/NVIDIA%20Corp%20logo%20on%20phone%20and%20AI%20chip-by%20Below%20the%20Sky%20via%20Shutterstock.jpg)

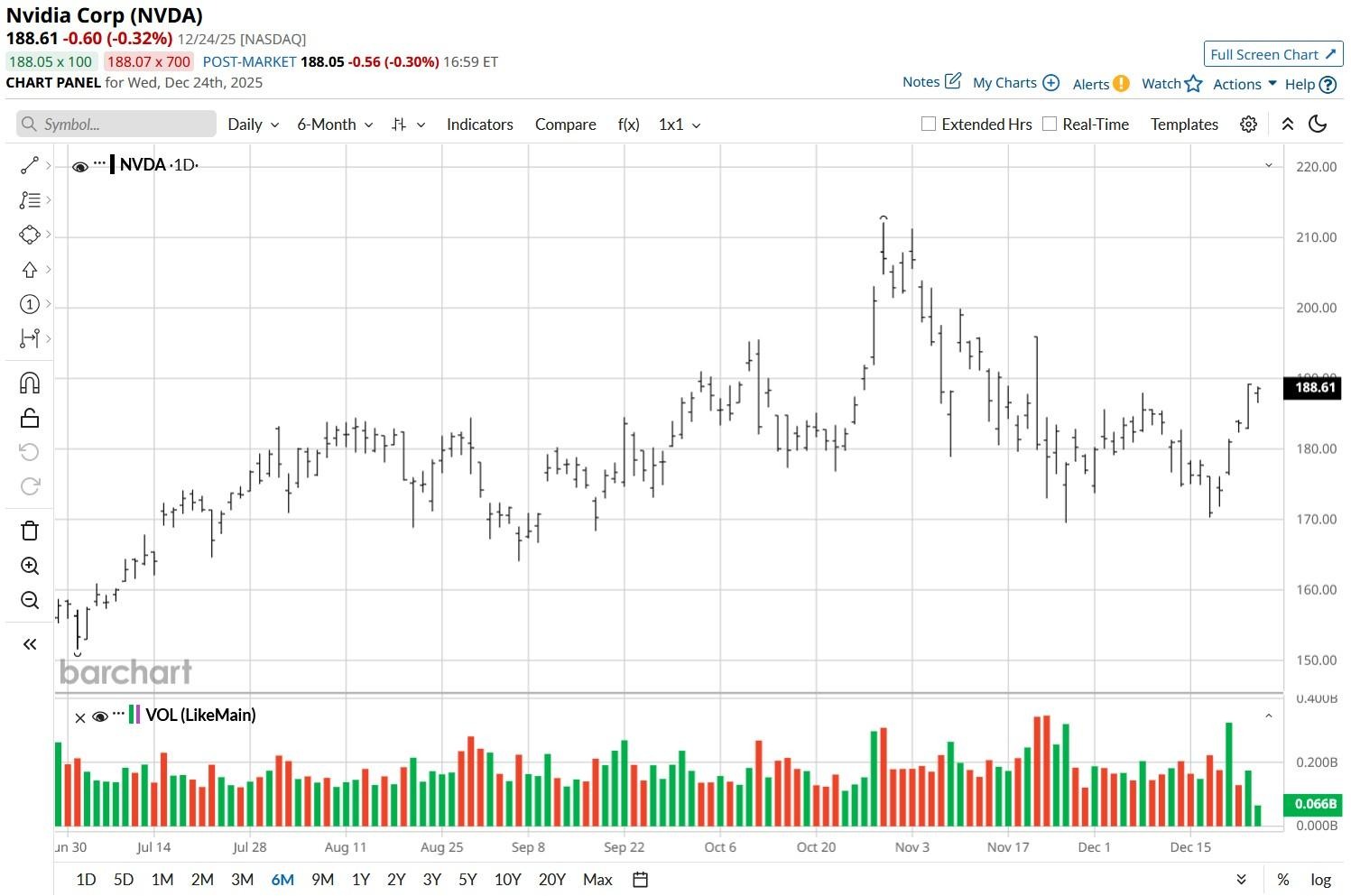

Nvidia (NVDA) shares remain down about 12% versus their record levels set in late October as bubble and valuation concerns continue to linger in investor sentiment.

However, Raymond James analysts remain confident in the AI darling’s ability to not just recover, but climb to a new all-time high in 2026.

Their bullish call is particularly significant given Nvidia stock is already trading at roughly double its price in early April.

Why Is Raymond James Bullish on Nvidia Stock?

Raymond James recommends owning NVDA stock at current levels mostly because recent reports suggest the semiconductor behemoth plans on resuming chip shipments to China.

In its latest research note, the investment firm estimated Beijing to deliver about a $7 billion boost (at least) to Nvidia’s revenue.

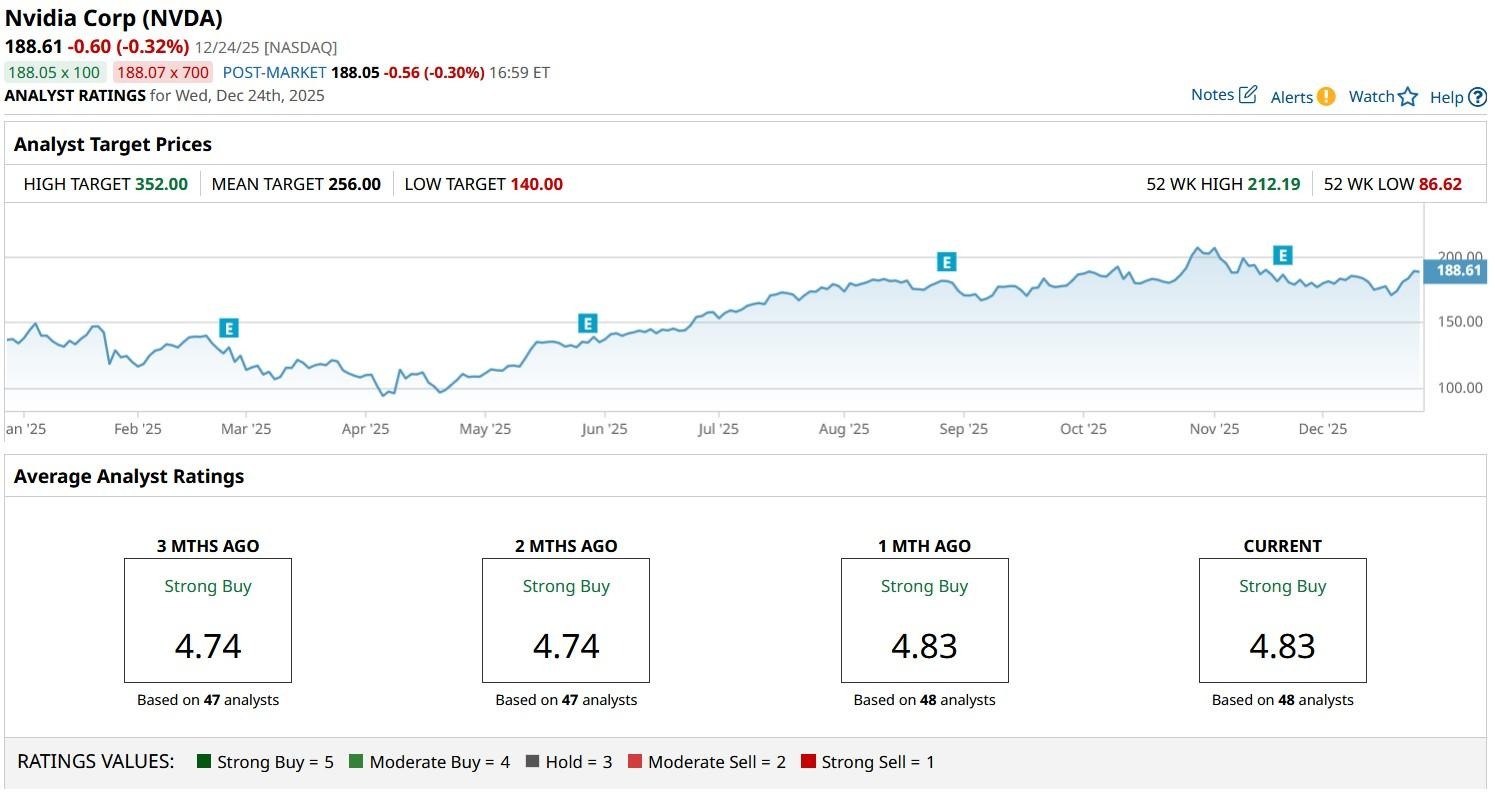

At the time of writing, it has a “Strong Buy” rating on the multinational with a $272 price objective indicating potential upside of another 45% from here.

Even from a technical perspective, NVDA is a raging “Buy” heading into 2026. It’s trading handily above its major moving averages (MAs), reinforcing that bulls remain in control across multiple timeframes.

Q4 Earnings Could Push NVDA Shares Higher

According to Raymond James, Nvidia’s Blackwell shipments could peak at about 7.8 million chips in calendar 2026.

Its analysts remain constructive on the AI stock also for its software moat – the CUDA ecosystem – that underpins developer loyalty and reinforces NVDA’s dominance in accelerated computing.

In its current financial quarter, the Nasdaq-listed firm is expected to earn $1.44 on a per-share basis – up a whopping 69% year-on-year – suggesting concerns of an AI bubble are rather overblown.

Historically, Nvidia shares start the new year with a bang, with an average of just under 6.0% gain in January over the past four years.

This seasonal pattern makes them even more attractive to own heading into 2026.

Nvidia Remains a ‘Buy’

While not as bullish as Raymond James, other Wall Street firms recommend sticking with NVDA shares.

The consensus rating on Nvidia stock remains at “Strong Buy” with the mean target of about $256 indicating potential upside of as much as 35% from current levels.