For The New York Times' Paul Krugman, the real crisis facing America's entitlement programs is that the media isn't working hard enough to ignore their impending collapse.

"I've seen numerous declarations from mainstream media that of course Medicare and Social Security can't be sustained in their present form," Krugman wrote in a Times op-ed this week. "And not just in the opinion pages."

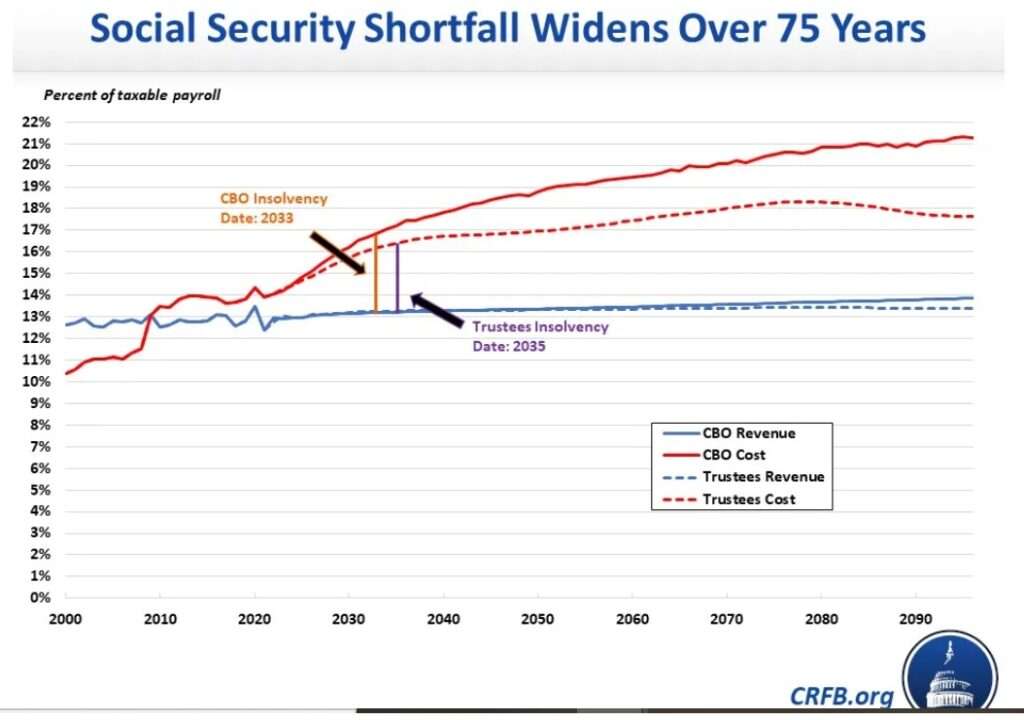

Perhaps that's because the unsustainable trajectories of Social Security and Medicare aren't a matter of opinion. They're factual realities, supported by the most recent annual reports of the programs' trustees and the independent analysis of the Congressional Budget Office (CBO). Social Security's main trust fund will hit insolvency somewhere between 2033 and 2035, according to those projections, while one of the main trust funds in Medicare will be insolvent before the end of this decade. When insolvency hits, there will be mandatory across-the-board benefit cuts—for Social Security, that's likely to translate into a roughly 20 percent reduction in promised benefits.

Nevertheless, Krugman says he's got a solution that "need not involve benefit cuts."

His argument boils down to three points. First, Krugman says the CBO's projections about future costs in Social Security and Medicare might be wrong. Second, he speculates that they might be wrong because life expectancy won't continue to increase. Finally, if those first two things turn out to be at least partially true, then it's possible that cost growth will be limited to only about 3 percent of gross domestic product (GDP) over the next three decades and we'll just raise taxes to cover that.

"America has the lowest taxes of any advanced nation; given the political will, of course we could come up with 3 percent more of G.D.P. in revenue," he writes. "We can keep these programs, which are so deeply embedded in American society, if we want to. Killing them would be a choice."

It's notable that Krugman sees benefit cuts as "a choice" but believes that implementing a massive tax increase on American employers and workers would be "of course" no big deal.

But that hardly addresses the substance of what he gets wrong. Let's take each of his three arguments in order and show why they're incorrect.

First, he says the CBO's projections about future costs for the two programs might be inaccurate because the agency is assuming that health care costs will continue to grow faster than the economy as a whole. At best, that means postponing insolvency by a few years. The structural imbalance between revenues and outlays means that depletion of the trust funds is a question of "when" and not "if," as this chart from the Committee for a Responsible Federal Budget makes clear.

Krugman even concedes that despite a decline in the expected rate of growth in future health care costs, those costs are still expected to rise faster than the economy grows. Combined with the aging of America's population, this is a demographic and fiscal time bomb. Ignoring that reality is certainly not a sound policy strategy.

Second, he speculates that mortality rates might continue to drop. While that might be good news from an actuarial perspective, it seems both morally horrifying and incredibly risky to base a long-term entitlement program on the assumption that more people will die at a younger age.

In fact, Krugman gets this point exactly backward. Instead of banking on a decline in life expectancy, Congress ought to raise the eligibility age for collecting benefits from Social Security and Medicare. That would create the same demographic benefits on the accounting side even as people live hopefully longer, better lives.

Krugman would no doubt see such a change as an unacceptable benefit cut, but in reality it would restore Social Security to its proper role as a safety net for the truly needy, not a conveyer belt to transfer wealth from the younger, working population to the older, relatively wealthier retired population. When Social Security launched in 1935, the average life expectancy for Americans was 61. That's changed, so the program's parameters should too.

Finally, the blitheness of Krugman's actual solution—a massive tax increase—ignores all the knock-on effects of that idea. Keeping Social Security and Medicare whole will require a tax increase in excess of $1 trillion, which would have massive repercussions on wages, the costs of starting a business, and economic growth in general. It's far from an ideal solution.

In all, Krugman's column amounts to an argument that his addiction to donuts is totally sustainable as long as someone else agrees to keep buying donuts for him (and as long as he ignores the long-term costs to his health). Maybe the doctors are wrong about the projected consequences of eating too many donuts. Maybe it will turn out that living longer just isn't all that great anyway. But if all else fails, at least he's got someone else willing to pay for his habit—and making any changes would be tantamount to killing a tradition deeply embedded in the Krugman morning routine. We must take that option off the breakfast table.

Instead of lying to their readers and constituents, America's thought and political leaders (not just President Joe Biden and Krugman but lawmakers and media commentators on all sides) should start acknowledging that America's entitlement programs are not sustainable in their current form.

Without changes, they will wreck the economy or force many retirees to deal with sudden cuts to benefits they expected to receive. Maybe both. Waiting to deal with this problem will only make it worse. If Krugman's column is the best argument for the long-term sustainability of America's two major entitlement programs, it should only underline how seriously screwed they are.

The post Paul Krugman Says Social Security Is Sustainable. It's Really Not. appeared first on Reason.com.