Nvidia (NVDA) stock may be struggling as a Chinese regulatory probe continues to weigh on it, but the company remains highly focused on growth.

Don't miss the move: SIGN UP for TheStreet's FREE daily newsletter

Since news of this investigation broke, NVDA has been volatile, falling 5% over the past five days. But even as it faces the prospect of a $1 billion fine if authorities find it guilty of antitrust violations, the company has made it clear that it isn't backing away from conquering the booming Chinese tech market.

In fact, Nvidia‘s hiring in China is increasing, even after the AI leader spent the year adding to its China-based workforce.

This hiring trend indicates that Nvidia is prioritizing expanding its research capabilities in China. More specifically, it seems that the company is focused on conquering a specific area of the growing Chinese tech market.

Nvidia is eyeing China’s market in a pivotal new technology

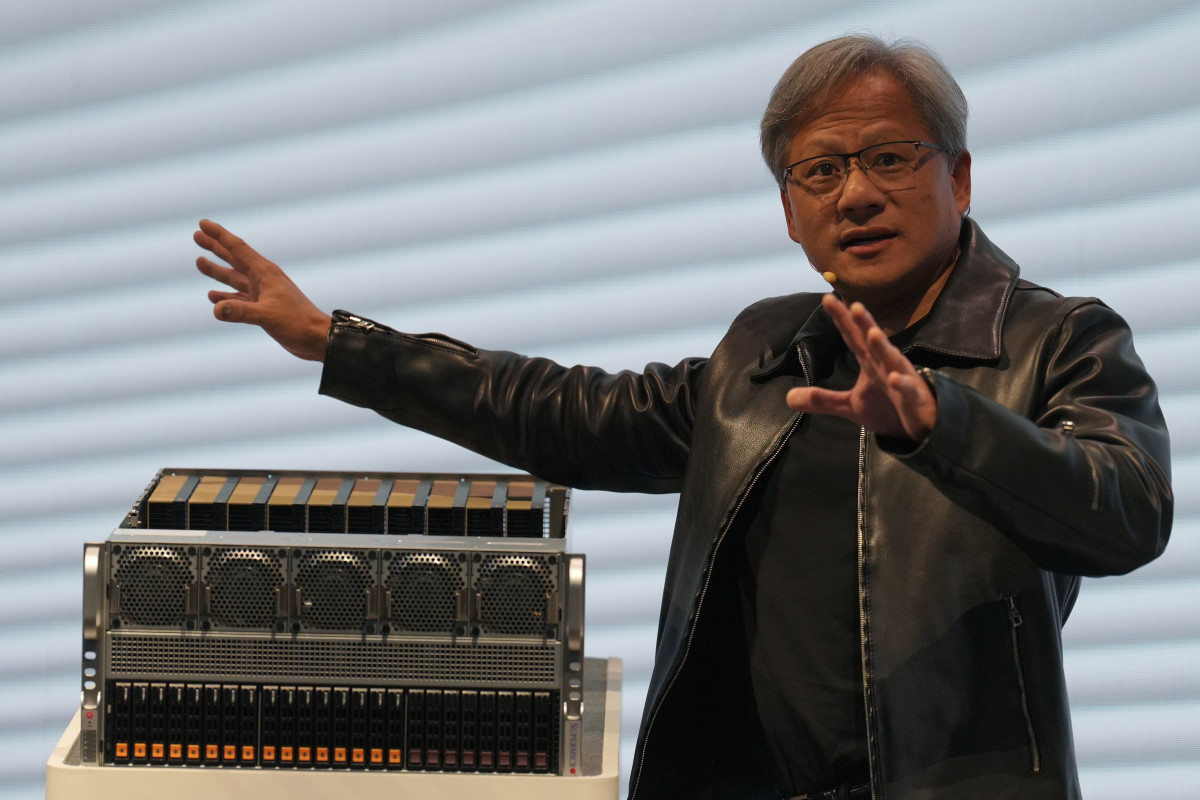

An undisputed leader in the AI space, Nvidia is best known for supplying the chips that most companies need to run large language models (LLMs).

Nvidia is likely not the first company that comes to mind when a discussion turns to self-driving cars. But, Nvidia is eyeing autonomous vehicle technology as it maneuvers to expand its hiring in China.

Related: Nvidia's next move could be a big deal for another AI stock

While U.S. companies such as Tesla (TSLA) and Google (GOOGL) subsidiary Waymo often dominate the headlines regarding self-driving technology advancements, China is also focused on helping usher in a driverless future.

As of this year, the east Asian nation is testing more self-driving vehicles than any other country, including the U.S. Cities such as Wuhan and Beijing are playing host to an increasing number of robotaxis, often operated with no safety driver present.

Chinese tech giant Baidu (BIDU) is one of the primary providers of these self-driving cars, although companies such as AutoX and Pony.ai have also been granted permits to test autonomous vehicles. According to the New York Times, these assisted driving systems go beyond the capabilities of Tesla’s full-self-driving (FSD) tech.

If Nvidia can find a niche helping these companies continue advancing their autonomous driving technology, it could help it procure a share in a booming new market. In turn, this could make the company more valuable, as it would be expanding into a new area of tech, going beyond supplying chips to firms that train LLMs and build data centers.

However, Nvidia’s plans to infiltrate this market predate its rise to industry leader status.

Related: Best-managed company rankings reveal a lot about top tech stocks

As Bloomberg reports, “Nvidia has been developing driving automation and AI software for over a decade, though its efforts have yet to bear fruit. The company’s China-based researchers would be well positioned to work with local automakers who are looking for such technologies to enhance their offerings.”

Given the speed at which China’s self-driving car market is growing and the Chinese government’s focus on helping it expand, more auto manufacturers will likely be looking to do precisely that in the coming years.

More Tech Stocks:

- Apple unveils AI decision that is a major blow to Nvidia

- Google unveils the ChatGPT of weather

- UnitedHealthcare spotlight reveals pivotal AI failure

Nvidia’s focus on hiring in China is highly strategic, as it shows that the company is looking to expand its Chinese operations to meet a demand that is likely to keep growing.

Nvidia could be a winning stock among self-driving car plays

As the race to pioneer the first truly self-driving car intensifies, investors are highly focused on identifying the automaker best positioned to win the driverless race. So far, no clear winner has emerged. Tesla recently announced that it plans to finally release some robotaxis in 2025, but Waymo has already put self-driving taxis on the road in multiple cities.

Meanwhile, Chinese companies continue to benefit from their government’s pro-autonomous driving stance, helping them test and refine their technologies. This development is a good reminder that gaining exposure to a new tech market through component suppliers can sometimes be a sound investing strategy.

Related: Google wants government agency to kill AI competitor's deal

Nvidia doesn’t build cars, but it has been extremely successful in providing the only chips that can power some AI models. If its autonomous driving tech proves anywhere near as effective, Nvidia will likely be in an excellent position to help Chinese companies advance toward their self-driving goals.

As Stephen Guilfoyle of TheStreet Pro recently noted, Nvidia is currently caught in the crossfire of the Biden administration imposing substantial restrictions on high-level tech exports to China and incoming president Donald Trump threatening to levy severe tariffs on Chinese imports to the U.S. However, Nvidia’s push to expand its operations in China indicates that the company isn’t overly worried about geopolitical factors.

Related: Veteran fund manager sees world of pain coming for stocks