To gain an edge, this is what you need to know today.

Turkey Is Biggest Winner

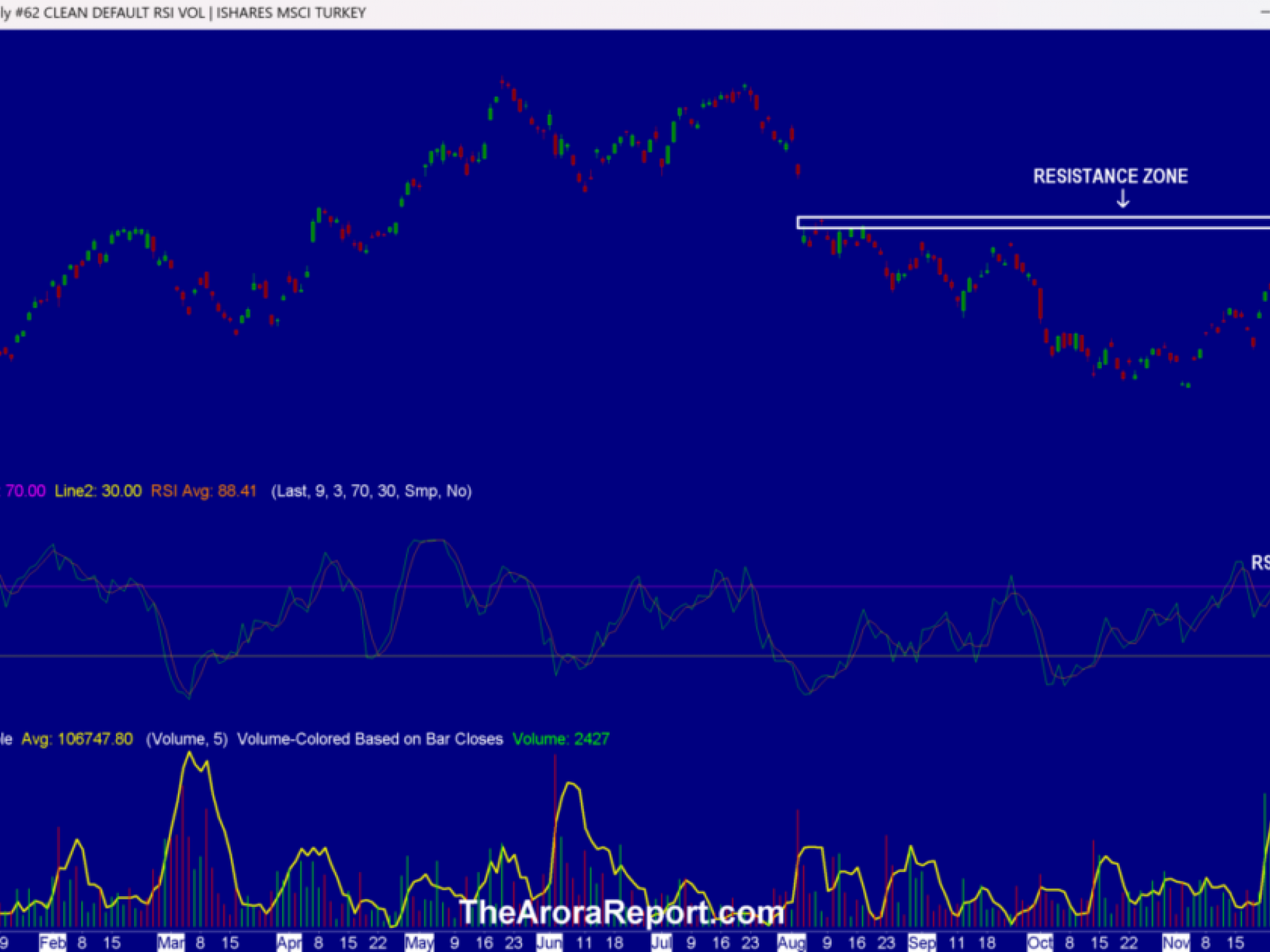

An enlarged chart of iShares MSCI Turkey ETF (NASDAQ:TUR).

Note the following:

- In Syria, the regime of Bashar al-Assad has fallen after a lightning fast advance by rebels over 11 days. Bashar al-Assad's father Hafez al-Assad seized power in a military coup in November 1970. In a stunning development, the 54-year al-Assad rule of Syria has ended. Bashar al-Assad has been granted asylum in Russia.

- Hayat Tahrir al-Sham's (HTS), the rebel group that captured Syria's capital Damascus, origin goes back to al-Qaeda. This group was essentially the Syrian branch of al-Qaeda. HTS is trying to rebrand itself with assurance to minorities and has so far, not engaged in violence. However, in The Arora Report analysis, prudent investors should be aware that this is a rigid Islamist group that had once vowed to impose Sharia law.

- In The Arora Report analysis, there is a power vacuum in Syria. The danger is the establishment of an Islamic caliphate.

- In The Arora Report analysis, the biggest winner from the situation in Syria is Turkey.

- The chart shows stocks in Turkey are up. Foreign money is flowing into Turkish stocks this morning.

- The chart shows that Turkey ETF TUR is now at the top band of the resistance zone.

- As clarity develops, there may be an opportunity in Turkey. The Arora Report’s ZYX Emerging has continuously followed Turkey for 17 years.

- Turkey is a member of NATO, but is also closely aligned with Russia. Turkey has also been a big supporter of Hamas in Gaza.

- The U.S. relationship with Turkey lately has been tense. Now, Turkey will have more leverage against both the U.S. and Russia.

- The U.S. has about 900 troops in Syria. The U.S. is conducting airstrikes against ISIS targets in Syria to prevent ISIS from gaining power. Yesterday, the U.S. conducted 75 airstrikes in Syria.

- The biggest losers are Iran, Russia, and Hezbollah. Russia has a naval base and an air base in Syria. The Russian naval base in Syria is Russia's only warm water naval base.

- Due to the prospects of instability, investors are buying gold, silver, and oil. Investors are selling bitcoin and other cryptos. This again shows that bitcoin and cryptos are not a hedge against global instability.

- In The Arora Report analysis, China is gearing up to fight Trump's potential tariffs. China has picked NVIDIA Corp (NASDAQ:NVDA) as the first target. As a result, NVDA stock is seeing selling.

- China is promising stimulative monetary policy. Stocks in Hong Kong and Shanghai are jumping. Foreign money is flowing into China.

- More inflation data is coming this week. Consumer Price Index (CPI) will be released on Wednesday at 8:30am ET, and Producer Price Index (PPI) will be released on Thursday at 8:30am ET. This data may be market moving.

Magnificent Seven Money Flows

In the early trade, money flows are positive in Tesla Inc (NASDAQ:TSLA).

In the early trade, money flows are neutral in Apple Inc (NASDAQ:AAPL), Meta Platforms Inc (NASDAQ:META), and NVIDIA Corp (NASDAQ:NVDA).

In the early trade, money flows are negative in Amazon.com, Inc. (NASDAQ:AMZN), Alphabet Inc Class C (NASDAQ:GOOG), and Microsoft Corp (NASDAQ:MSFT).

In the early trade, money flows are neutral in SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust Series 1 (NASDAQ:QQQ).

Momo Crowd And Smart Money In Stocks

Investors can gain an edge by knowing money flows in SPY and QQQ. Investors can get a bigger edge by knowing when smart money is buying stocks, gold, and oil. The most popular ETF for gold is SPDR Gold Trust (NYSE:GLD). The most popular ETF for silver is iShares Silver Trust (NYSE:SLV). The most popular ETF for oil is United States Oil ETF (ASCA:USO).

Bitcoin

Bitcoin (CRYPTO: BTC) is under $100K and seeing selling on Syria developments.

Protection Band And What To Do Now

It is important for investors to look ahead and not in the rearview mirror. The proprietary protection band from The Arora Report is very popular. The protection band puts all of the data, all of the indicators, all of the news, all of the crosscurrents, all of the models, and all of the analysis in an analytical framework that is easily actionable by investors.

Consider continuing to hold good, very long term, existing positions. Based on individual risk preference, consider a protection band consisting of cash or Treasury bills or short-term tactical trades as well as short to medium term hedges and short term hedges. This is a good way to protect yourself and participate in the upside at the same time.

You can determine your protection bands by adding cash to hedges. The high band of the protection is appropriate for those who are older or conservative. The low band of the protection is appropriate for those who are younger or aggressive. If you do not hedge, the total cash level should be more than stated above but significantly less than cash plus hedges.

A protection band of 0% would be very bullish and would indicate full investment with 0% in cash. A protection band of 100% would be very bearish and would indicate a need for aggressive protection with cash and hedges or aggressive short selling.

It is worth reminding that you cannot take advantage of new upcoming opportunities if you are not holding enough cash. When adjusting hedge levels, consider adjusting partial stop quantities for stock positions (non ETF); consider using wider stops on remaining quantities and also allowing more room for high beta stocks. High beta stocks are the ones that move more than the market.

Traditional 60/40 Portfolio

Probability based risk reward adjusted for inflation does not favor long duration strategic bond allocation at this time.

Those who want to stick to traditional 60% allocation to stocks and 40% to bonds may consider focusing on only high quality bonds and bonds of five year duration or less. Those willing to bring sophistication to their investing may consider using bond ETFs as tactical positions and not strategic positions at this time.

The Arora Report is known for its accurate calls. The Arora Report correctly called the big artificial intelligence rally before anyone else, the new bull market of 2023, the bear market of 2022, new stock market highs right after the virus low in 2020, the virus drop in 2020, the DJIA rally to 30,000 when it was trading at 16,000, the start of a mega bull market in 2009, and the financial crash of 2008. Please click here to sign up for a free forever Generate Wealth Newsletter.