Nvidia shares slipped in and out of positive territory on Tuesday, and could face ongoing pressure over the coming weeks as supply-chain issues, some of which are tied to the political crisis in South Korea, affect Blackwell sales forecasts.

Nvidia (NVDA) , which is counting on several billions of dollars of Blackwell sales over the group's fiscal fourth quarter ending in January, relies heavily on South Korea-based SK Hynix for memory chips crucial to its performance.

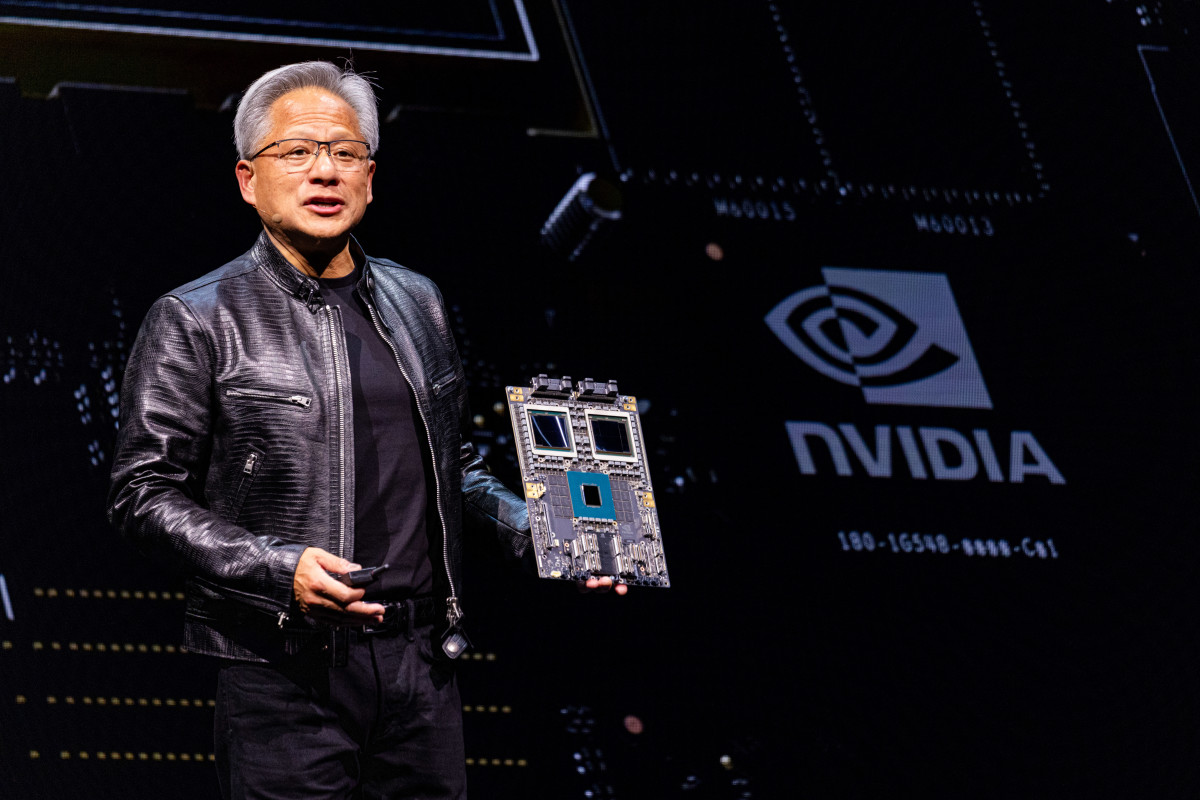

Earlier this fall, Nvidia CEO Jensen Huang asked SK Hynix to speed up the supply of its newest high-bandwidth memory chips, HBM4, as it ramped production of Blackwell graphics-processing units into next year.

SK Hynix also plans to invest $6.8 billion in a new chip plant based in Yongin, around 25 miles southeast of Seoul, that the group said would be "the foundation for SK Hynix's mid-to long-term growth."

South Korea's semiconductor exports in November rose 30.8% from the year-earlier month to $12.5 billion. The figure marked the fourth consecutive record total, even as overall exports slowed 1.4% to $56.35 billion.

South Korea invokes martial law

However, South Korea is now in the throes of an unprecedented political crisis following President Yoon Suk Yeol's declaration of martial law earlier Tuesday.

Yoon Suk Yeol said the move was justified by opposition Democratic Party moves to impeach him. He said the declaration would enable him to “eradicate pro-North Korean forces and protect the constitutional democratic order.”

Related: Nvidia stock extends November gains as investors bet on 2025 AI dominance

Reports suggest soldiers have banned lawmakers from entering South Korea's National Assembly, while curbs on the media and the right to protest are expected over the coming days.

National Assembly lawmakers quickly voted against the order, and Yoon lifted his declaration, the first since the country's infamous coup d'etat in 1979, but significant uncertainty lingers over one of the biggest economies in the region.

That is likely to hinder production at both SK Hynix and Samsung Electronics, which is reportedly looking to supply Nvidia with HBM3 memory chips in a major challenge to its domestic rival.

Nvidia, meanwhile, told investors at the UBS Global Technology and AI Conference in New York on Tuesday that broader supply constraints tied to its Blackwell ramp would continue into the coming year.

Related: Nvidia earnings adjust chances for S&P 500 record year

"What we are seeing right now is demand continues to be fueled by the size of models and the complexity of inferencing," finance chief Colette Kress told the event.

"What we see in terms of Blackwell this quarter is also a supply constraint that is going to take us well into our next fiscal year (and) for several quarters," she added.

Wall Street analysts expect Blackwell sales to add between $3 billion and $5 billion to Nvidia's fourth-quarter revenue, before those figures accelerate to around $62 billion in 2025 and $97 billion the following year.

More AI Stocks:

- Analysts update Salesforce stock price targets ahead of earnings

- Druckenmiller predicted Nvidia's rally, now has new AI target

- The 5 biggest takeaways following Nvidia's earnings

Nvidia shares were last marked 0.4% higher, changing hands at $139.13.

South Korea's Won was marked at the lowest level against the U.S. dollar in at least three years following the Yoon declaration.

Related: Veteran fund manager sees world of pain coming for stocks