/Mohawk%20Industries%2C%20Inc_%20logo%20on%20phone%20by-%20viewimage%20via%20Shutterstock.jpg)

Mohawk Industries, Inc. (MHK), headquartered in Calhoun, Georgia, designs, manufactures, sources, distributes, and markets flooring products for residential and commercial applications and new construction markets. Valued at $7.3 billion by market cap, the company offers a broad range of products, including ceramic and porcelain tiles, natural stone, carpets, rugs, laminate, luxury vinyl tile, sheet vinyl, wood flooring, and countertops. The flooring giant is expected to announce its fiscal fourth-quarter earnings for 2025 in the near term.

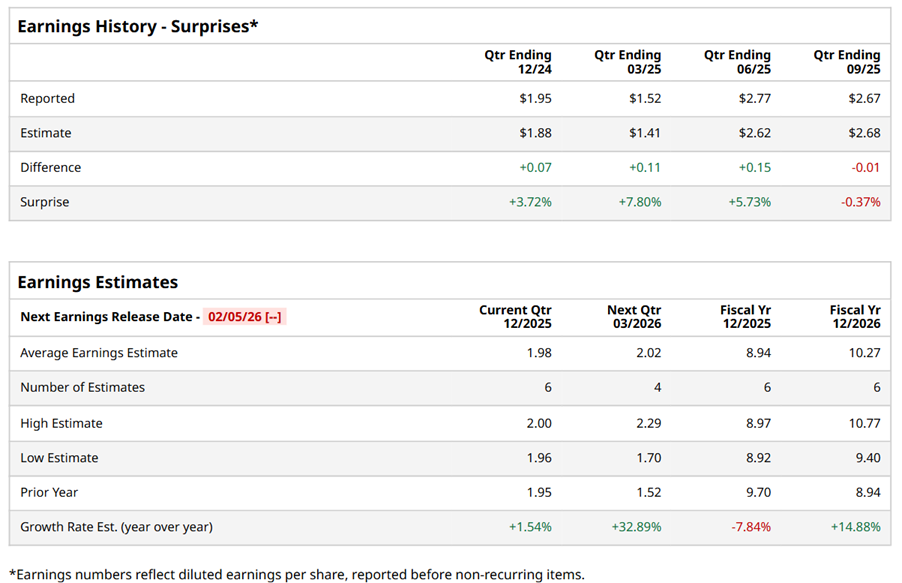

Ahead of the event, analysts expect MHK to report a profit of $1.98 per share on a diluted basis, up 1.5% from $1.95 per share in the year-ago quarter. The company beat the consensus estimates in three of the last four quarters while missing the forecast on another occasion.

For the full year, analysts expect MHK to report EPS of $8.94, down 7.8% from $9.70 in fiscal 2024. However, its EPS is expected to rise 14.9% year over year to $10.27 in fiscal 2026.

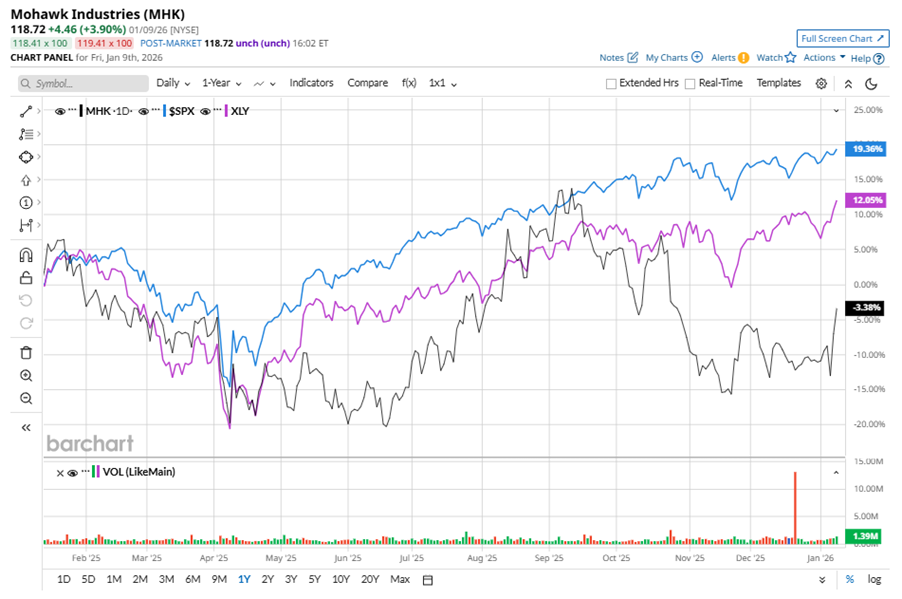

MHK stock has underperformed the S&P 500 Index’s ($SPX) 17.7% gains over the past 52 weeks, with shares up marginally during this period. Similarly, it underperformed the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 11.6% rise over the same time frame.

MHK's softer quarter was driven by weaker economic conditions and higher input costs, offsetting benefits from premium product sales and productivity initiatives. Management cited ongoing challenges in home furnishings, low consumer confidence, inflation, and hurricane impacts.

On Oct. 23, 2025, MHK reported its Q3 results, and its shares closed down by 7% in the following trading session. Its adjusted EPS of $2.67 fell short of Wall Street expectations of $2.68. The company’s revenue was $2.8 billion, topping Wall Street forecasts of $2.7 billion. For Q4, MHK expects its adjusted EPS to range from $1.90 to $2.

Analysts’ consensus opinion on MHK stock is moderately bullish, with a “Moderate Buy” rating overall. Out of 18 analysts covering the stock, eight advise a “Strong Buy” rating, and 10 give a “Hold.” MHK’s average analyst price target is $136.27, indicating a potential upside of 14.8% from the current levels.