Forget art, wine, bitcoin or NFTs: investing in sneakers could be the Next Big Thing. So big there are sneakerhead conventions, tipsheets, sneakers being sold for thousands at Sotheby’s, even a company doing nothing but authenticate sneakers to make sure eBay listings aren’t fakes. Aimee Ng, 17, checks out the market for Newsroom

The 22-year-old we speak with lives in Hamilton and runs the @puresteal.nz Instagram page. He has 1000 or so followers who come to his page to buy sneakers.

Not any old sneakers. Special sneakers which the young man buys, new or secondhand, and then resells for a profit.

Since he started his business during lockdown last year, he’s made between $3000 and $4000 profit from his sneaker investing.

The Hamilton man is what is known as a sneakerhead – someone who collects and trades sneakers as a hobby or a business. He’s the shoe version of an art collector or a wine investor.

There are thousands of people like him around the world, and with high inflation and shaky stock markets pushing investors into more niche markets, some in the investment community predict more people will get into the sneaker market.

There are some crazy stories. Nikes that might initially have cost a couple of hundred dollars, sold at auction in Hong Kong at the end of April for up to $10,000.

A pair of the Dior x Air Jordan 1 High sneakers released in 2020 and retailing that year at US$2,200 could now fetch anywhere between US$9,000 and US$24,000.

At the truly mind-blowing end of the scale, an auction in February this year of 200 pairs of special edition Louis Vuitton and Nike Air Force 1 sneakers created by late American designer Virgil Abloh fetched an average of $150,000 each at an online sale at Sotheby’s, or a total of $38.5 million.

The most sought-after pair sold for more than $540,000.

The Waikato man – and most Kiwi sneaker investors – aren’t in that league. Still, keen sneakerheads and sneaker resellers here can enter raffles from retailers such as Culture Kings to get their hands on, say, a pair of newly released Air Jordan 1s. Then sell them on, hopefully at a profit.

They can also buy from specialised platforms like eBay or StockX, both of which provide sneaker authentication and verification to weed out fakes. In fact StockX, an online, real-time marketplace (much like a stock exchange), was set up in 2015-2016 mainly to allow people to trade sneakers.

And of course sneaker entrepreneurs can do it the old fashioned way and queue round the block outside a store in the early hours of the morning when something special gets released.

The 22-year-old says he buys his sneakers locally and online from Australia, sometimes from private groups. And he does his homework.

“It’s about trial and error, but it’s important to do your research. Personally, I first began learning from YouTube, online articles, and some friends who are a part of the sneaker community.”

To sell the sneakers, sellers like John tend to use social media platforms like Instagram and Facebook groups; some use StockX to sell too – the marketplace takes a commission fee.

Over the last eight months, John says he has sold over 100 pairs of shoes and although he’s in the black overall, he has also made some losses, and has taken that as a learning experience.

“It was mainly due to the shoes being targeted at the wrong audiences.”

The history of sneakerhead investment

The sneakerhead culture first began in the US in the 1980s, growing alongside the rise in popularity of basketball (especially Michael Jordan) and the growing influence of hip hop. The trend has benefitted from the more recent ‘hype culture’, where excitement is built up around the limited release of a product and consumers are desperate to own the rarest items, including shoes.

In early 2021, research firm Piper Sandler estimated the global sneaker reseller market was worth $US10 billion, up from $US6 million in 2019.

A year earlier, Cowen Equity Research classified sneakers as an “emerging alternative asset class” and forecast the sneaker resale market could potentially reach $30 billion by 2030.

But don’t be fooled, the potential risks are high.

US-based alternative investment company Alts.com runs a newsletter called Sneakers Insider where, according to the company, they “use Moneyball tactics to discover sneaker arbitrage opportunities across the fractional platforms”. Whatever that means.

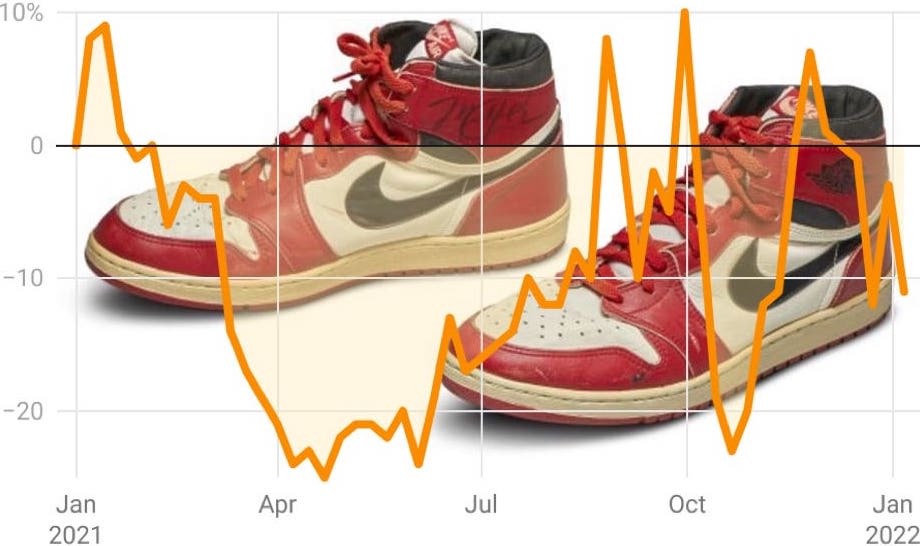

The December 2021 edition described sneakers as “probably the choppiest asset class on fractional marketplaces” over last year, adding that the market had “been all over the place" in 2021. “After a tough start to the year, things looked like they were picking up … until autumn, at which point they immediately sunk back to their early Q1 lows.”

The volatility hasn’t put people off. Plenty of teenagers (and twenty somethings, like John) are running their own sneaker reseller businesses, according to a Boston Magazine article in May last year called "Meet Boston’s new teenage sneaker moguls".

The magazine interviewed 17-year-old reseller Damian Mathews (aka Newton Kicks), who said in a good month he was able to make $US10,000 to $US12,000 in profit from his sneaker business.

Not only had he bought himself a car, he told the magazine, but the experience had been an education around starting and managing a business.

Back in New Zealand, financial coach Shula Newland is cautiously encouraging for anyone thinking about sneakers as an investment.

“As sneakers are tangible, their secondhand value will generally increase with inflation as well as any underlying supply and demand pricing,” she told Newsroom.

While most clients she spoke to saw collectable investments such as sneakers as more of a hobby, “it is a potential form of investment”, she says.

“It is just important to do your research and see how it fits into your own financial goals.”