/Northern%20Trust%20Corp_%20sign%20on%20bank-by%20BackyardProduction%20via%20iStock.jpg)

Northern Trust Corporation (NTRS), based in Chicago, Illinois, is a top-tier global financial institution delivering services in asset servicing, investment management, and wealth management. It supports institutional clients, corporations, and wealthy individuals with a wide network of offices in several countries.

The firm manages assets exceeding $1 trillion and aims to provide tailored financial solutions in a dynamic industry environment. The company has a market capitalization of $23.21 billion.

Over the past year, the stock has held up well based on sound fundamentals. Over the past 52 weeks, Northern Trust’s stock has gained 14.6%, while it is up 15.6% over the past six months. It had reached a 52-week high of $135.48 in September, but is down 7.9% from that level.

On the other hand, the broader S&P 500 Index ($SPX) has gained 12.3% and 11.1% over the same periods, respectively, indicating that the stock has outperformed the broader market. Next, we compare the stock with its own sector. The Financial Select Sector SPDR Fund (XLF) gained 2.7% over the past 52 weeks but declined marginally over the past six months, underperforming Northern Trust’s stock.

On Oct. 22, Northern Trust reported its third-quarter results above analyst estimates. At quarter-end, the company had $1.77 trillion in assets under management, while Wall Street analysts had expected $1.72 trillion. Its revenue increased 2.9% year-over-year (YOY) to $2.03 billion, surpassing the expected $2.02 billion. Northern Trust’s EPS was $2.29, up 3.2% YOY and higher than the expected $2.24.

For the fiscal year 2025, which ends in December 2025, Wall Street analysts expect Northern Trust’s EPS to grow 12.6% YOY to $8.67 on a diluted basis. Moreover, EPS is expected to increase 8% annually to $9.36 in fiscal 2026. The company has a solid history of surpassing consensus estimates, topping them in all four trailing quarters.

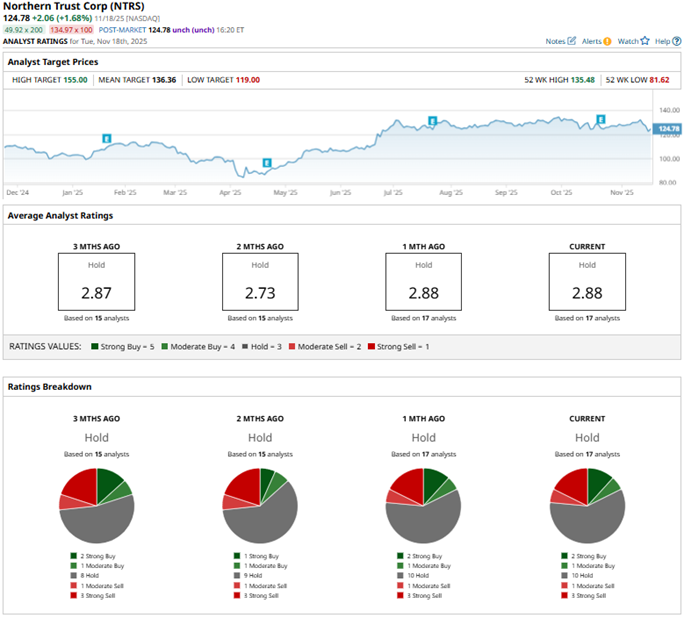

Among the 17 Wall Street analysts covering Northern Trust’s stock, the consensus is a “Hold.” That’s based on two “Strong Buy” ratings, one “Moderate Buy,” 10 “Holds,” one “Moderate Sell,” and three “Strong Sells.” The ratings configuration has become more bullish over the past two months, with two “Strong Buy” ratings, up from one previously.

Last month, analysts at Truist Securities maintained a “Hold” rating on Northern Trust’s stock, while Wells Fargo analyst Mike Mayo also maintained an “Equal-Weight” rating and raised the price target from $127 to $131.

Northern Trust’s mean price target of $136.36 indicates a 9.3% upside over current market prices. The Street-high price target of $155 implies a potential upside of 24.2%.