The stock market is trading higher midday as Amazon's earnings boosted tech stocks.

The S&P 500 rose 0.44%, while the tech-heavy Nasdaq Composite climbed 0.73%. The Dow Jones Industrial Average gained 0.64%. The Russell 2000 Index added 0.42%.

S&P 500 big stock movers today

Five S&P 500 stocks making big midday moves are:

- Waters (WAT) +16.9%

- Charter Communications (CHTR) +12.7%

- Lululemon Athletica (LULU) +7.9%

- Intel (INTC) +6.9%

- Cardinal Health (CAH) +6.6%

The worst-performing five S&P 500 stocks with the largest midday drop are:

- Super Micro Computer Inc (SMCI) -9.7%

- AES (AES) -8.9%

- Erie Indemnity (ERIE) -8.1%

- Amcor (AMCR) -8.1%

- Entergy (ETR) -5.6%

Stocks also worth noting include:

- Amazon (AMZN) +6.19%

- Apple (AAPL) -1.62%

- Microsoft (MSFT) +1.42%

- Nvidia (NVDA) +1.76%

- Tesla (TSLA) -1.05%

Getty

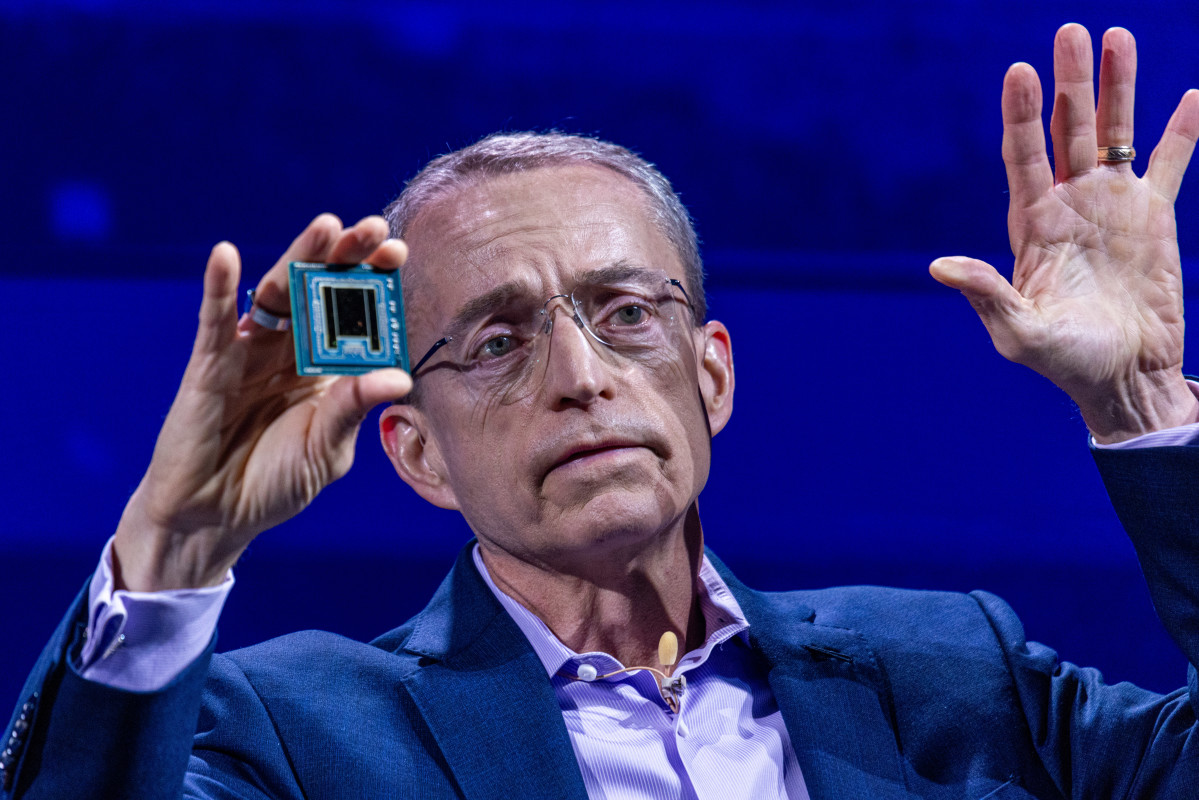

Intel surges after earnings beat

Intel shares jumped 6% following a stronger-than-expected earnings report and optimistic guidance.

The chipmaker posted adjusted earnings of 17 cents a share, beating expectations of a 2-cent loss. Revenue came in at $13.28 billion, down 6%, compared with the anticipated $13.02 billion.

Related: Can Intel be rescued? Analysts review embattled tech stock before earnings

Intel projected adjusted earnings of 12 cents per share for the fiscal fourth quarter, with revenue estimated between $13.3 billion and $14.3 billion. Analysts had anticipated adjusted earnings of 8 cents per share and revenue of around $13.66 billion.

CEO Pat Gelsinger highlighted Intel’s transformative restructuring efforts, which include cutting 16,500 jobs and reducing its real estate footprint, as part of a plan expected to be complete by late 2025.

Intel also plans to turn its foundry business into an independent subsidiary.

Apple falls after fiscal Q4 earnings

Apple dropped 1.5% despite an earnings beat.

For the quarter ending Sept. 28, Apple reported adjusted earnings of $1.64 per share, beating the $1.60 estimate, with revenue coming in at $94.93 billion, above the anticipated $94.58 billion.

Apple’s iPhone revenue hit $46.22 billion, up 6% year-over-year, while other segments like Mac, iPad, and Services trailed forecasts in the September quarter.

Related: Analysts revisit Apple stock price targets after earnings, iPhone 16 outlook

For the December quarter, Apple expects low-to-mid-single-digit-percent sales growth and similar momentum in its Services division.

Apple Intelligence for iPhones and Macs started to roll out this week as part of the iOS 18.1 update.

“We’re getting great feedback from customers and developers already and a really early stat, which is only three days worth of data: Users are adopting iOS 18.1 at twice the rate that they adopted 17.1 in the year-ago quarter,” Chief Executive Tim Cook said.

Amazon rises on stronger-than-anticipated earnings

Amazon added 6% after the company reported earnings of $1.43 per share, topping expectations of $1.14, with revenue reaching $158.88 billion, above the anticipated $157.2 billion. The performance was driven by solid growth in cloud computing and advertising.

Amazon Web Services, the company’s cloud segment, posted $27.4 billion in revenue, below the $27.5 billion forecast. AWS grew 19% year-over-year, above the 12% growth in the year-earlier quarter.

More AI Stocks:

- Analysts update Meta stock price target with Q3 earnings in focus

- Veteran trader who called Palantir rally unveils new price target

- Open AI is burning cash (and losing billions!)

Amazon CEO Andy Jassy said the company expected to allocate $75 billion to capital expenditures in 2024, and probably more than that in 2025, driven by generative AI.

“It is a really unusually large, maybe once-in-a-lifetime type of opportunity,” he said.

Related: Veteran fund manager sees world of pain coming for stocks