Tech stocks continue to lead the broader market, pacing gains for a surprise May rally that has lifted all three major benchmarks to record highs ahead of the final first quarter update from the megacap Magnificent 7 tech stocks set for next week.

Nvidia, which has outpaced the Nasdaq's 6.5% gain over the past month with an 9.22% advance, will report fiscal first quarter earnings on May 22 in what is likely be the final test for the market's searing spring rally into the Federal Reserve's next policy meeting on June 12.

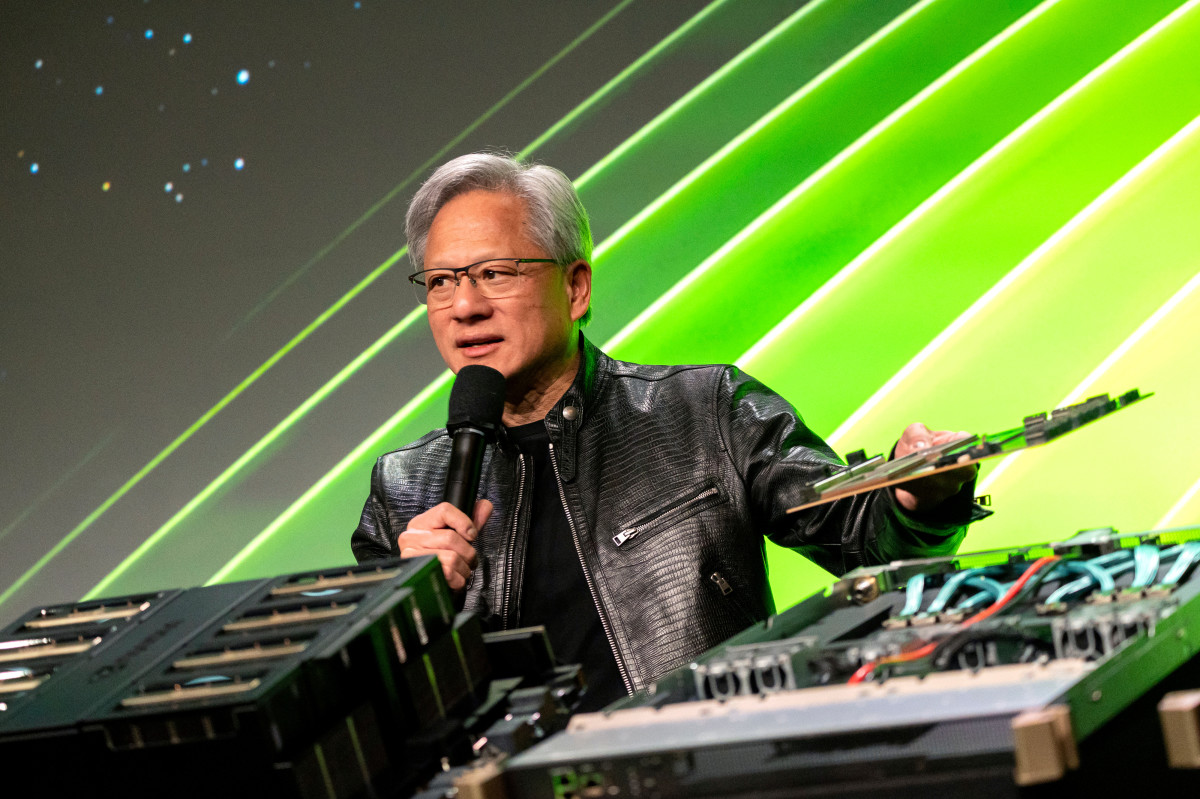

The market's undisputed leader in AI chip production, which has added more than $1 trillion of market value this year, sparked a massive surge of interest in that sector last year when it forecast a doubling of revenue tied to demand for its H100 processors.

Nvidia has since launched a newer and more expensive series of artificial intelligenc focused graphics processing units called Blackwell, building a commanding lead in the global AI supply chain for hyperscalers such as Microsoft (MSFT) , Alphabet (GOOG) , Meta Platforms (META) and Amazon (AMZN) .

Nvidia CEO Jensen Huang, in fact, sees the data-center market growing at $250 billion a year — on top of an installed base he estimates is valued at $1 trillion — as companies like IBM (IBM) and Alibaba Cloud (BABA) mount nascent challenges to their larger rivals.

Nvidia earnings crucial to spring rally

"We sell an entire data center in parts, and so our percentage of that $250 billion per year is likely a lot, lot, lot higher than somebody who sells a chip," Huang told investors during the group's GTC developers' conference in San Jose, Calif., earlier this year.

Nvidia's (NVDA) broader connection to the tech-market zeitgeist, however, may prove just as important as analysts and investors look to its end-of-year forecasts to justify both the Nasdaq's 13.1% gain so far this year and the hundreds of billions in capital spending planned by its biggest customers.

Related: Analyst updates S&P 500 price target after CPI inflation surprise

LSEG data suggest that the communications services sector, including Google and Meta, and the information technology sector, including Microsoft, Apple, and Nvidia, will contribute just over half of the S&P 500's $494.4 billion in second-quarter earnings.

"Despite anticipation of next-generation Blackwell GPUs in the second half of the year, we see limited signs of a demand pause," said KeyBanc Capital Markets analyst John Vinh.

"We expect Nvidia to report first-quarter results and second-quarter guidance meaningfully above expectations," added Vinh, who carries a $1,200 price target and an overweight rating on Nvidia stock.

S&P 500 surges through rate hikes

Wall Street analysts see Nvidia's profit rising more than fivefold from last year to $5.58 a share, or $13.86 billion, over the three months ending in April.

Group revenues, meanwhile, are expected to triple from last year to around $24.6 billion, with quarterly sales expected to top the $30 billion mark by the end of its current financial year in January 2025.

Earnings growth, as well as the surprising outperformance of the U.S. economy, has proven far more powerful than the expectation of rate cuts or the constant calls for recession from the bond market in driving the market's post-COVID gain.

Related: Analysts overhaul Nvidia stock price targets ahead of earnings

The S&P 500, which hit an all-time closing high of 5,308.15 points on May 15, is up more than 11.8% for the year and has risen more than 22% since the Fed started hiking interest rates just over two years ago.

Collective S&P 500 profits are expected to rise by 10.4% this year, with a 14.1% advance in 2025, even as analysts see economic growth slowing and unemployment rising over the next six months.

Bulls shrug off slow growth concerns

The Conference Board's index of leading economic indicators, published late last week, noted that "elevated inflation, high interest rates, rising household debt, and depleted pandemic savings are all expected to continue weighing on the US economy in 2024."

"As a result, we project that real GDP growth will slow to under 1% over the Q2 to Q3 2024 period," the report added.

Data from two closely tracked Wall Street surveys published last week also suggested investors were seeing a clear path to new all-time highs, even if the Fed keeps to its word and holds rates steady until year-end.

S&P Global's Investment Manager Index, published May 14, showed equity-risk appetite surged to a two-and-a-half-year high this month, citing S&P 500 earnings potential over rate cut optimism.

More Economic Analysis:

- Watch out for 8% mortgage rates

- Hot inflation report batters stocks; here's what happens next

- Inflation report will disappoint markets (and the Fed)

Meanwhile, Bank of America's monthly survey of global fund managers suggests investors are the most bullish since November 2021. However, it notes that 80% of respondents expect at least two rate cuts in order to support that optimism.

Stocks might also get their long-awaited rate cut following the slower-than-expected April inflation reading and signs of a weakening labor market in the summer months.

CME Group's FedWatch tool suggests little chance the Fed will move on rates over its next two policy meetings, in June and July, but it pegs the odds of a September rate cut at around 70%.

That view could be altered by the central bank's fresh growth and inflation forecasts, otherwise known as the dot plots, which Fed officials will publish next month. But Chairman Jerome Powell has largely taken any risk of a rate hike off the table in his recent public remarks.

Related: Will the S&P 500 defy 'Sell in May' this year?

A dovish Fed, or even one content with holding rates steady into the end of the year, a resilient economy and consistently improving corporate earnings should set the market up for a solid second half, argues Ryan Detrick, chief market strategist at Carson Group.

"Earnings continue to surprise to the upside [and] balance sheets for corporate America are in great shape," Detrick said. While consumers "might have some cracks, [they're] still strong thanks to a very healthy employment backdrop.

"Then consider lower rates are likely coming, thanks to inflation that should drastically improve the second half of this year. It is an election year, so expect some bumps, but overall the bull market that started in October 2022 is alive and well," he added.

Related: Single Best Trade: Wall Street veteran picks Palantir stock