The stock market is trading higher midday.

The S&P 500 gained 0.32% and the tech-heavy Nasdaq Composite added 0.56%. The Dow Jones Industrial Average rose 0.4%, while the Russell 2000 Index lost 0.3%.

Nvidia shares rose 2% by midday, touching a record $140.89. This uptick follows a strong third-quarter earnings report from Taiwan Semiconductor, a key Nvidia supplier, which also saw its stock rally.

S&P 500 big stock movers today

Five S&P 500 stocks making big midday moves are:

- Snap-On (SNA) +8.1%

- Travelers (TRV) +7.9%

- Blackstone (BX) 7.5%

- Steel Dynamics (STLD) +5.6%

- M&T Bank (MTB) +4.9%

The worst-performing five S&P 500 stocks with the largest midday drop are:

- Molina Healthcare (MOH) -12.9%

- Elevance Health (ELV) -11.7%

- Centene (CNC) -9.4%

- CSX (CSX) -5.8%

- Walgreens Boots Alliance (WBA) -5.4%

Stocks also worth noting include:

- Nvidia (NVDA) +2.7%

- Apple (AAPL) +0.3%

- Taiwan Semiconductor (TSM) +12.3%

- Uber (UBER) -2%

- Expedia (EXPE) +4.3%

Shutterstock

Taiwan Semiconductor surges on solid earnings

Taiwan Semiconductor shares surged 12% after the company reported strong Q3 earnings driven by AI demand.

Q3 net income reached NT$325.3 billion ($10.1 billion), beating LSEG estimates, while revenue grew 39% year-over-year to NT$759.69 billion ($23.6 billion).

Related: Nvidia CEO's bombshell raises the bar for the stock

For Q4, TSMC forecasts revenue between $26.1 billion and $26.9 billion, with the midpoint of $26.5 billion topping Wall Street's estimate of $24.9 billion.

“Our business was supported by strong smartphone and AI-related demand for our industry leading 3nm and 5nm technologies,” the company said in a statement.

Nvidia, Micron, and AMD shares also rose on the news, gaining 3%, 4%, and 1%, respectively.

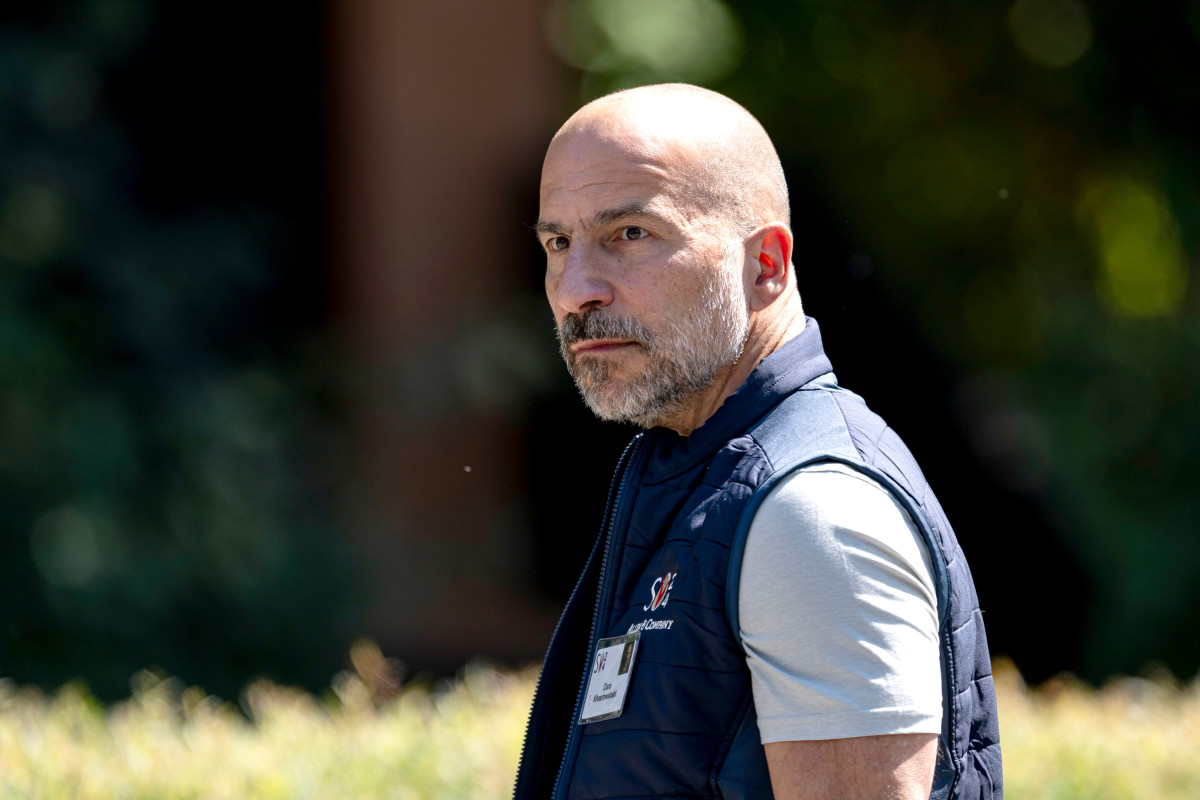

Expedia pops on potential Uber takeover

Expedia stock added 4% midday after the Financial Times reported a potential Uber takeover bid. Uber shares lost 2%.

Uber has held initial talks about a potential acquisition of Expedia, valued at $20 billion. The discussions are in early stages.

Related: Expedia CEO flags a trend that is hurting its pockets

Uber CEO Dara Khosrowshahi has a close connection to Expedia, having served as its CEO from 2005 to 2017 and currently holding a nonexecutive board position.

Wedbush Securities managing partner Dan Ives said in a CNBC interview that the acquisition of Expedia would be a step toward a “super app” for Uber.

Elevance Health slumps after weak earnings

Elevance Health shares lost more than 11% after the health insurance group posted weaker-than-expected third-quarter earnings.

The company reported adjusted earnings per share of $8.37, missing analysts’ forecast of $9.66. Total revenue increased by 5.3% to $45.1 billion from $42.8 billion a year earlier, beating the consensus estimate of $43.5 billion.

More Economic Analysis:

- Goldman Sachs analyst overhauls S&P 500 targets for 2024, 2025

- PCE Inflation report resets bets on another big Fed rate cut

- Why stocks are soaring and the rally has room to run

“We remain confident in the long-term earnings potential of our diverse businesses as we navigate a dynamic operating environment and unprecedented challenges in the Medicaid business,” CEO Gail Boudreaux said in a statement.

Health-care stocks Molina Healthcare and Centene also fell, down 13% and 10%, respectively.

Related: Veteran fund manager sees world of pain coming for stocks