Olema Oncology launched in 2006 to develop drugs for cancers affecting women. That mission has sent OLMA stock soaring this year as the biopharma firm embraces a strategy summed up by Chief Executive Sean Bohen as, "We punch above our weight."

Olema is taking on two markets worth $15 billion. The company's lead asset, called palazestrant, is in testing alone and in combinations for a subset of patients with metastatic breast cancer. Next month, Olema plans to announce the results of study combining palazestrant with Novartis' approved drug, Kisqali.

Bohen suggests the results are promising. In fact, Olema, which has 80 employees, has already decided to expand its study. The results could draw more cheers from Wall Street. Despite an abysmal equity market for biotech, OLMA stock — which was a dollar stock last year — has skyrocketed more than 551% this year as of the close on Nov. 20.

"We're a little company," Bohen told Investor's Business Daily. "We're now a Phase 3 company for a multibillion-dollar market and I think with an asset that the markets are finally starting to really appreciate."

OLMA Stock: Hormonal Cancer Drivers

Olema is known for developing drugs that aim to completely turn off estrogen, a hormonal driver of cancer cells.

Last month, Olema unveiled at the European Society of Medical Oncology annual meeting in Madrid midstage test results for palazestrant, which is geared to patients with metastatic breast cancer. The results were promising.

Patients who took the daily pill lived a median of 4.6 months before their cancer worsened — a measure called progression-free survival. In patients with a mutation in the ESR1 gene, the median progression-free survival was 5.6 months.

OLMA stock jumped almost 3% on the news. That's because the results position palazestrant well vs. Orserdu, an approved treatment for breast cancer patients with the ESR1 mutation. In the study that won Orserdu U.S. approval, patients lived for a median of 3.8 months before their cancer worsened.

"We saw a significant improvement in that (ESR1-mutated) population," Olema's Bohen said.

The results allowed Olema to begin a pivotal Phase 3 study of palazestrant, a key step in taking on a market Bohen said was worth $5 billion. The company expects to enroll the first patient for that study sometime this quarter.

The Bigger Opportunity: Combinations

But the bigger $10 billion opportunity for Olema and OLMA stock investors is combination therapy. Olema is testing palazestrant in combination with drugs that block enzymes called CDK4/6. This drug class is designed to interrupt the growth of cancer cells.

In May, Olema said palazestrant showed "attractive combinability" with Pfizer's Ibrance, a CDK4/6 inhibitor. The combo proved safe and tolerable across 29 patients. Tumors shrank and patients had "stable" disease, even among those who previously received a CDK4/6-blocking drug.

OLMA stock rose more than 2% on the news.

Now, Olema is planning to unveil updated test results for a combination of palazestrant and Novartis' Kisqali at the San Antonio Breast Cancer Symposium next month in San Antonio, Texas. The companies announced that they would expand the study to 60 patients and test the full dose of each drug, in October. The results could pave the way to a pivotal, Phase 3 study, Bohen said.

"You can infer we saw something to support doing that expansion," he said.

However, combining treatments poses risks, including unexpected drug interactions. One drug can change the metabolism of another. Others can enhance the toxicity in the combination, so it limits the dosage of both treatments.

"It's been a challenging sort of needle to thread," Bohen said. "We've shown data with the (Ibrance) combo where we think, pretty convincingly, that we show we're doing it. We're not altering the pharmacokinetics. We're not enhancing the toxicity."

OLMA Stock Is Top Rated

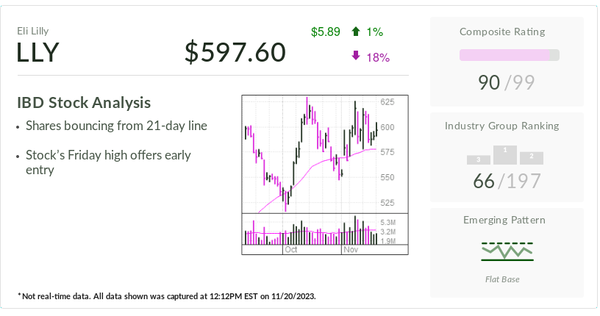

OLMA stock currently has a best-possible Relative Strength Rating of 99. This means shares rank in the top 1% of all stocks when it comes to 12-month performance, according to IBD Digital.

MarketSmith.com shows Olema shares have also stayed above their key moving averages for much of the year.

Olema is eyeing opportunities beyond cancers affecting women. The company is working on earlier-stage cancer treatments, including one that could potentially move it into a men's cancer: castration-resistant prostate cancer. Investors are taking notice, but shares still aren't taking off the way the data suggest they should, Bohen said.

"There's a very good rationale for why we think we should have a higher valuation," he said. "At the same time, I'm very much appreciative that the markets are paying some attention now. We have shown good data. They're looking at it. They're appreciating it."

Follow Allison Gatlin on X, the platform formerly known as Twitter, at @IBD_AGatlin.