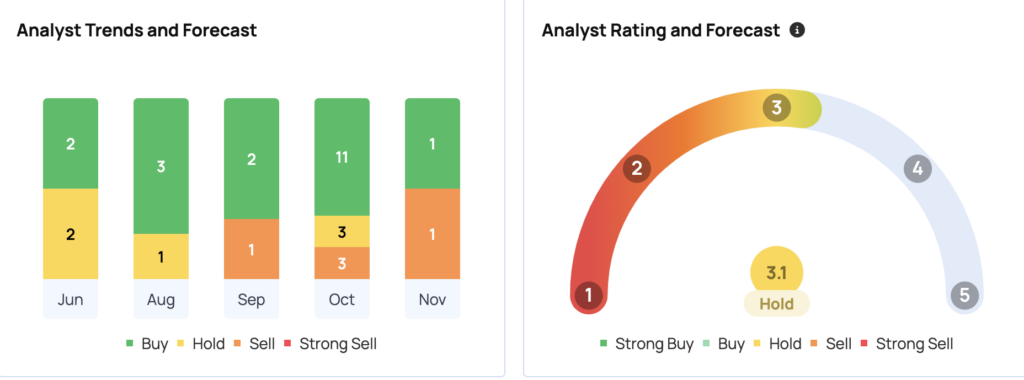

Data from Benzinga Pro shows a consensus price target of $197.85 among 23 analysts, with projections ranging from a high of $260 to a low of $85. Recent ratings from JP Morgan, Wells Fargo, and RBC Capital suggest an average target of $158.33, indicating a potential upside of 1.11%.

Read Also:

Image via Shutterstock