Nvidia shares moved lower again Tuesday, dragging the stock into so-called 'correction territory' and the lowest levels in two months, as investors look to take end-of-year profits from one of the top-performing stocks of the year.

Nvidia (NVDA) , the market's clear standout performer prior to the November election, is the only so-called Magnificent 7 tech stock to have fallen in value since President-elect Donald Trump was swept back into the White House.

The AI chipmaker, in fact, has fallen more than 10% since its last closing high, recorded on Nov. 7, losing around $400 billion in market value and falling to third place, behind Apple (AAPL) and Microsoft (MSFT) , in the list of the world's most-valuable companies.

Curiously, there hasn't been a defining catalyst for the sell-off, although an antitrust probe, launched earlier this month by government officials in China, suggests the group could find itself in the crosshairs of an escalating tech trade ware between Washington and Beijing.

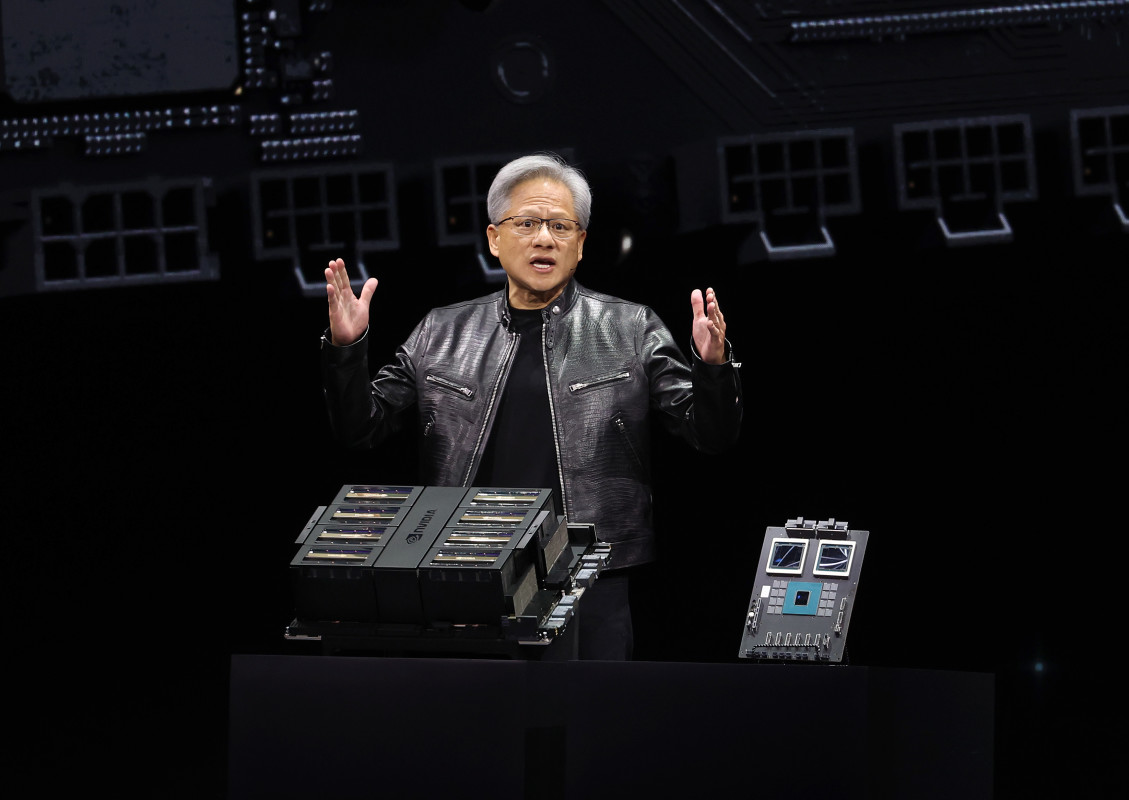

In fact, most Wall Street analysts remain bullish on the stock, suggesting the ongoing ramp of its Blackwell processors, which are expected to developing a commanding share of the market for AI-powering chips, will add billions to its current quarter topline and many billions more over the coming financial year.

$100 billion profit target

The group's profit margins, as well, are likely to remain robust, and hold at levels in the low 70% range as it rushes to produce and deliver the expensive Blackwell systems amid supply chain challenges and production capacity limits.

Putting those margins into context, Nvidia reported net income of $4.37 billion in the fiscal year that ended in January of 2023 and included the launch of ChatGPT. By the end of the next fiscal year, which ends in January of 2026, that figure is forecast to rise to $102 billion.

Related: Nvidia stock faces new threat after China update

It's also a cash cow with very little debt, leaving it ample room for stock buybacks that reward investors for their longer-term views. Nvidia is likely to generated $62 billion in free cash flow in its coming fiscal year, according to GimmeCredit analyst Dave Novosel, with around $36 billion of that set aside for share buybacks.

"2025 seems likely to be an exceedingly good year," said Bernstein analysts, lead by Stacy Rasgon, who reiterated their assessment of Nvidia as a 'top pick' in the sector in a note published Monday.

KeyBanc Capital Markets analyst John Vinh also notes that some of Nvidia's key customers, such as Google parent Alphabet (GOOGL) and Facebook parent Meta Platforms (META) , are starting to build their own AI chips in house in order to diversify supplies in their most-important technology.

Nvidia a compelling buy

Broadcom's (AVGO) recent forecast that it sees a market for its custom AI chips of between $60 billion and $90 billion by fiscal 2027 could also eat into Nvidia's market share.

That said, Vinh sees Nvidia as a compelling buy at levels below $130 per share.

More AI Stocks:

- Top analyst revisits Micron stock price target ahead of Q1 earnings

- Analysts revamp Ciena stock price target after AI outlook

- Cathie Wood buys $30 million of under-the-radar AI stock

"We're far from being a zero sum gain in the AI space, and there are going to be multiple winners alongside Nvidia," he told CNBC Tuesday. "And there remains at least some uncertainty as to whether the biggest hyperscalers will be successful in building their own AI chips."

Related: Nvidia stock extends November gains as investors bet on 2025 AI dominance

Nvidia, which guides investors on revenue and profit forecasts for only the coming quarter, topped Wall Street estimates by only 1.5% for its end-January revenue tally of $37.5 billion.

That compares to forecast beats, when compared to Street estimates, of between 5% and 20% over the past two years.

Nvidia shares were last marked 2.5% lower in early Tuesday trading to change hands at $129.01 each, the lowest since early October.

Related: Veteran fund manager delivers alarming S&P 500 forecast