The essential takeaway from the Q1 iteration of MoffettNathanson’s quarterly All Things Streaming report is that the domestic SVOD business has reached a point of maturity, with penetration settling in at around 84%, and neither expanding or declining from that precipice.

Also read: Streaming Became a Mature Business in Q1, Analyst Says

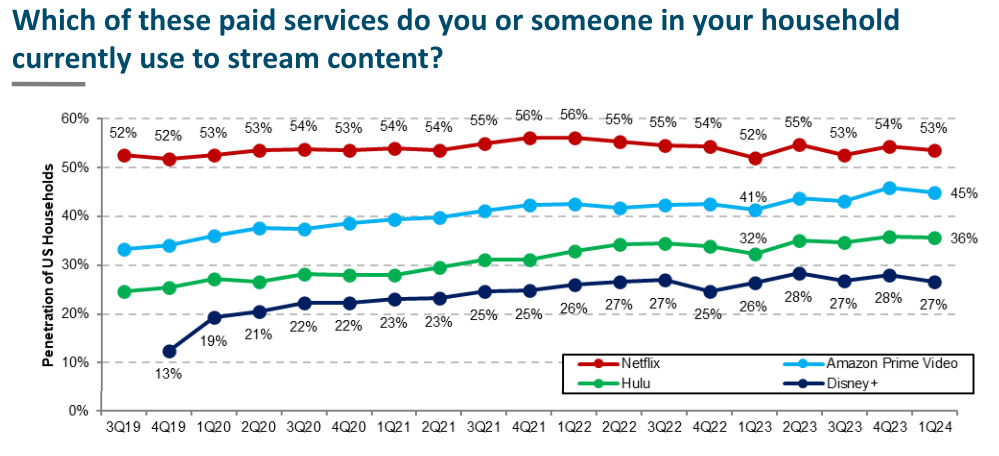

That stagnation seems especially true among the “Big Four” subscription video on demand platforms, Netflix, Amazon Prime Video, Hulu and Disney Plus. Based on a robust survey of 23,769 U.S. consumers conducted for equity analyst shop MoffettNathanson by research company HarrisX, none of the four largest U.S. SVODs has changed its U.S. TV household penetration rate much at all in the past three years.

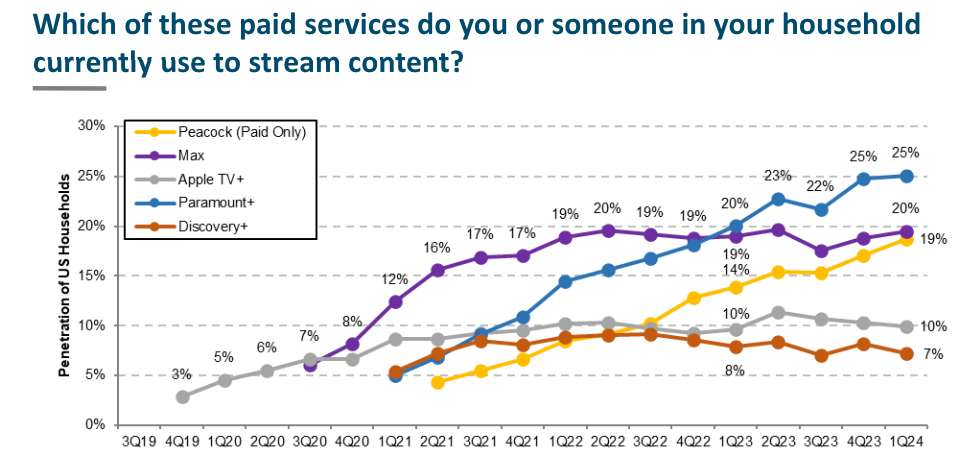

However, the situation is much more fluid and dynamic among the so-called less-scaled subscription services: Max, Paramount Plus, Peacock and Apple TV Plus.

According to the HarrisX survey, Peacock and Paramount Plus saw steep penetration rate increases in Q1.

"The biggest growth continues to come from less scaled players with this quarter's crown belonging to Peacock (+170 basis points), which benefited from an exclusive NFL playoff game in January. Paramount Plus, which streamed the Super Bowl, grew thought at a slower rate than in previous quarters (+30 bps), perhaps due to its Walmart+ partnership reaching saturation,” the MoffettNathanson reported stated.

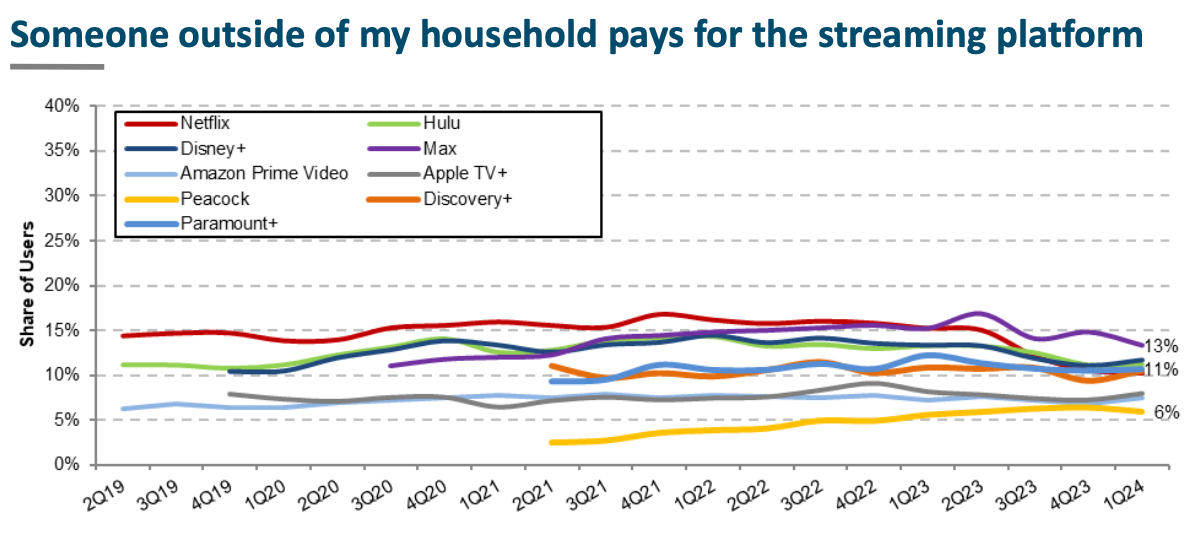

Another takeaway from the Q1 All Things Streaming report: Netflix’s crackdown on account sharing has indeed lowered password-passing activity.

“We are well into Netflix’s password-sharing crackdown and the effects are clear to see in HarrisX’s data,“ the report stated. “While 15% of users in 2Q23 when the crackdown started reported using an account belonging to someone outside their households, that number fell to just 10% in 1Q.”