AS one of Australia's biggest coal producing regions, the global debate over coal and gas prices - and whether there are ways of bringing them down by market intervention - affects the Hunter Region directly.

On the plus side of the equation for price caps, any intervention by the federal government that could effectively bring down energy prices would naturally tend to help households, especially those whose economic circumstances are such that they are struggling to cope with rising power bills.

With yesterday's planned meeting of federal and state leaders over energy prices postponed until Friday after Prime Minister Anthony Albanese tested positive for COVID, debate continues over the cost of energy, and the best ways, if any, of "protecting" households.

Historically, attempts to intervene in free markets - as imperfect as they may be - have tended to fail, for a variety of reasons.

Calls for Canberra to intervene in coal prices follows a move by the G7 group of nations to attempt to impose gas and oil caps on Russia.

European countries, publicly promoting themselves as "renewables leaders", have been since exposed as more reliant than they were wont to admit on Russian gas and oil.

Reuters reported this week that a G7 "cap" on oil, which is also to be "enforced" by Australia, began on Monday.

Russia, however, said on Sunday, that it would not accept the cut, and would not sell oil that was subject to it, even if it had to cut production.

Reuters reported that oil prices began to rise after the Russian sanctions began.

In theory, the price of any commodity represents a juncture between supply and demand.

The more of a product there is to sell, the lower the price is likely to be. In simple terms, this represents a "buyers' market".

But that's not where we are now with gas and coal.

Across the national media, the steep increases in the prices of coal and gas are almost invariably ascribed to Russia's invasion of Ukraine.

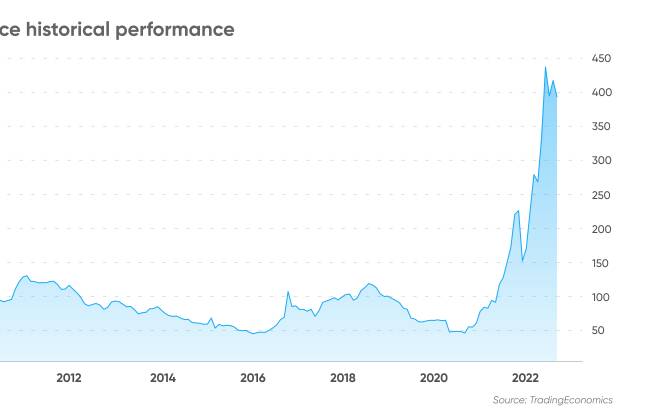

But as the Newcastle Herald has pointed out previously, the massive rise in the price of thermal coal - which is used in power stations - began well before the invasion of Ukraine.

One major cause will surely be the regulatory blanket smothering the coal industry in the name of combating global warming.

In mid-2020, when coal prices were sitting at about $US60 a tonne, global commodities company Glencore announced a fortnight September shutdown of its 11 mines exporting through Newcastle and its six in Queensland in an effort to stimulate prices by creating a shortage.

"We've reacted, like we always do, when you have falling commodity prices and oversupply in the market," Ivan Glasenberg, who was Glencore's CEO until his retirement last year, said at the time.

Glencore had done a similar thing in 2015.

Prices recovered - although production cuts by Glencore and other producers may not have been the only reason.

In June 2020, the weekly Australian Coal Report had the benchmark for high-quality Newcastle thermal coal at $US50 a tonne.

By June 25 last year, it was $US128.

By the end of last year it was $US181 and on February 16 this year, a week before President Putin ordered the invasion on February 22, it was $US260 a tonne.

Today, the price stands at $US350 a tonne - having reached an all time high in September of more than $US440 a tonne.

At such historically stratospheric prices the obvious thing for the giants of the global coal industry to do would be ramp up production and to sell as much as they possibly can while ever conditions remain lucrative.

But the reality is that many of the world's big mining companies have sold their coal interests to smaller operators, some of which will not have the size or borrowing capacity to finance a rapid expansion of production.

Probably more importantly, the regulatory hurdles that coalmines must now satisfy to obtain state and federal government planning approval are now so onerous - and the opposition so overwhelming and loud - that even those companies with the ability to start a new mine or expand an existing one would find it hard to do so.

This means, then, that the textbook response to high prices - an increase in production to move from today's "sellers' market" to a balanced market - is unlikely to happen.

Certainly not in Australia, anyway.

Commenting on the current situation, NSW Minerals Council CEO Stephen Galilee said yesterday: "Increasing the available supply of coal to NSW power stations would help drive prices down, and larger coal stockpiles at the generators themselves would also mitigate against unexpected supply shortages caused by weather, or other sudden events.

"A price cap on domestic coal supply will distort the coal market, potentially disrupt existing commercial arrangements, create disincentives for coal producers to supply local power stations, and may force some producers to supply coal at a loss, threatening jobs, predominantly in regional coal mining communities."

Mr Galilee said that about 80 per cent of the coal sold to NSW power stations was on long-term contracts at prices well below the global export price.

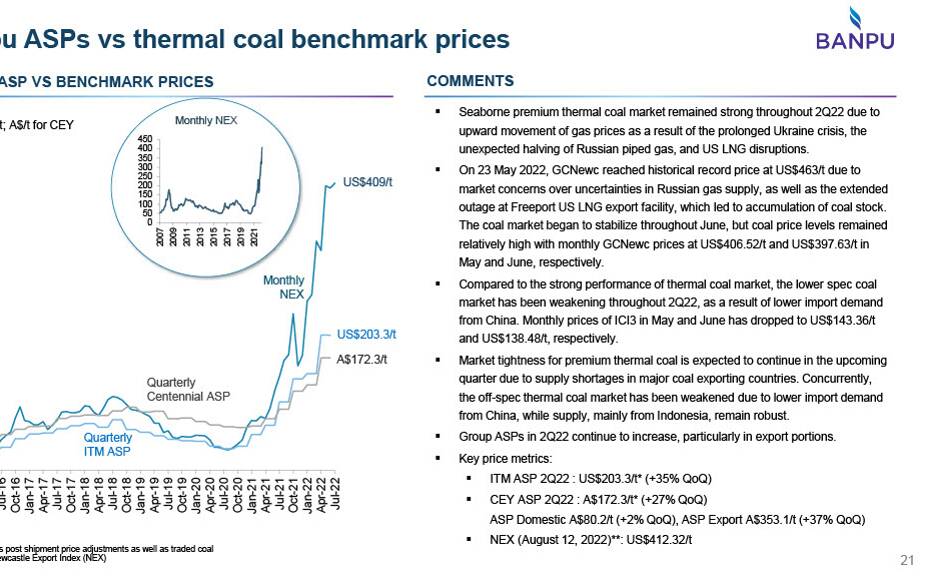

The biggest supplier to NSW power stations is Centennial Coal, which was formed from the privatisation of state government mines and is now owned by Thai company Banpu.

Its 2nd quarter 2022 results published on August 17 show Mr Galilee's point.

Centennial's export coal fetched an average of $353.10 a tonne, up 37 per cent.

Its domestic coal fetched just $80.20 a tonne, up 2.0 per cent.

An obvious recent example of the regulatory hurdles facing Australian coal was outlined in the latest, November 30, edition of the Australian Coal Report.

In this case, the Land Court of Queensland has ruled against a mining lease application from Waratah Coal Pty Ltd - a company controlled by the controversial Clive Palmer - on what ACR described as "environmental and human rights grounds".

The Galilee Basin had long been identified as Queensland's "next big" export coalfield before the once obscure district became a household name via the long controversy over the Adani coalmine.

A 370-page judgement recommended the Queensland government refuse Waratah a lease, citing international law including the 2016 Paris Agreement and the 2019 Human Rights Act.

"As a matter of law, I have decided I can take the emissions into account in applying the principles of ecologically sustainable development and in considering whether the [mining and environmental] applications are in the public interest," President Fleur Kingham wrote in the court's November 25 judgement.

"Wherever the coal is burnt the emissions will contribute to environmental harm, including in Queensland."

WHAT DO YOU THINK? We've made it a whole lot easier for you to have your say. Our new comment platform requires only one log-in to access articles and to join the discussion on the Newcastle Herald website. Find out how to register so you can enjoy civil, friendly and engaging discussions. Sign up for a subscription here.