Over the past 100 years, the companies that have commercialized new technologies the most have tended to be startups, e.g., personal computers, integrated circuits, enterprise software, and e-commerce services were all predominantly commercialized by startups. Even in the fields that established companies commercialized products, it has often been the case that startups ended up becoming the dominant companies.

On the surface, artificial intelligence (AI) is following the same trend. A large number of AI startups were founded in the 2010s, and venture capital (VC) funding for AI startups set records in 2020 and 2021. This suggests that AI startups are doing quite well, and AI is also doing very well.

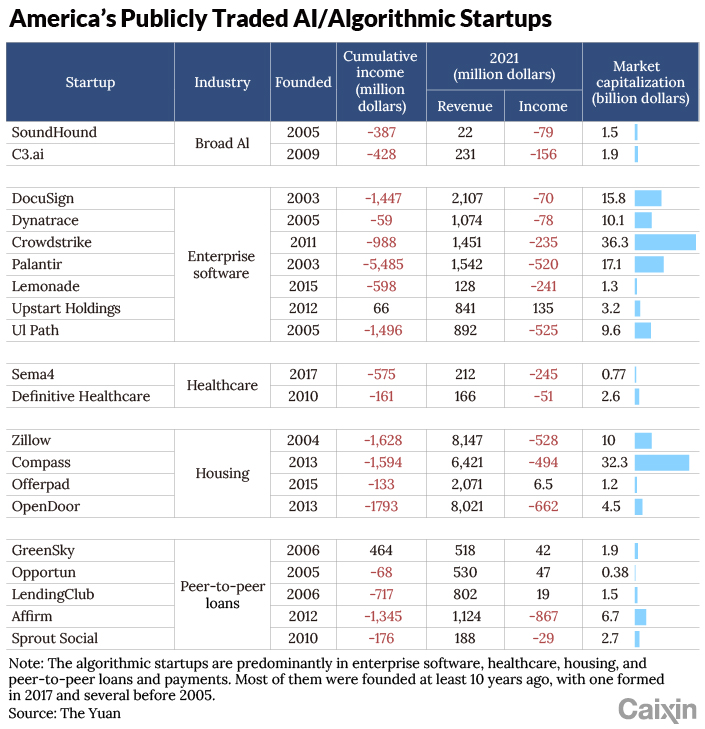

Below the surface, however, lies a more nuanced picture. Only two publicly traded startups, SoundHound and c3.AI, can be truly defined as AI firms, and neither are profitable or have large market capitalizations.

The table shows many other startups that use algorithms, and many of them claim to use AI, thus implying that their algorithms use AI. Some people will say that these are not true AI startups, but with so few publicly traded AI startups, one must define this liberally to talk about it. This small number is interesting in and of itself too. Given the record amounts of funding and such hype surrounding AI, one would have expected many more startups to have gone public.

The most profitable new firms in this group are the peer-to-peer (P2P) loan and payment ones, which connect borrowers directly to lenders. These startups set their rates and terms using algorithms, representing a limited form of AI. Four of the five startups listed in the table are profitable, and only Affirm, a company offering buy-now-pay-later services, has reported big losses.

Most of the other startups are highly unprofitable. Only one in business software, Upstart Holdings, and one in housing, Offerpad, make a profit. Ironically, Upstart sells the software that powers the P2P lending platforms, but its share (NASDAQ:UPST) price recently plummeted because it cut its outlook for the second quarter as well as for the whole year.

Aside from Upstart, the other algorithmic startups that offer enterprise software are all losing money. Lemonade has losses greater than its revenue and UI Path has losses greater than 50 percent of its revenue, as do the two AI startups C3.ai and SoundHound, as well as one of the healthcare startups, Definitive Healthcare.

Startups that use algorithms to flip homes are particularly problematic. Many factors impact the buying and selling price of homes and algorithms do not seem to be very good at doing this, particularly as home prices have recently started to fall. Due to excessive losses, Zillow has stopped flipping homes and gone back to just facilitating purchases. OpenDoor and OfferPad continue to flip homes and continue to rack up losses. The numbers shown in the table do not fully capture the true degree of losses, because these companies must subtract their buying expenses as well as many legal and administrative fees from any profits they make, i.e., the difference between the buying and selling prices. Thus, the fact that revenue, which includes the total home prices, is much greater than losses is less meaningful than it would be with startups in other categories.

Nevertheless, comparing revenues to cumulative losses is still relevant. Cumulative losses refer to those that have been accrued over the years, and high cumulative losses reflect years of losing money. Seven of the 21 startups listed above have cumulative losses greater than revenues, but this is still not as bad as the ratio for startups in general. Over 50 percent of publicly traded unicorns have greater cumulative losses than revenues, so in this respect the performance of AI startups is not so bad, but large cumulative losses (Palantir’s are $5.5 billion) will become increasingly hard to manage with interest rates rising again.

Their market capitalizations are also especially small. There is not a single AI or algorithm startup in the top 400 of global firms in market capitalization, which suggests that AI and algorithms have yet to make a big impact on the world. Crowdstrike is the highest ranked among these startups at 458th place (as of May 13). This is partly because the share prices of startups have dropped significantly over the last year, but even a year ago they were still not that much higher.

Contrast this with the market capitalizations for, e.g., personal computer and Internet stocks. Many of these were able to achieve top 100 market capitalization status within 10 or 15 years after their founding. And many of the algorithm and AI startups shown in the table above were formed at least 10 or 15 years ago.

Could privately held AI/algorithm startups be doing better? The VCs certainly think so, given huge valuations. They have published many sites listing the top 40 or 50 AI startups.

But if publicly traded startups are unprofitable, then why should privately held startups be doing any better? One would expect that the best startups would have gone public first, while those with weaker financials would do so later. Therefore, the above data on publicly traded AI companies suggests that privately traded AI startups are not doing particularly well.

Data on publicly traded unicorns in general suggest the same thing. By one count, 19 of today’s 140 publicly traded ex-unicorns (14 percent) were profitable in 2021, up from 17 in 2020 and 13 in 2019. This suggests that few privately traded unicorns are profitable, despite the fact that such profitable unicorns have been increasing a bit lately.

There is also the question of why privately held AI startups have not done public offerings or special purpose acquisition companies (SPACs). Certainly, there were many startups who did do this in 2020 and 2021, when a record number went public. But why did even more AI startups not go public in 2020 and 2021? Did they have worse financials than startups that did SPACs, many of which had no revenues?

Or could it be that they are planning to go public in 2022? Probably not: the share prices for startups have been declining since last November, and recently those share price declines have been accelerating even more. Today’s AI startups are doing poorly, and other than a few exceptions, we cannot expect there to be many positive outcomes.

Jeffrey Lee Funk is a contributor for the Yuan.

The content herein is subject to copyright by The Yuan. All rights reserved. The content of the services is owned or licensed to Caixin Global. The copying or storing of any content for anything other than personal use is expressly prohibited without prior written permission from The Yuan, or the copyright holder identified in the copyright notice contained in the content.

The views and opinions expressed in this opinion section are those of the authors and do not necessarily reflect the editorial positions of Caixin Media.

If you would like to write an opinion for Caixin Global, please send your ideas or finished opinions to our email: opinionen@caixin.com

Get our weekly free Must-Read newsletter.