There are “no innocent errors” when it comes to tax penalties, the head of HMRC has said during the ongoing dispute over Nadhim Zahawi’s tax affairs.

James Hara, HMRC’s chief executive, told MPs on Thursday: “There are no penalties for innocent errors in your tax affairs.

“So if you take reasonable care, but nevertheless make a mistake, whilst you will be liable for the tax and for interest if it’s paid late, you would not be liable for a penalty. But if your error was as a result of carelessness, then legislation says that a penalty could apply in those circumstances.”

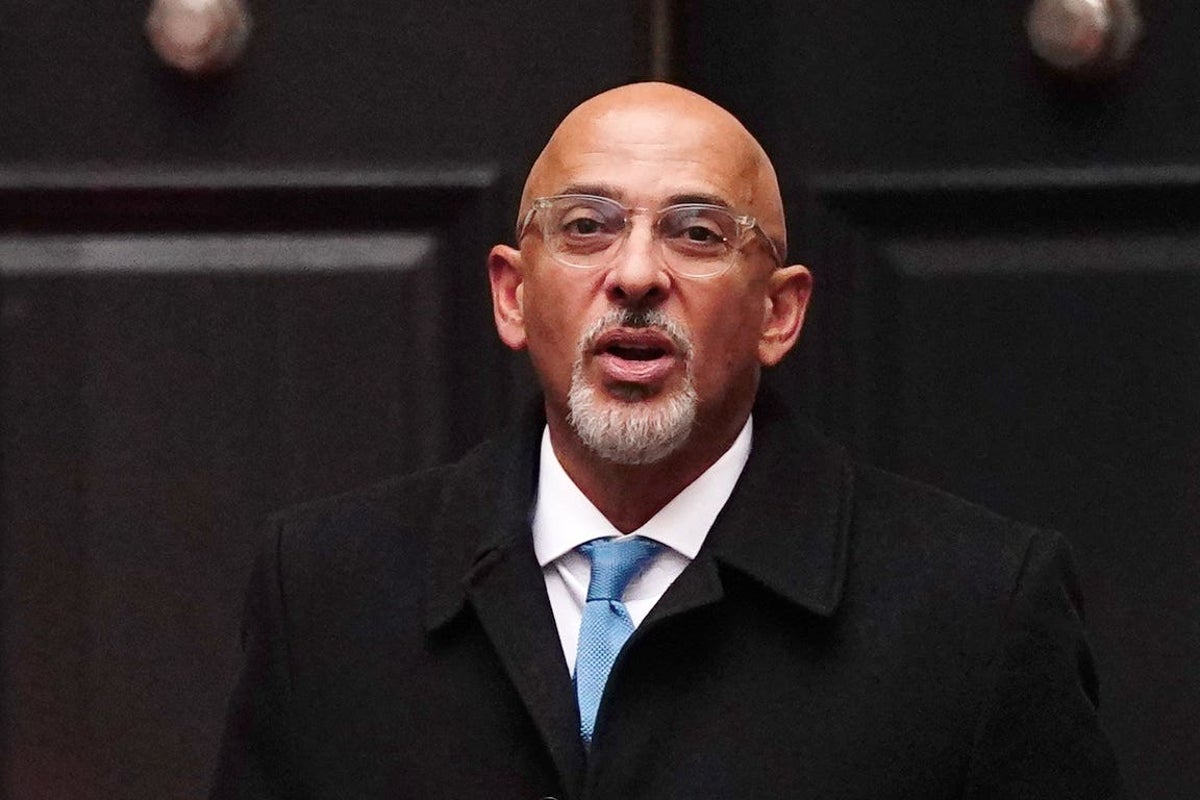

The row surrounding Mr Zahawi centres on a tax bill over the sale of shares in YouGov, the polling firm Mr Zahawi founded, worth an estimated £27 million which were held by Balshore Investments, a company registered offshore in Gibraltar and linked to Mr Zahawi’s family.

Mr Zahawi has said that HMRC concluded there had been a “careless and not deliberate” error in the way the founders’ shares, which he had allocated to his father, had been treated.

Rishi Sunak – who has ordered his ethics adviser to investigate Mr Zahawi’s tax settlement – is said to be “livid” with his Cabinet minister over the saga, according to The Times.

The prime minister has not spoken to his party chairman since he revealed details of his settlement with HM Revenue and Customs at the weekend.