Nvidia hasn't reported its third quarter update yet, but it's the clearest winner of the megacap earnings season. It stands poised to reap billions in spending on new AI technologies and infrastructure over the coming years.

Nvidia (NVDA) , which closed out October with a 9.3% gain, well ahead of the 0.5% advance for the Nasdaq benchmark, has added more than $2 trillion in market value this year thanks to the surge in investment in AI tech and its hammerlock on the chip market that powers it.

Related: Veteran trader makes surprising call between Palantir, Nvidia stock

It was also chosen to replace Intel (INTC) in the Dow Jones Industrial Average on November 8. With its now $3.3 trillion in market value, it will sit just below Apple (AAPL) as the benchmark and the world's second-most valuable company.

It's influence on the AI chip market is no less impressive

UBS analysts see the four biggest hyperscalers, all of which posted third-quarter earnings this week and form the spine of the global AI investment race, to spend $267 billion on capital projects tied to the new technologies next year, a 33.5% increase from this year's forecast.

Google parent Alphabet (GOOGL) , Facebook parent Meta Platforms (META) , Amazon (AMZN) and Microsoft (MSFT) , in fact, are already poised to spend around $200 billion this year alone in what Amazon CEO Andy Jassy called a "once-in-a-lifetime" opportunity in generative AI.

Amazon pegged its 2024 capital spending at around $75 billion, most of which will "support the growing need for technology infrastructure [primarily Amazon Web Services] as we invest to support demand for our AI services."

Meta said this year's bill would rise to between $38 billion and $40 billion, with "significant acceleration in infrastructure expense growth next year."

Microsoft, which spent $55.4 billion in the financial year that ended in June, will likely shell out $80 billion this year. Google's tally is forecast at $51 billion.

Even Tesla (TSLA) , which is chasing CEO Elon Musk's bold ambitions of a fleet of autonomous robotaxis and self-driving electric vehicles, expects to spend around $11 billion this year "largely because of investments in AI compute."

Nvidia's commanding AI chip market share

And Nvidia — which commands an 80% share of the market for the chips and processors that power not only the massive datasets being trained by the hyperscalers, but also the enterprise customers that would like to apply the technology to everything from restaurant sales to pharmaceutical research — is poised to reap the benefits.

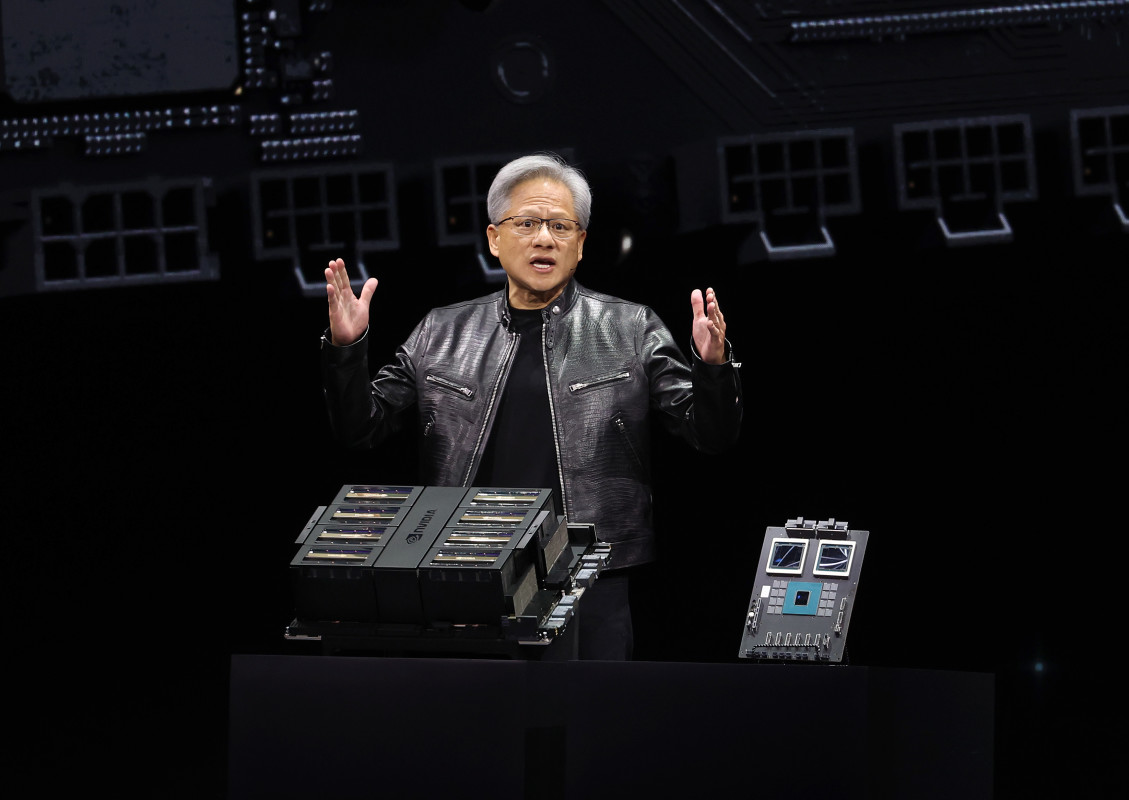

CEO Jensen Huang, in fact, described AI demand last month as "insane," while rival chip-sector boss Lisa Su at Advanced Micro Devices (AMD) forecast the total addressable market for AI accelerators alone would grow more than 60% annually and reach $500 billion by 2028.

Meanwhile, total AI spending, which includes software, hardware and services, is likely to more than double to around $632 billion by 2028 from $235 billion last year, according to IDC estimates.

Related: Goldman Sachs analyst updates Amazon stock price target after earnings

Last year, the entire semiconductor industry, including everything from chips and processors in mobile phones to memory inserts in personal computers, generated $500 billion in sales.

CFRA analyst Angelo Zino, however, sees Nvidia as the principal beneficiary as it launches its newest line of chips and processors, dubbed Blackwell, and preps for a next-generation system, called Rubin, in the coming years.

"Blackwell will take greater wallet share from hyperscalers amid an AI war in the cloud," Zino said in a recent note. "The supply chain is also confirming the strength of AI demand, improving visibility entering 2025."

If you can't beat 'em ...

The broader market demand is so compelling that Amazon is getting in on the act by investing in its own high-performance chips, called Trainium, that it can sell directly to clients who may not wish to wait for, or pay for, Nvidia's sought-after products.

Amazon told investors on Thursday that some of its cloud customers want "better price performance on their AI workloads" as they scale their operations and look to reduce costs.

Microsoft is also working up a new line of AI accelerators, which it calls the Maia 100, to train large-language models. These could both help it wean it from reliance on Nvidia and offer a lower-priced alternative to its Azure cloud customers.

Related: Analysts revisit Microsoft stock price targets after Q1 earnings

The surge in demand, however, has tested the limits of capacity across the supply chain that Zino cites, in a market that remains dominated by only a handful of assemblers and designers.

Taiwan Semiconductor, (TSM) the supply-chain linchpin, told investors last month that "our customers' demand far exceeds our ability to supply," a clear reference to Nvidia.

TSM posted record quarterly profit, the equivalent of US$10.06 billion, and forecast a full-year revenue growth rate of around 30%. It also pegged its overall capital spending plans at just more than $30 billion for this year and higher still in 2025.

Nvidia earnings will be reported in November

All this points to another monster quarter for Nvidia when, later this month, it reports sales and profit for the three months that ended in October and its outlook for the coming year.

Nvidia told investors in late August that Q3's current quarter revenue would be in the region of $32.5 billion, more than double the tally of the year-earlier period. However, the company faced some delays in shipping its new line of Blackwell processors amid design changes and supply-chain snarls.

Related: Legendary billionaire tech investor makes an amazing claim about Nvidia's stock

"What we're looking at now is the next wave of AI, and the biggest wave of AI, and this is really all about companies using it to be more productive as well to revolutionize the way they build their products — and the products they build," Huang told CNBC last month.

“Everybody wants to have the most, and everybody wants to be first,” Huang told CNBC last month. "Blackwell is in full production, Blackwell is as planned, and the demand for Blackwell is insane."

More AI Stocks:

- Analysts update Meta stock price target with Q3 earnings in focus

- Veteran trader who called Palantir rally unveils new price target

- Open AI is burning cash (and losing billions!)

Nvidia shares rose 2% in Friday trading to end the session at $135.37 each, a move that extend the stock's six-month gain to around 63%.

Related: Veteran fund manager sees world of pain coming for stocks