READ THE FULL NHWK RESEARCH REPORT

NightHawk Biosciences, Inc. (NYSE:NHWK) reported second quarter results on August 10, 2022 in a press release and in its Form 10-Q filing. It has been a whirlwind year for the company as it made an acquisition, expanded its manufacturing efforts, converted into a vertically integrated biosciences company and executed several transformational changes. The company's San Antonio biologics manufacturing facility is on track to open in 3Q:22 and early efforts are being made to build and fund the Manhattan, Kansas manufacturing and bioanalytic services facility. Clinical work continues with the PTX-35 asset and new contracts signed for the Elusys subsidiary

Highlights for 2022 include:

➢ Merger with Elusys completed – April 2022

➢ Type C meeting (manufacturing items) with FDA for HS-110 – April 2022

➢ Canadian contract executed for Anthim distribution – April 2022

➢ New biodefense manufacturing facility in Manhattan, Kansas announced – April 2022

➢ Name change to NightHawk Biosciences (NHWK) – May 2022

➢ Presentation at the Treg Directed Therapies Summit, Boston, MA – May 2022

➢ Stephan Kutzer, Ph.D. appointed Interim CEO of Scorpion – June 2022

For its second quarter, NightHawk generated $51,000 in grant and contract revenue, and posted a net loss of ($10.2) million, or ($0.40) per share. As of June 30, 2022, NightHawk had a grants receivable balance of $1.5 million for CPRIT proceeds not yet received.

For the quarter ending June 30, 2022 versus the same ending June 30, 2021:

➢ Revenues were $51,000, down 89% from $459,000, with the decline reflecting absence of revenues related to contracts under the CPRIT program;

➢ Research & development expenses totaled $4.7 million, up 12% from $4.2 million, driven primarily by higher unallocated R&D expenses and more spending on the PTX-35 and other programs partially offset by lower allocations to HS-110 and HS-130;

➢ General & administrative expenses were $4.9 million, a 71% rise from $2.9 million, on higher stock-based compensation, greater personnel costs and expanded consulting and other professional expenses;

➢ Net loss was ($10.2) million, or ($0.40) per share, compared to ($6.5) million or ($0.26) per share.

At the end of the quarter, NightHawk held cash, equivalents and short-term investments totaling $69.9 million, compared to $96.4 million at the end of 2021. Cash used in operations for the first six months of the year was ($1.4) million, compared to ($11.0) million in the comparable 2021 period.

Scorpion Biosciences

In mid-April, CEO Jeff Wolf announced a partnership with the State of Kansas and Kansas State University to develop a biodefense-focused large molecule and biologics biomanufacturing facility in Manhattan, Kansas. Kansas State University hosts the Biosecurity Research Institute (BRI), and the National Bio and Agro-Defense Facility (NBAF), providing a supportive environment for the endeavor. The new facility will exceed 500,000 square feet and is designed for manufacturing large molecules and biologics, with a focus on biodefense. When fully operational, the facility will directly employ over 500 people and will provide capacity of up to 144,000 liters across 48 bioreactors.

Scorpion is also building a 20,144 square foot facility in San Antonio, Texas to produce product for laboratory, research, analytical, and/or biomanufacturing purposes and is expected to be operational before year-end. The goal of the build is to reduce dependence on third-party vendors as the company advances R&D and approved products. Excess capacity will be available for contract and provide offsetting revenue for the business unit.

In mid-June, Stephan Kutzer, Ph.D. was appointed as Interim CEO of Scorpion Biological Services. He also serves on Scorpion's advisory board. Dr. Kutzer was previously CEO of Alcami Corporation, and divisional CEO of the Pharma Biotech & Customer Manufacturing division of Lonza Group. He has also held a variety of other senior roles at Lonza.

Elusys Therapeutics

On December 21, 2021, NightHawk announced that it had signed a definitive merger agreement to acquire Elusys Therapeutics which was subsequently closed on April 20, 2022. Elusys is a commercial-stage biodefense company and manufacturer of obiltoxaximab (Anthim), a treatment for anthrax inhalation that is approved in the US, Canada, Europe and the UK. Elusys is a wholly owned subsidiary of NightHawk, expanding NightHawk's infectious disease portfolio. Elusys has been supplying Anthim to the US Strategic National Stockpile through an ongoing, multi-year partnership. Anthim is a monoclonal antibody that binds to the protective antigen component of anthrax toxin, thereby preventing the entry of the toxin into vulnerable cells. On January 31, 2022, NIghtHawk announced that Elusys had finalized its contract to deliver Anthim to the US Department of Health and Human Services (HHS). The first phase of the contract, worth $50 million, was completed, and HHS has options valued up to $31 million, resulting in total contract value of approximately $80.9 million. The contract is now expected to complete in 1H:23. To date, Elusys has won over $400 million in research and development contracts and procurement orders and was recently awarded a CAD$7.9 million contract to deliver Anthim to Canada's National Emergency Strategic Stockpile.

NightHawk paid $3.0 million at closing and expects to pay another $2.0 million subject to reduction based on cash balance and other purchase price reductions. Earn out payments are also owed equal to 10% of sales for a period of 12 years following the close of the arrangement. Additional obligations exist to Elusys shareholders following the close of the deal regarding near term sales and to Elusys employees.

The recently announced Manhattan, Kansas commercial biodefense biomanufacturing facility will produce Anthim to satisfy contracts when it is fully functional.

HS-110

NightHawk held its Type C meeting to discuss manufacturing details with the FDA in early 2022. The Type B meeting (end of Phase II) to discuss trial design for HS-110 will be scheduled only after a partner is identified to advance the trial. Since the partner will sponsor the majority of the cost, management wants them to play a role in designing the trial during the regulatory interaction. For now, HS-110 is in a holding pattern until a partnership is executed.

Events and Milestones

➢ Continued enrollment in PTX-35 trial - 2022

➢ Break ground on Scorpion Manhattan facility – 2H:22

➢ Scorpion San Antonio facility grand opening – 4Q:22

➢ Grand opening of Scorpion's San Antonio facility – 3Q:22

➢ Completion of Scorpion Manhattan facility construction – 1H:25

SUBSCRIBE TO ZACKS SMALL CAP RESEARCH to receive our articles and reports emailed directly to you each morning. Please visit our website for additional information on Zacks SCR.

DISCLOSURE: Zacks SCR has received compensation from the issuer directly, from an investment manager, or from an investor relations consulting firm, engaged by the issuer, for providing research coverage for a period of no less than one year. Research articles, as seen here, are part of the service Zacks SCR provides and Zacks SCR receives quarterly payments totaling a maximum fee of up to $40,000 annually for these services provided to or regarding the issuer. Full Disclaimer HERE.

________________________

1. Source: NightHawk Corporate Website.

2. Source: Heat Biologics January 2022 Corporate Presentation.

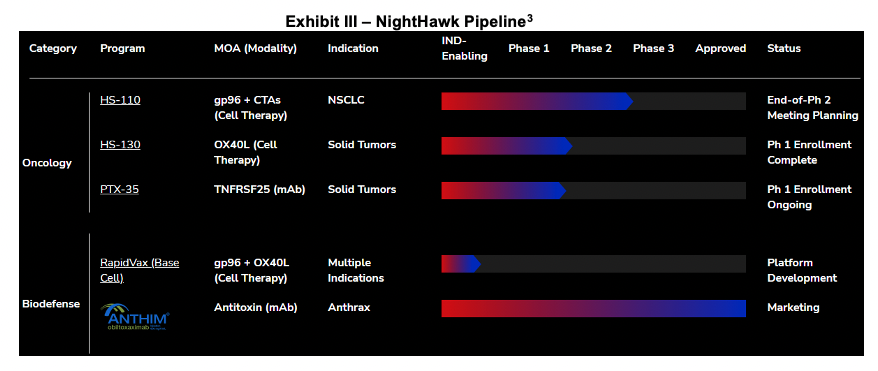

3. Source: NightHawk Corporate Website accessed May 2022.