The price per barrel for Brent Crude oil opened at $75.00 on Thursday, up 9.3% relative to last Tuesday's low of $68.61, as tensions in the Red Sea remain high following a string of attacks on shipping by Yemen's Houthi rebels.

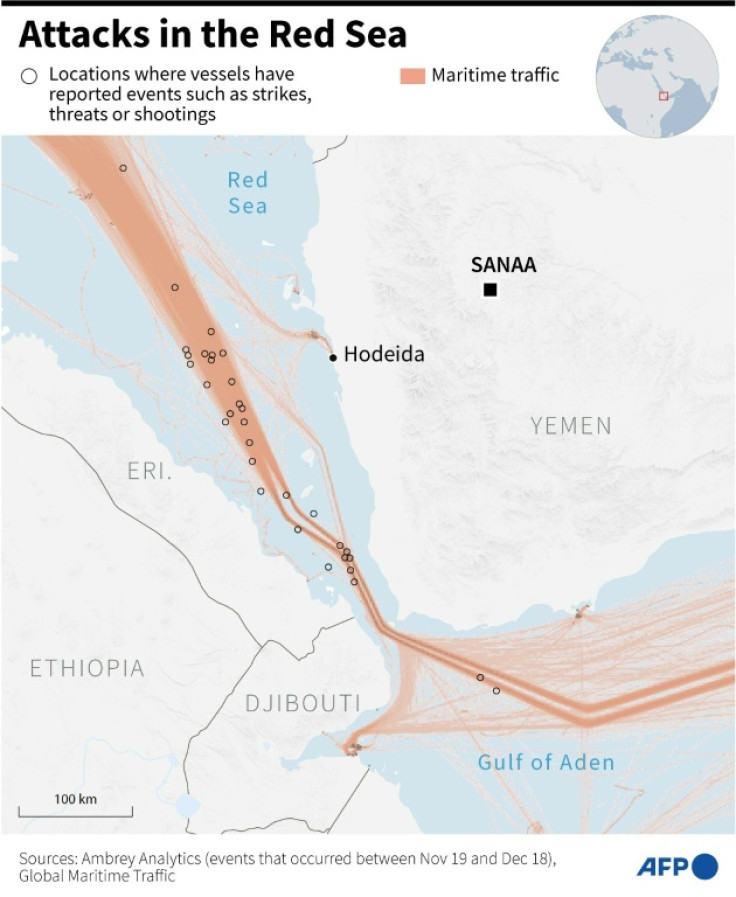

Dozens of incidents have been reported since mid-October, intensifying in early December, of Houthi military forces launching remote drone strikes, shooting live rounds and taking hostages on non-combatant shipping vessels. Two Norway- and Panama-flagged cargo ships were the latest targets of a naval drone attack on Monday, with no injuries reported.

While attacking shipping in the Red Sea isn't necessarily a new tactic for the Houthis, the Iranian-backed rebel organization that controls a large swath of Yemeni territory, including the majority of the country's Red Sea coastline, has increased dramatically since Hamas' October 7 attack on Israel. The high frequency and apparently random scope of attacks in November and December 2023 comes as a direct response to the conflict between Israel and Hamas in Gaza.

The Houthis said in a statement Saturday that "real steps to ease the humanitarian crisis in Gaza would contribute to reducing the escalation," Al Jazeera English reported. The group reportedly began de-escalatory talks with unnamed "international parties" over the weekend, which are being mediated by Oman.

U.S. Defense Secretary Lloyd Austin announced the formation of an international task force to address the issue on Tuesday. However, with full-scale Israeli military operations in Gaza likely lasting through January and Houthi attacks continuing, multiple major shipping companies have announced delays and suspension of their operations in the Red Sea and through the Suez Canal.

Shipping firms MSC, Maersk, CMA CGM and Haag-Lloyd and have all suspended operations, already diverting over $35 billion in Red Sea cargo. At least 103 ships have been redirected from the Red Sea this week, adding thousands of miles around the Cape of Good Hope to voyages and complicating last-minute holiday shipments between Asia and Europe.

Oil major British Petroleum (BP) announced Monday that it has paused all shipments through the Suez Canal due to "deteriorating security"; Equinor told CNBC on Monday that it had rerouted a number of oil and gas shipments but had yet to take a decision on pausing future ones. BP and Equinor did not immediately reply to a request for comment from International Business Times.

The tense situation in the Red Sea has given a boost to global oil prices, which witnessed positive growth in five of the previous six business days. Brent oil prices have declined 19% since peaking in late September at over $90 per barrel, as record US oil production drives down prices in spite of expanding OPEC output cuts.

Oil's reaction to Houthi attacks in the Red Sea highlights the sensitivity of hydrocarbon commodity markets to geopolitical uncertainty.

2024 will be an undoubtedly volatile year for oil and gas, with events like Brazil's plans to join OPEC+ and the possible resumption of U.S. sanctions on Venezuela certain to alter pre-existing market forecasts -- not even to mention general elections in the U.S., India, Mexico and Indonesia.