/Pfizer%20Inc_%20NY%20HQ-by%20JHVEPhoto%20via%20iStock.jpg)

Pfizer Inc. (PFE), headquartered in New York, discovers, develops, manufactures, markets, distributes, and sells biopharmaceutical products. With a market cap of $143.2 billion, the company offers medicines, vaccines, medical devices, and consumer healthcare products for oncology, inflammation, cardiovascular, and other therapeutic areas. The pharmaceutical giant is expected to announce its fiscal fourth-quarter earnings for 2025 before the market opens on Tuesday, Feb. 3.

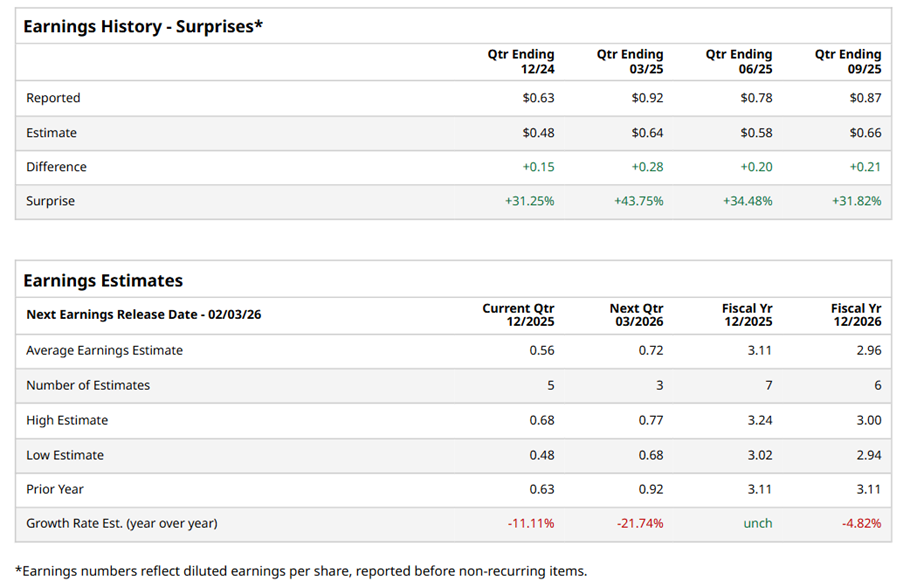

Ahead of the event, analysts expect PFE to report a profit of $0.56 per share on a diluted basis, down 11.1% from $0.63 per share in the year-ago quarter. The company has consistently surpassed Wall Street’s EPS estimates in its last four quarterly reports.

For the full year, analysts expect PFE to report EPS of $3.11, unchanged from the year-ago quarter. However, its EPS is expected to decline 4.8% year over year to $2.96 in fiscal 2026.

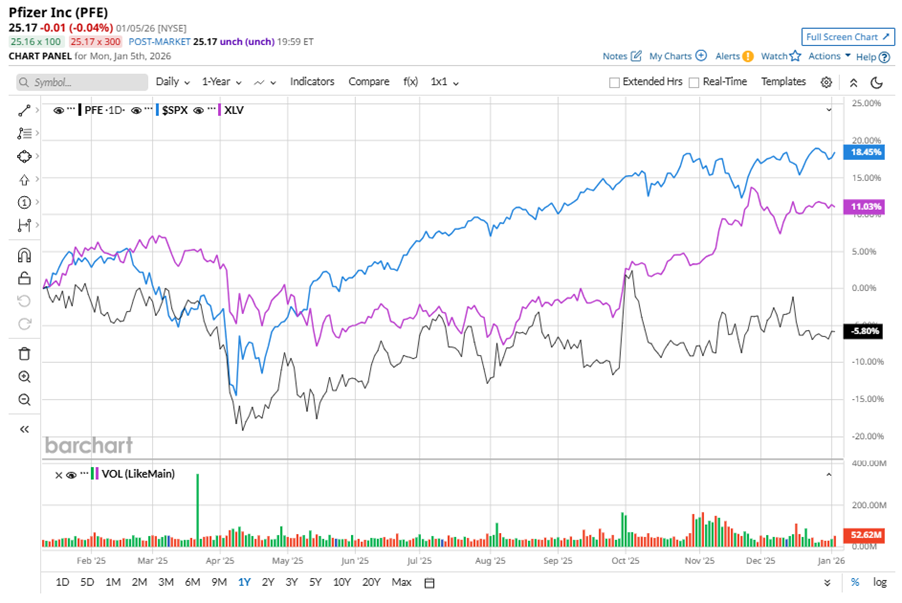

PFE stock has underperformed the S&P 500 Index’s ($SPX) 16.2% gains over the past 52 weeks, with shares down 5.3% during this period. Similarly, it underperformed the Health Care Select Sector SPDR Fund’s (XLV) 11.6% returns over the same time frame.

Pfizer's underperformance is due to worries about patent expirations for blockbuster meds like Eliquis and Ibrance, plus fading COVID-19 sales.

On Nov. 4, 2025, PFE shares closed down by 1.5% after reporting its Q3 results. Its adjusted EPS of $0.87 exceeded Wall Street expectations of $0.66. The company’s revenue was $16.7 billion, topping Wall Street forecasts of $16.6 billion. PFE expects full-year adjusted EPS in the range of $3 to $3.15, and expects revenue in the range of $61 billion to $64 billion.

Analysts’ consensus opinion on PFE stock is moderately bullish, with a “Moderate Buy” rating overall. Out of 24 analysts covering the stock, six advise a “Strong Buy” rating, one suggests a “Moderate Buy,” 16 give a “Hold,” and one recommends a “Strong Sell.” PFE’s average analyst price target is $27.95, indicating a potential upside of 11% from the current levels.