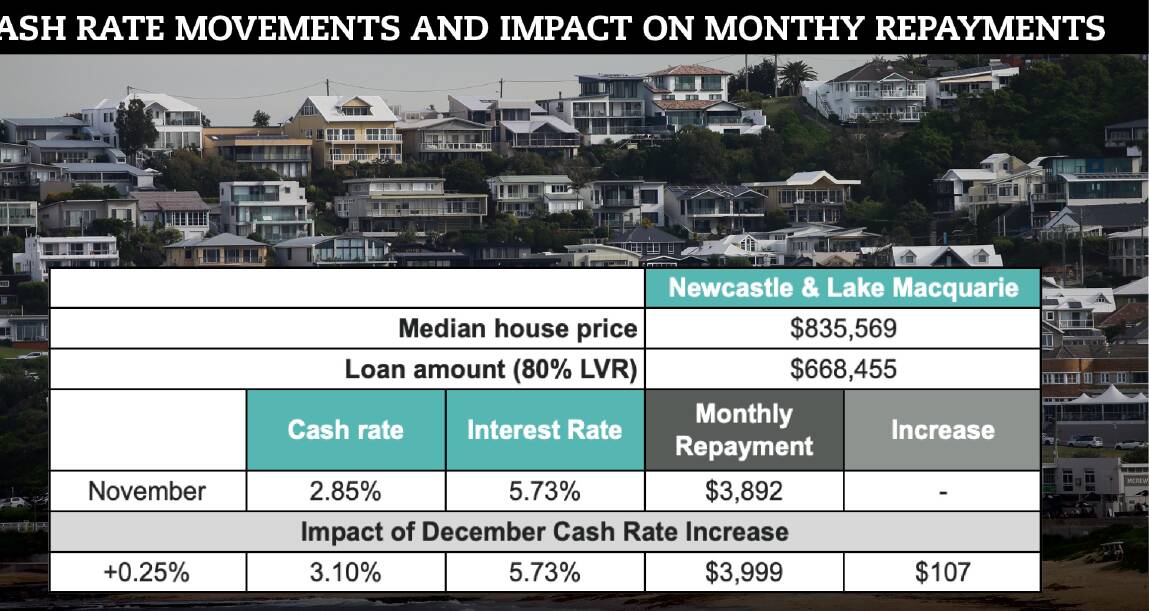

HOMEOWNERS in Newcastle and Lake Macquarie could pay an extra $107 on their monthly mortgage following the latest cash rate hike.

The Reserve Bank of Australia increased the cash rate a further 25 basis points on Tuesday, taking it up to 3.10 per cent.

The increase marks the eighth consecutive rate hike since May when it sat at a record low of 0.1 per cent.

Figures compiled by comparison site Canstar show that in Newcastle and Lake Macquarie, where the median house price is $835,569, homeowners could pay an extra $107 each month on their mortgage as a result of the rate rise, with their monthly repayments increasing to $3,999.

The calculation is based on an 80 per cent loan of $668,455 over 30 years.

Homeowners Pinn and Jaydn Tongue spoke to the Newcastle Herald in May following the first rate rise a few months after they sold an investment property and their home to purchase another house in Charlestown.

At the time the couple was considering fixing part of their loan but they have since met with a mortgage broker to refinance following eight months of rate rises.

"Our repayment has gone up around $500 a month since May," Mrs Tongue said.

"I don't know if that's a lot, but I know some people who have $100 left after they pay the bills.

"We are looking to refinance, only because our rate is so high and we negotiated with our current lender but they can't come down any more.

"I feel stressed for the people who fluked getting a home loan and now they can't refinance because they probably won't get approved for a home loan. It's scary."

Mrs Tongue said she did not expect the latest rate hike to deeply impact their situation, but admitted that the rising cost of living had forced the family to keep track of their spending.

"Overall, I'm not too worried about this latest increase," she said.

"We are prepared for what's the come but it's the cost of living that is affecting us. Groceries are significant, petrol is significant and I'm on maternity leave so it has all come at a bad time.

"We have never been budget-y type of people but this has definitely made us tighten our belts.

"We are having to pull back a bit more. It's at the point now where we're like 'OK, well we don't need to do that. Let's save the money'.

"We are managing but it's tight. We need to budget and be smart with our money and making our money work better for us."

A survey from Finder has revealed that more than two in five Australians (44 per cent) are running out of money between payday.

Graham Cooke, head of consumer research at Finder, said Australians were having to devote a bigger share of their budgets to essential living expenses.

"The current series of rake hikes has added almost $11,000 to the annual cost of a $500,000 mortgage - a huge amount of extra money for mortgage holders to fork out.," Mr Cooke said.

"Renters are also doing it tough; vacancy levels are at record lows and the latest Rental Affordability Index shows all capital cities saw a drop in affordability in this year.

"Between what Aussies earn and what they spend - for many there's nothing left over at the end of the month."