/Parker-Hannifin%20Corp_%20logo%20on%20phone%20and%20site-by%20T_Schneider%20via%20Shutterstock.jpg)

With a market cap of $103.6 billion, Parker-Hannifin Corporation (PH) is a global manufacturer of motion and control technologies serving aerospace, defense, industrial, transportation, energy, and HVAC/refrigeration markets. Operating through its Diversified Industrial and Aerospace Systems segments, the company provides advanced components and systems ranging from sealing and filtration solutions to flight control and hydraulic technologies.

Shares of the Cleveland, Ohio-based company have exceeded the broader market over the past 52 weeks. PH stock has risen 17.6% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 12%. Moreover, shares of the company have increased 27.9% on a YTD basis, compared to SPX’s 12.2% gain.

Focusing more closely, shares of the motion and control products maker have outpaced the Industrial Select Sector SPDR Fund’s (XLI) 7.6% return over the past 52 weeks.

Shares of Parker-Hannifin surged 7.8% on Nov. 6 after the company posted stronger-than-expected Q1 2026 results, including adjusted EPS of $7.22 and record quarterly sales of $5.08 billion. Investors reacted positively to strong segment performance, especially Aerospace Systems, which posted 13.3% sales growth and a 30% adjusted margin, along with companywide order rates up 8% and backlog reaching a record $11.3 billion. Confidence was further boosted as Parker raised its full-year 2026 outlook, lifting adjusted EPS guidance to $29.60 - $30.40.

For the fiscal year ending in June 2026, analysts expect Parker-Hannifin’s adjusted EPS to grow nearly 11% year-over-year to $30.33. The company's earnings surprise history is promising. It topped the consensus estimates in the last four quarters.

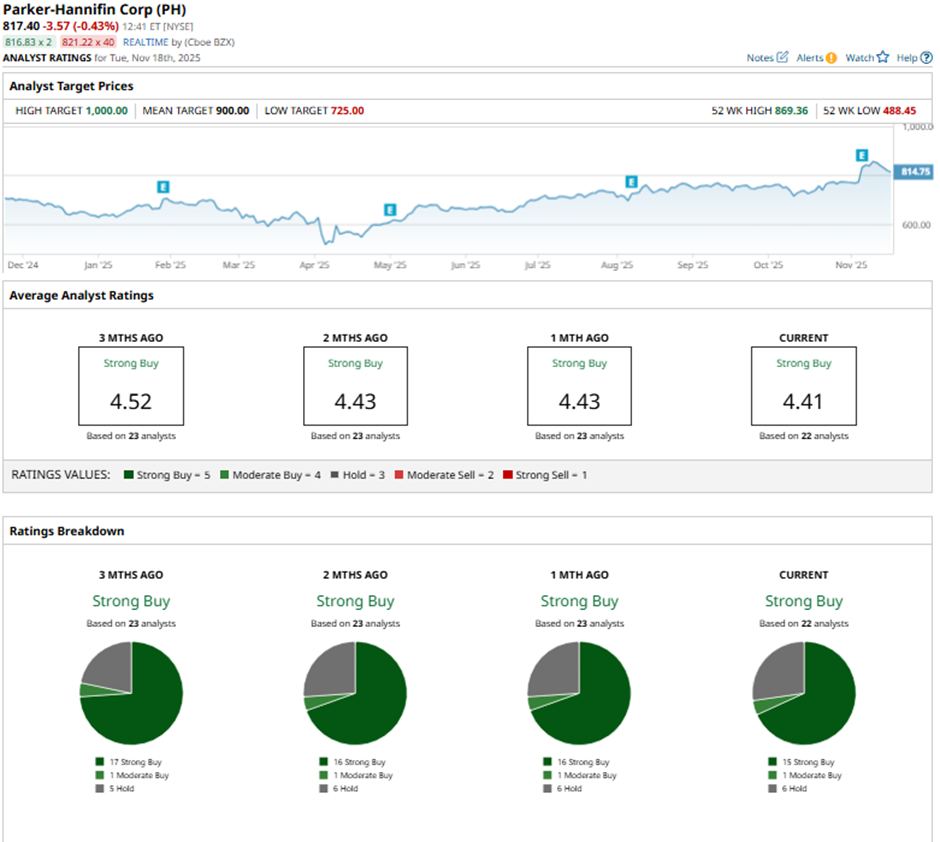

Among the 22 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 15 “Strong Buy” ratings, one “Moderate Buy,” and six “Holds.”

This configuration is less bullish than three months ago, with 17 “Strong Buy” ratings on the stock.

On Nov. 12, Baird analyst Mircea Dobre raised Parker-Hannifin’s price target to $960 and reiterated an “Outperform” rating.

The mean price target of $900 represents a premium of 10.1% to PH's current price. The Street-high price target of $1,000 suggests a 22.3% potential upside.