Artificial intelligence plays Taiwan Semiconductor and Tradeweb Markets lead this week's list of stocks to watch. Nvidia chipmaker Taiwan Semiconductor is basing, while Tradeweb closes in on a buy point near record highs. Hoka maker Deckers Brands broke out to all-time highs Friday, and TechnipFMC hit a record Friday after clearing an entry on Thursday. Jira software maker Altassian also broke out Friday, with shares jumping to 52-week highs.

Deckers and Tradeweb Markets are on the IBD Leaderboard list. Tradeweb also appears on IBD's Big Cap 20 list, along with Altassian.

Taiwan Semiconductor Stock

Taiwan Semiconductor is finding support along its 50-day moving average, within a five-week flat base just above a prior cup-with-handle pattern.

The current base has a 212.60 buy point, TSMC stock's record high from Oct. 17. Investors could find an early entry opportunity on a move off Taiwan Semiconductor's 21-day exponential moving average. But it's hitting resistance at that key level.

TSM stock has rallied nearly 83% so far this year.

Chipmaker Taiwan Semiconductor, also known as TSMC, on Oct. 17 beat Q3 estimates with a 54% increase in earnings on a 39% sales jump. Chief Financial Officer Wendell Huang credited the results to "strong smartphone and AI-related demand for our industry-leading 3-nanometer and 5-nanometer technologies."

TSMC guided Q4 revenue to a range of $26.1 billion to $26.9 billion, well above Wall Street's target for $24.9 billion. Following results, Needham analysts noted that TSMC expects to triple AI revenue this year, likely reaching $13 billion.

Taiwan Semiconductor makes chips for Nvidia, Broadcom and many others.

TechnipFMC Stock

Oil field services firm TechnipFMC has rallied more than 15% since the U.S. elections on Nov. 5, trending to record highs. Energy stocks, including oil exploration and drilling names, have jumped since Donald Trump won reelection. He was considered to be the more petroleum-friendly candidate with his "drill, baby, drill" campaign slogan.

Meanwhile, TechnipFMC has record triple-digit earnings growth the last seven quarters. However, revenue gains have slowed over the past three quarters.

However, TechnipFMC and other oil stocks will continue to swing with crude prices.

FTI stock broke out above a 29.49 buy point on Thursday and continued climbing to a record high on Friday.

Shares are trading in the buy zone for the current pattern, which extends 5% beyond the buy point to 30.96.

TechnipFMC is up 53% in 2024.

Deckers Stock

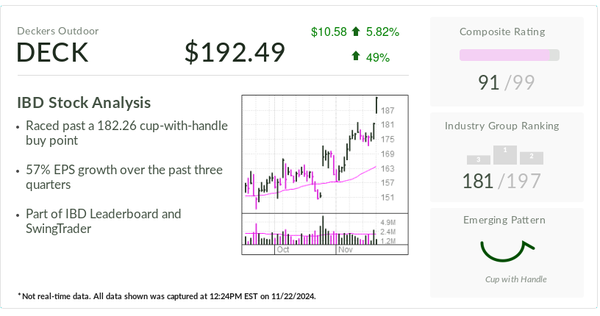

Hoka and Ugg maker Deckers was the IBD Stock Of The Day for Friday as shares cleared a buy point.

Deckers stock has trended higher since its Q2 beat in late October, which saw earnings increase 39% on a 20% sales jump. Meanwhile, Needham on Friday initiated coverage of DECK stock with a buy rating, calling it "one of the highest-quality companies in our coverage."

DECK stock broke out to all-time highs on Friday, jumping past a 182.26 buy point for a cup-with-handle base. Shares were actionable Thursday as they cleared a short-term downtrend.

Deckers is trading just above the top of the buy zone, which extends to 191.37.

SwingTrader currently has a 3/4 position for DECK stock after adding shares this week.

SwingTrader added a 1/2 position on Thursday with a 180.83 entry and added a 1/4 position Friday at 189, with an average cost of 183.55.

Shares of the Hoka maker sprinted 72.5% higher so far this year and are trading at record highs.

Altassian Stock

Atlassian stock broke out Friday above a 256.34 cup-with-handle buy point and hit a 52-week high.

The weekly chart on MarketSurge shows a 258.69 buy point for a deep, 43-week cup base, which TEAM shares also cleared Friday.

Ideally, the handle would have extended a bit longer and added more depth, which would have allowed its moving averages a chance to catch up.

TEAM stock is trading nearly 33% above its 50-day line and almost 42% above its 200-day moving average.

Shares advanced nearly 10% so far this year, including a 35% spike in November.

The Jira software maker handily beat Q1 earnings estimates at the beginning of November, with shares popping 38% this month on the back of its quarterly report and the U.S. election results.

Atlassian's software and infrastructure is used in the Mars rover named Curiosity, which landed on the planet in August 2012, and is there indefinitely. In addition, the U.S. Space Force uses Atlassian's Confluence and Jira products.

Tradeweb Markets

Electronic marketplace builder and operator Tradeweb was Tuesday's IBD Stock Of The Day. The financial AI company has seen a number of hedge funds increasingly incorporate its Automated Intelligent Execution (AiEX) tool into their trading systems.

Tradeweb has seen earnings growth accelerate over the past two quarters. For its most recent results on Oct. 30, Tradeweb posted a 36% EPS increase on 37% sales growth, but both came up short of analyst forecasts.

Wall Street expects profits will rise 28% in 2024, slowing to 14% growth in 2025.

TW stock is trading right below a 136.13 buy point for a six-week flat base.

Shares briefly cleared the buy point on Wednesday and Friday intraday.

Tradeweb stock has soared almost 50% in 2024.

You can follow Harrison Miller for more stock news and updates on X/Twitter @IBD_Harrison