TheStreet’s Conway Gittens talks Nvidia (NVDA) latest business headlines from the floor of the New York Stock Exchange as markets open for trading Thursday, June 6.

Related: Why a veteran fund manager sold some Nvidia stock before its stock split

Full Video Transcript Below:

CONWAY GITTENS: I’m Conway Gittens reporting from the New York Stock Exchange. Here’s what we’re watching on TheStreet today.

Stocks are coming off a solid session on Wall Street with the S&P 500 notching a new record high thanks to a rally in Nvidia shares just a few days after the company launched its new AI chip. Separately, new weekly jobless claims data showed unemployment applications jumped to a four-week high. investors are looking ahead to the all-important May jobs report out Friday for clues into the health of the U.S. labor market.

In other business headlines - chipmaker Nvidia has surpassed Apple as the second-most valuable public company in the U.S. On June 5 Nvidia became only the third company to ever cross the $3 trillion market cap threshold. Apple’s market cap hovers around $3 trillion.

After Nvidia saw its stock increase by an incredible 239% in 2023, it’s already up another 147% so far this year. Over the last 5 years, shares are up nearly 3,300%.

While the company’s success has been long-sustained, its recent bump higher can be attributed to a couple of things. In the first quarter of 2024, the AI chip giant beat analyst estimates with profit skyrocketing over 600 percent.

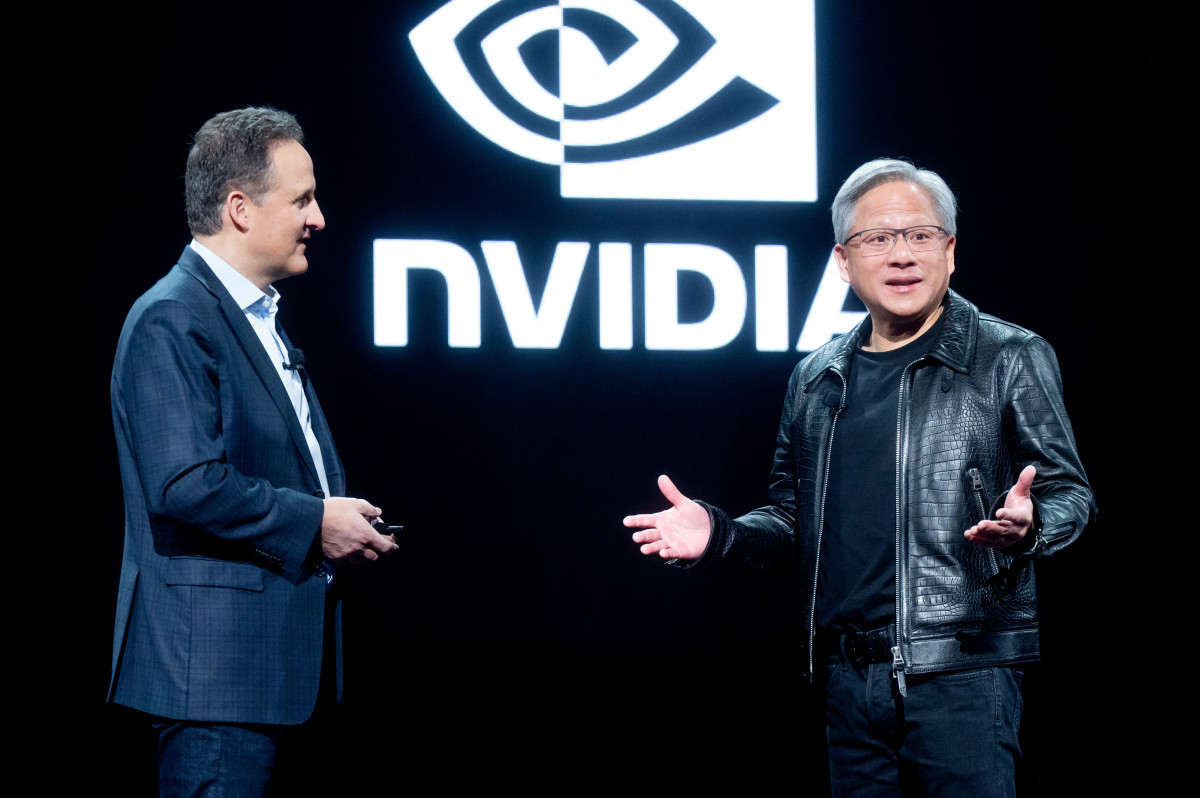

And on June 2 CEO Jensen Huang unveiled Nvidia’s new generation of AI chips - saying ““With our innovations in AI and accelerated computing, we’re pushing the boundaries of what’s possible and driving the next wave of technological advancement.”

Nvidia now trails only Microsoft, which has a market cap of $3.15 trillion.

That’ll do it for your daily briefing. From the New York Stock Exchange, I’m Conway Gittens with TheStreet.

More expert Nvidia commentary:

A New High, Sure. But Not for Most Stocks

Nvidia: Is it Different This Time?

Nvidia $3 Trillion, Market Igniters, Jumpin' July? Index Trends, D-Day Remembered