As the broader domestic usage of free ad-supported streaming explodes, the “couch potatoes” of Paramount’s Pluto TV seem to be getting left in the dust.

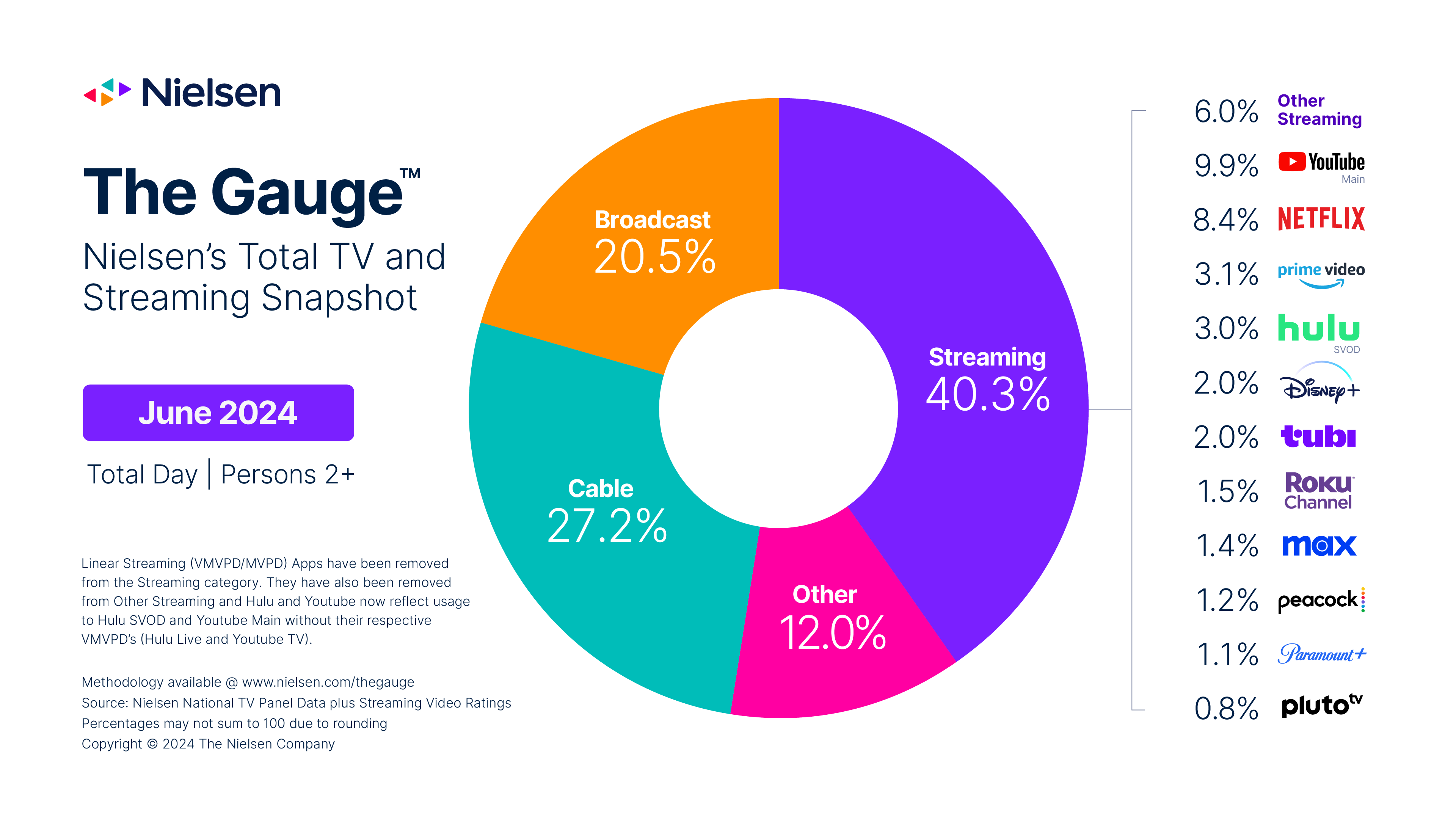

According to Nielsen's latest monthly U.S. TV usage market-share tracker, The Gauge, the FAST accounted for just 0.8% of overall domestic television consumption in June, vs. 0.9% in June of 2023.

Conversely, Fox’s rival FAST service, Tubi, has seen its market share grow from 1.4% to 2% over that same 12-month span, and The Roku Channel has expanded from 1% to 1.5%.

Free, ad-supported YouTube, the unchallenged leader of all streaming platforms, has seen its market share grow from 8.8% to 9.9% in one year.

As Lightshed Partners analyst Richard Greenfield noted on Tuesday, Paramount was first to recognize the potential of free ad-supported streaming and was the first to move into the space, paying $340 million to acquire startup Pluto TV in January 2019.

“Add Pluto to the challenges facing Paramount as part of the in-process Skydance transaction,” Greenfield wrote.

For his part, Greenfield wondered if Tubi's commitment to a Netflix-like, algorithmically driven UX versus Pluto TV’s traditional, pay TV program-guide-like interface is key to the growing chasm between the two ad-based services.

“Pluto feels more like the TV guide of the past compared to the algorithm-driven feeds consumers are increasingly accustomed to,” Greenfield wrote. “We have to believe the power of Tubi’s algorithm is enabling it to flourish.”

He added that has Roku begins to surface an increasing amount of its content in the same algorithmic way, learning user habits and responding to them over time, “it will be interesting to see if its share of time spent ticks up materially over the coming year. We are also curious to see if Pluto begins to pivot toward the Tubi business model following the Skydance transaction next year.”