Throughout the last three months, 15 analysts have evaluated Duolingo (NASDAQ:DUOL), offering a diverse set of opinions from bullish to bearish.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 7 | 5 | 3 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 3 | 2 | 2 | 0 | 0 |

| 2M Ago | 1 | 0 | 1 | 0 | 0 |

| 3M Ago | 3 | 2 | 0 | 0 | 0 |

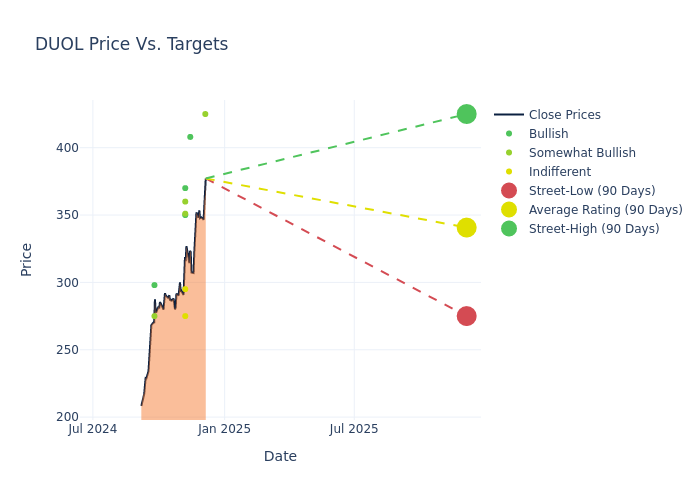

The 12-month price targets, analyzed by analysts, offer insights with an average target of $325.0, a high estimate of $425.00, and a low estimate of $250.00. This upward trend is evident, with the current average reflecting a 24.76% increase from the previous average price target of $260.50.

Exploring Analyst Ratings: An In-Depth Overview

The perception of Duolingo by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Nat Schindler | Scotiabank | Announces | Sector Outperform | $425.00 | - |

| Chris Kuntarich | UBS | Raises | Buy | $408.00 | $355.00 |

| Wyatt Swanson | DA Davidson | Raises | Buy | $350.00 | $250.00 |

| Bryan Smilek | JP Morgan | Raises | Overweight | $360.00 | $303.00 |

| Eric Sheridan | Goldman Sachs | Raises | Neutral | $275.00 | $250.00 |

| Mario Lu | Barclays | Raises | Equal-Weight | $295.00 | $183.00 |

| Ryan MacDonald | Needham | Raises | Buy | $370.00 | $310.00 |

| Arvind Ramnani | Piper Sandler | Raises | Overweight | $351.00 | $271.00 |

| Eric Sheridan | Goldman Sachs | Raises | Neutral | $250.00 | $198.00 |

| Chris Kuntarich | UBS | Raises | Buy | $355.00 | $225.00 |

| Bryan Smilek | JP Morgan | Raises | Overweight | $303.00 | $255.00 |

| Nat Schindler | B of A Securities | Raises | Buy | $298.00 | $292.00 |

| Andrew Boone | JMP Securities | Raises | Market Outperform | $275.00 | $260.00 |

| Ryan MacDonald | Needham | Raises | Buy | $310.00 | $245.00 |

| Wyatt Swanson | DA Davidson | Maintains | Buy | $250.00 | $250.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Duolingo. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Duolingo compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Duolingo's stock. This comparison reveals trends in analysts' expectations over time.

To gain a panoramic view of Duolingo's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Duolingo analyst ratings.

Discovering Duolingo: A Closer Look

Duolingo Inc is a technology company that develops mobile learning platform to learn languages and is the top-grossing app in the Education category on both Google Play and the Apple App Store. Its products are powered by sophisticated data analytics and artificial intelligence and delivered with class art, animation, and design to make it easier for learners to stay motivated master new material, and achieve their learning goals. Its solutions include The Duolingo Language Learning App, Super Duolingo, Duolingo English Test: AI-Driven Language Assessment, Duolingo For Schools, Duolingo ABC, and Duolingo Math. It has three predominant sources of revenue; time-based subscriptions, in-app advertising placement by third parties, and the Duolingo English Test.

Breaking Down Duolingo's Financial Performance

Market Capitalization Analysis: The company's market capitalization is above the industry average, indicating that it is relatively larger in size compared to peers. This may suggest a higher level of investor confidence and market recognition.

Revenue Growth: Over the 3 months period, Duolingo showcased positive performance, achieving a revenue growth rate of 39.94% as of 30 September, 2024. This reflects a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Consumer Discretionary sector.

Net Margin: Duolingo's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 12.13% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Duolingo's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 2.94% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): Duolingo's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 1.98%, the company showcases efficient use of assets and strong financial health.

Debt Management: With a below-average debt-to-equity ratio of 0.07, Duolingo adopts a prudent financial strategy, indicating a balanced approach to debt management.

The Significance of Analyst Ratings Explained

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.