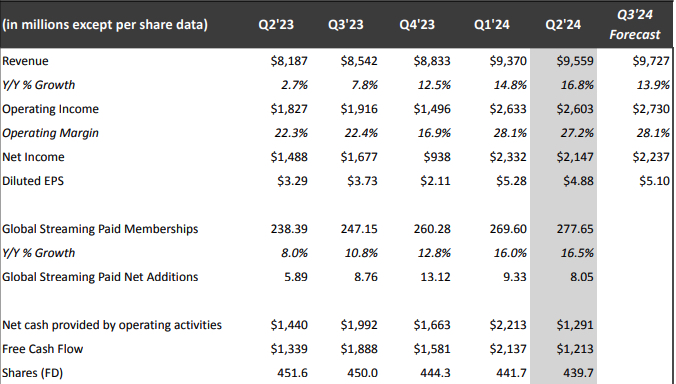

Netflix reported revenue expansion of 16.8% to $9.559 billion in the second quarter, solidly beating guidance issued back in Q1 of 15.9% revenue growth.

Globally, the streaming giant expanded its user base by more than 8 million customers, with its ranks now swelling to 277.65 million paid members worldwide. Netflix added only around six million customers over the same period last year. Membership was up by 1.45 million in Netflix's biggest market, the U.S. and Canada, where account-sharing restrictions are still reshaping its market.

But back on Wall Street, it all wasn't good enough. As of the typing of this sentence, Netflix shares were in decline more than 3% in after-hours trading, with investors concerned that, based on Netflix guidance, the rate of sales expansion will slow slightly to 13.9%. The stock drop leveled off within an hour of Netflix's earnings disclosure. (Here's Netflix's Q2 2024 letter to shareholders.)

A 14% bounce would still be well above the 7.8% revenue growth Netflix reported in the third quarter of 2023.

In its shareholder letter, Netflix touted second quarter programming hits, including the third season of Bridgerton, British limited anthology series Baby Reindeer, French action movie Under Paris, and domestic films Atlas and Hit Man. Also receiving a shoutout was The Roast of Tom Brady, which Netflix said was its most watched live-streamed show ever.

Ad-tier membership increased by 34% in the second quarter, Netflix said,

The company also said it began in June testing "a new, simpler and more intuitive TV homepage," which it believes "will significantly improve the discovery experience on Netflix.

"This new interface provides more visible title information at a glance — including synopsis, genre and ratings,” Netflix added. “Title previews are also larger and more dynamic, with more immersive trailers and bigger box art to make browsing easier. We’ve also simplified the navigation bar and moved it to the top of the page to create quicker, easier short cuts. And this new design includes My Netflix, which has everything members have saved or watched and was previously only available on mobile.”

Meanwhile, regarding its ad-sales business, Netflix told investors it needs some time to scale that business.

"Given this sustained progress, we believe that we’re on track to achieve critical ad subscriber scale for advertisers in our ad countries in 2025, creating a strong base from which we can further increase our ad membership in 2026 and beyond," Netflix said in its shareholder letter. "Our ad revenue is growing nicely and is becoming a more meaningful contributor to our business. But building a business from scratch takes time — and coupled with the large size of our subscription revenue — we don't expect advertising to be a primary driver of our revenue growth in 2024 or 2025."