In Taiwan, they're keeping a sharp eye on the Liaoning.

Liaoning is a Chinese aircraft carrier. Defense officials on the island nation in the western Pacific Ocean said they are assessing China's military activities as Beijing could launch new war games as soon as this weekend, Reuters reported on Dec. 2.

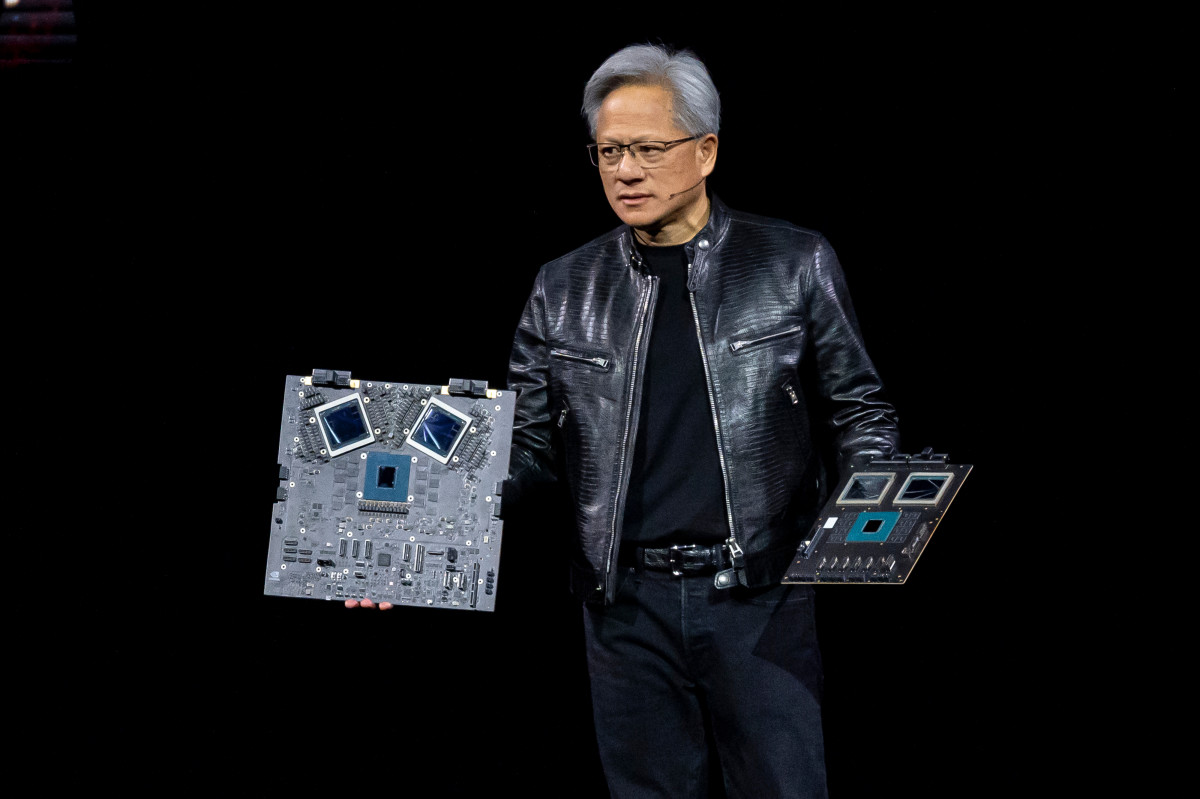

Related: Amazon wants to cut reliance on, and challenge, Nvidia

China, which claims democratically governed Taiwan as its own territory, has held two rounds of war games around the island so far this year, and its forces operate daily nearby.

Taiwan Defense Ministry spokesperson Sun Li-fang said Taiwan knew where the Liaoning was but could not give details. The aircraft carrier was involved in the last Chinese war games in October.

"The Ministry of National Defense takes a serious view of the enemy situation and handles this matter very seriously," he said. "We have very solid preparations and are not afraid of any threats."

🚨Don’t Miss this amazing Cyber Week Move! Get 60% off TheStreet Pro. Act now before it’s gone 😲

Meanwhile, China fired another salvo in the ongoing tech sector war.

Four of China’s top industry associations said on Dec. 3 that Chinese companies should be wary of buying U.S. chips as they are “no longer safe” and buy locally instead.

China bans export of rare materials

The Internet Society of China urged domestic companies to think carefully before procuring U.S. chips and seek to expand cooperation with chip firms from countries and regions other than the United States, Reuters reported, citing the group's official WeChat account.

That means increased risk to Nvidia (NVDA) , AMD, and other semiconductor companies that still generate revenue in China.

The society encouraged domestic firms to "proactively" use chips produced by both domestic and foreign-owned enterprises in China.

Related: Analysts reset Intel stock forecasts after CEO exits

U.S. chip export controls have caused "substantial harm" to the health and development of China's internet industry, the group added.

The China Association of Communication Enterprises said it no longer saw U.S. chip products as reliable or safe, and the Chinese government should investigate how secure the supply chain of the country's critical information infrastructure was.

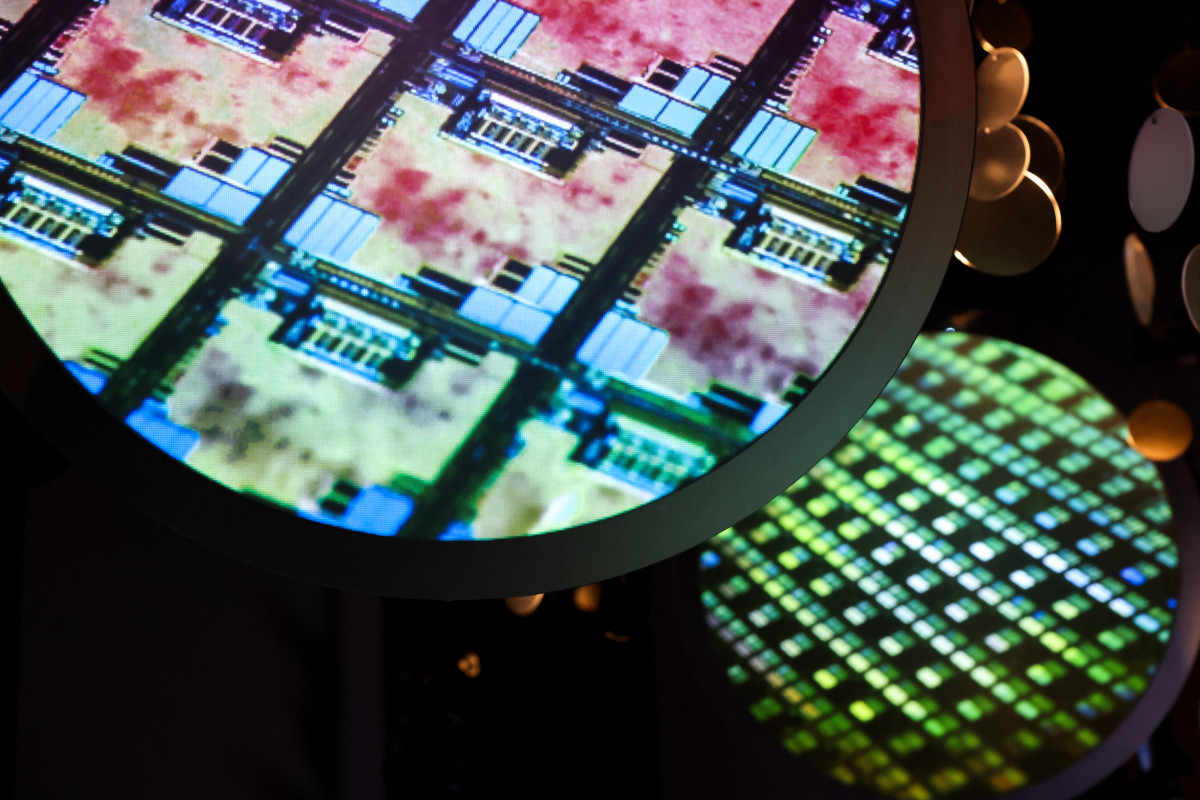

Meanwhile, the Chinese government banned export of rare minerals used in military applications, solar cells, fiber optic cables and other manufacturing processes.

The U.S. gets about half its supply of both gallium and germanium metals directly from China, according to the U.S. Geological Survey. China exported about 23 metric tons (25 tons) of gallium in 2022 and produces about 600 metric tons (660 tons) of germanium annually.

China's actions came after the U.S. added 140 new companies to the “entity list” of sanctioned companies that are off-limits to U.S. businesses without a special exemption. There are also 14 modifications to companies that are already on the list.

The U.S. Commerce Department announcement also restricts trade in 24 types of chipmaking equipment and three software tools. It also provides new “red-flag guidance” to help with compliance and prevent chips from entering China through third parties.

The actions marked the Biden Administration’s third round of export restrictions imposed on China.

Last year, the Commerce Department reduced the types of semiconductors that American companies can sell to China.

In September, the agency proposed a ban on selling or importing smart vehicles that use specific Chinese or Russian technology, citing security concerns.

For its part, China said last year that it would require exporters to apply for licenses to send strategically important materials such as gallium and germanium to the U.S.

In March, China introduced new guidelines to phase out U.S. processors in government computers and servers, effectively blocking chips from Intel (INTC) and AMD (AMD) .

A few months later, in August, the Chinese Commerce Ministry said it would restrict exports of antimony, which is used in a wide range of products from batteries to weapons, and impose tighter controls on graphite exports.

Analyst warns against tariffs

A new administration will be moving to Washington next month. TheStreet Pro's Alex Frew McMillan said that President-elect Donald Trump's proposed tariffs "would be inflationary, very hard to implement and ultimately paid by U.S. consumers."

"They’re highly disruptive, and a bad idea," he said.

More Tech Stocks:

- Super Micro's stock price surges after key ruling

- Veteran trader takes a fresh look at Sofi Technologies

- Druckenmiller predicted Nvidia's rally, now has new AI target

The Biden Administration's approach makes better sense, he added, because they limit China’s access to high-end technology used for military purposes or to hamper human rights.

McMillan, a global equities expert, acknowledged that the restrictions are far from perfect.

Taiwan Semiconductor Manufacturing (TSM) suspended the supply of its artificial intelligence chips to all Chinese customers after the world’s largest chip foundry learned its chips were found in products made by Huawei Technologies, which is under US export control.

McMillan said TSMC was his stock of the year for 2024, but its China business has been lagging.

TSMC has been diversifying production away from its reliance on Taiwan and into Japan, Germany, and the U.S., with total investment of $65 billion announced to make three chip “fabs” in Phoenix.

McMillan said this was friend-shoring—where production and trade are moved to countries that are considered political allies or reliable—at its most effective. It will bring TSMC closer to key customers such as Nvidia and Apple (AAPL) .

"It’s highly likely that Trump’s bluster over tariffs is merely his opening stance in a negotiation over trade," McMillan said. "Last time he was in office, he pushed for a trade deal with China that essentially requires closer ties between the U.S. and China economies, not greater distance. We’ll see where he heads once in office this time."

He noted that the timbre has changed in Washington, where there’s greater bipartisan agreement to “get tough on China.”

"I’m not so sure we’ll see any phase two of the phase one trade deal with China agreed during the last Trump presidency," McMillan said. "It is likely that the next administration will keep these new restrictions in place."

"Let’s hope any future trade curbs and tariffs on Chinese goods are equally targeted, in a way that advances U.S. interests but doesn’t unnecessarily punish U.S. importers or consumers," he added.

Related: Veteran fund manager delivers alarming S&P 500 forecast