Nvidia (NVDA) may soon be able to stamp ‘made in America’ on one of its most highly anticipated artificial intelligence (AI) innovations.

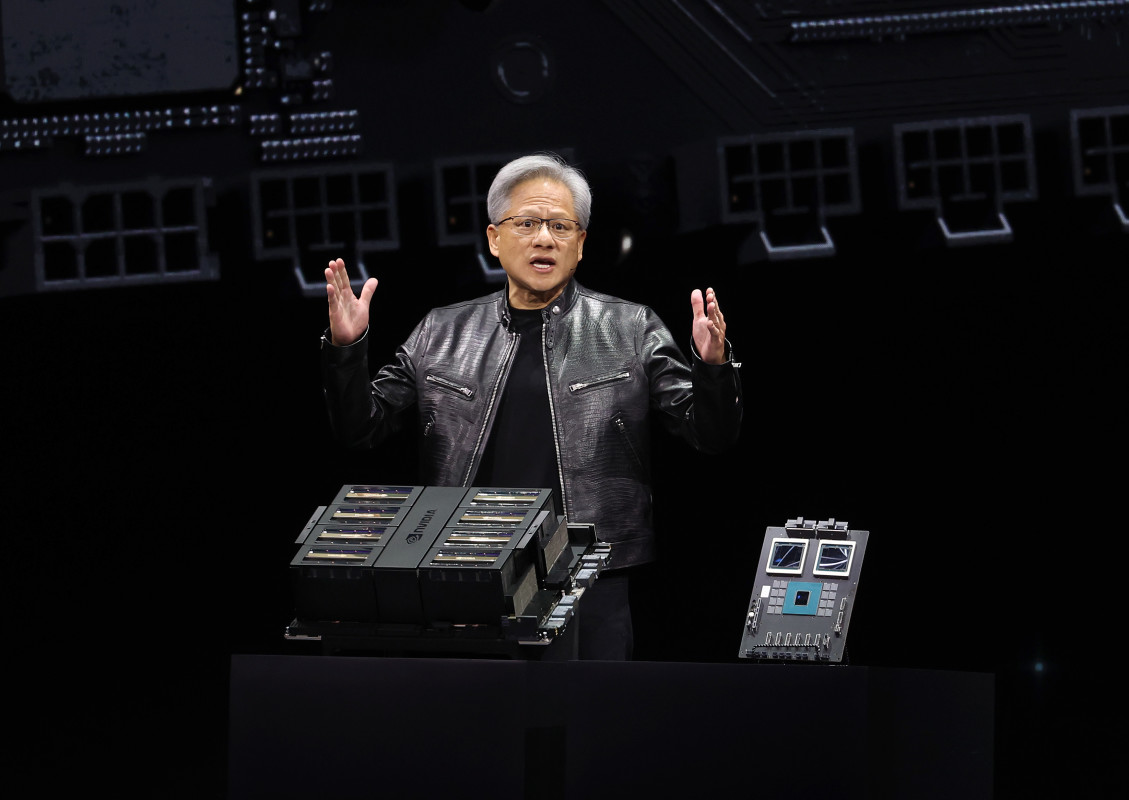

Ever since Nvidia unveiled the Blackwell AI chip in March 2023, investors and consumers have been highly focused on the company. Until now, Nvidia has successfully cornered much of the AI chip market, supplying many companies with the graphics- processing units they need to continue building their AI models.

🚨Don’t miss this amazing Cyber Week Move! Get 60% off TheStreet Pro. Act now before it’s gone. 😲

The Blackwell is by no means Nvidia’s first chip, but it represents a significant step forward in graphics-processing technology.

Related: One tech heavyweight may prove a threat to Nvidia

So far, this crucial new chip has been manufactured in Taiwan before being shipped out. However, Nvidia is reportedly in talks to start building it in the U.S. with the help of a new partner in a deal that would have significant implications for both companies as well as the broader AI sector.

Will Nvidia Blackwell chips be made in America?

If an AI firm is building something in Taiwan, it's more than likely working with Taiwan Semiconductor (TSM) . A quiet leader in the AI arms race, TSM has carved out a niche for itself, supplying chips to big tech leaders such as Nvidia and Apple (AAPL) . After building the first Nvidia Blackwell chips in Taiwan, it is reportedly on the verge of manufacturing them at its factory in Phoenix.

Related: The 5 biggest takeaways following Nvidia's earnings

Given Taiwan Semiconductor’s current partnerships with Nvidia, it makes sense that the AI leader would be exploring a partnership. Despite reports of early Blackwell chips overheating in their servers, experts have confirmed that these issues have been resolved. As such, there is likely no reason to doubt Taiwan Semiconductor’s manufacturing capabilities.

Building the Blackwell chips on U.S. soil would make it easier for Nvidia to ship them to its long list of buyers, which includes Microsoft (MSFT) , Oracle (ORCL) and OpenAI. Elon Musk has discussed plans to spend $9 billion to acquire the Blackwell chips necessary to power the supercomputers his new venture xAI is working on.

The fact that many of the tech sector’s most prominent names rushed to stock up on these new AI chips indicates strong demand and a clear sector-wide reliance on Nvidia’s technology.

But if the company starts building its chips in the U.S., the cost will inevitably rise for buyers. This raises an important question: How high can Nvidia raise its chip prices before clients stop buying?

As noted, most customers rely on Nvidia’s chips for their own AI endeavors. But Nvidia's prices are already extremely high, even by big tech standards. Individual B100 GPUs are priced between $30,000-$35,000 to start, with the GB200 Superchip costing $60,000-$65,000 per unit.

The company also offers Blackwell chip server cabinet options that cost $1.8 million and $3 million.

Related: Apple unveils AI decision that is a major blow to Nvidia

While Nvidia currently dominates the AI chip market, other companies are working hard to create a lower-cost alternative. Apple recently revealed that it buys chips made by Amazon (AMZN) subsidiary Amazon Web Services for its search function.

More Tech Stocks:

- Analysts reset price targets for surging Nvidia rival after earnings

- Tesla replaced by much smaller rival in EV charging project

- Cathie Wood buys $22.1 million of battered tech stock

This development could be a blow to Nvidia, as it indicates that prominent tech companies are considering alternative AI chips. Analysts have floated the possibility that Nvidia’s market share is not sustainable, given the trend of competitors working to build their own chips and undercut Nvidia’s high prices.

A likely win for TSM, a potential win for Nvidia

So far, news of this potential partnership boosted both Nvidia and Taiwan Semiconductor shares.

No Wall Street analysts have issued new ratings or price targets, likely because the two companies have yet to announce any official plans to build Nvidia Blackwell chips in the U.S.

If they do reach an agreement, though, TSM stock will likely win the deal. Increasing its work with Nvidia will likely signal to investors that the company is poised to continue growing as it further establishes itself as a leader among AI component suppliers.

Nvidia risks losing its market share if it raises chip prices too much. However, if it becomes the U.S. manufacturing partner to an AI leader, Taiwan Semiconductor will significantly benefit.

Related: Veteran fund manager sees world of pain coming for stocks