Analysts' ratings for Interactive Brokers Gr (NASDAQ:IBKR) over the last quarter vary from bullish to bearish, as provided by 8 analysts.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 4 | 0 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 2 | 4 | 0 | 0 | 0 |

| 3M Ago | 1 | 0 | 0 | 0 | 0 |

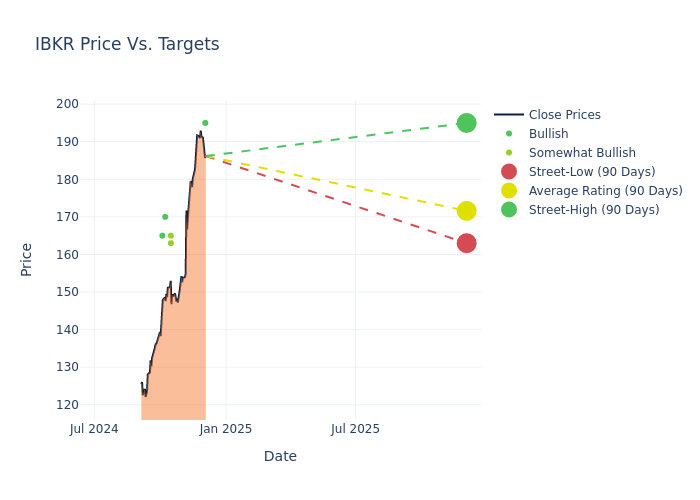

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $167.75, along with a high estimate of $195.00 and a low estimate of $155.00. This upward trend is apparent, with the current average reflecting a 8.31% increase from the previous average price target of $154.88.

Understanding Analyst Ratings: A Comprehensive Breakdown

The perception of Interactive Brokers Gr by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| James Yaro | Goldman Sachs | Raises | Buy | $195.00 | $171.00 |

| Benjamin Budish | Barclays | Lowers | Overweight | $165.00 | $166.00 |

| Patrick Moley | Piper Sandler | Maintains | Overweight | $163.00 | $163.00 |

| Brennan Hawken | UBS | Raises | Buy | $170.00 | $155.00 |

| Patrick Moley | Piper Sandler | Raises | Overweight | $163.00 | $140.00 |

| Benjamin Budish | Barclays | Raises | Overweight | $166.00 | $147.00 |

| Daniel Fannon | Jefferies | Raises | Buy | $165.00 | $152.00 |

| Brennan Hawken | UBS | Raises | Buy | $155.00 | $145.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Interactive Brokers Gr. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Interactive Brokers Gr compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Interactive Brokers Gr's stock. This comparison reveals trends in analysts' expectations over time.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Interactive Brokers Gr's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Interactive Brokers Gr analyst ratings.

About Interactive Brokers Gr

Interactive Brokers is an online brokerage that generates trading commissions (around 31% of net revenue) from facilitating trading in a wide range of products, including equity, options, futures, foreign exchange, bonds, mutual funds, and exchange-traded funds. Interactive Brokers also generates net interest income (about 64% of net revenue) from idle client cash and earns fees (about 6% of net revenue) from ancillary services. Principal trading and other miscellaneous activities are small (about 5% of net revenue). The firm derives about 70% of its net revenue from the US and 30% from international markets.

Interactive Brokers Gr: A Financial Overview

Market Capitalization Analysis: Positioned below industry benchmarks, the company's market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: Interactive Brokers Gr's revenue growth over a period of 3 months has been noteworthy. As of 30 September, 2024, the company achieved a revenue growth rate of approximately 18.1%. This indicates a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Financials sector.

Net Margin: Interactive Brokers Gr's net margin lags behind industry averages, suggesting challenges in maintaining strong profitability. With a net margin of 7.68%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Interactive Brokers Gr's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 4.56%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Interactive Brokers Gr's ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of 0.13%, the company may face hurdles in achieving optimal financial performance.

Debt Management: Interactive Brokers Gr's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.01.

Understanding the Relevance of Analyst Ratings

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.