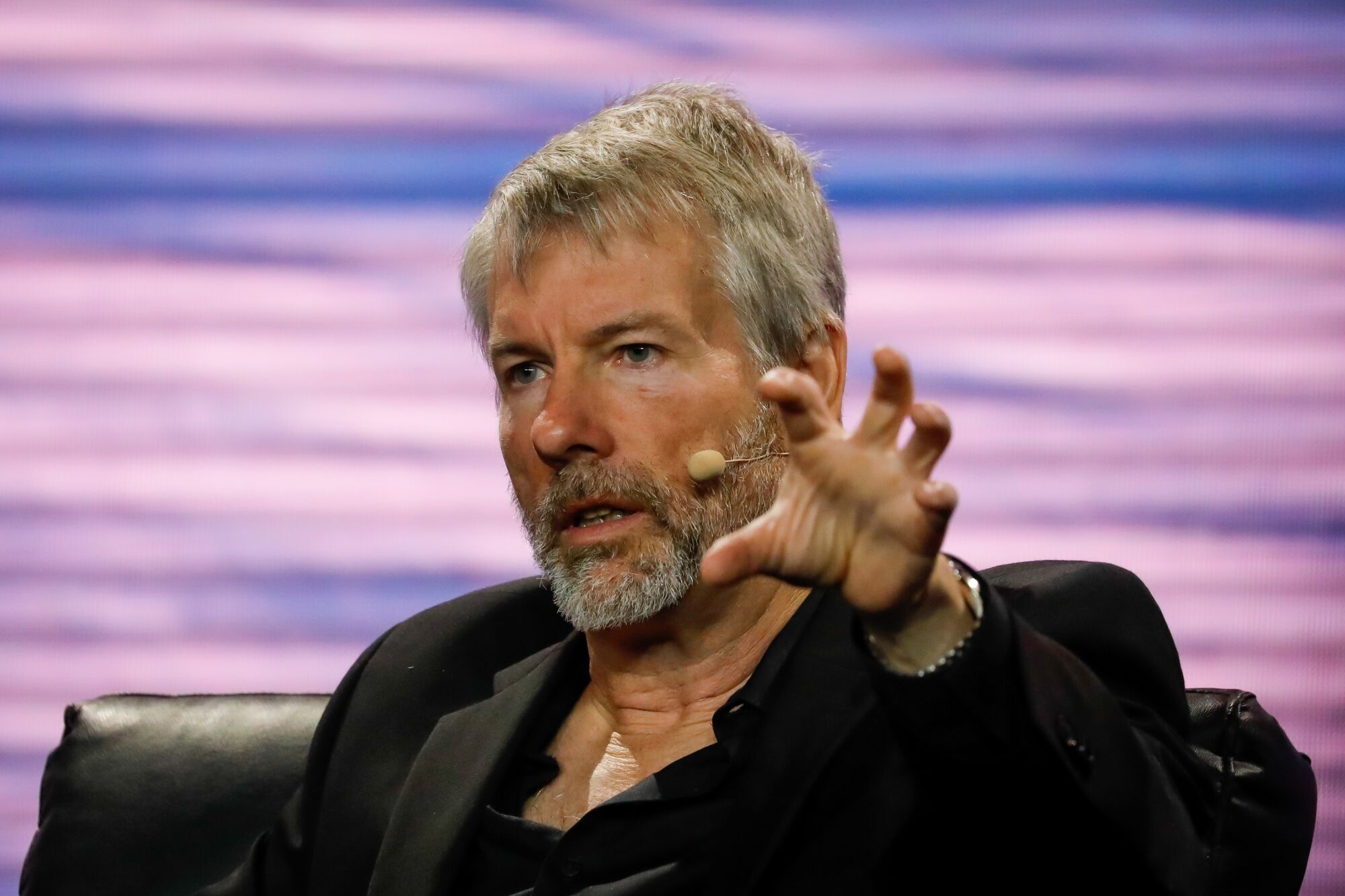

MicroStrategy Inc. co-founder and Executive Chairman Michael Saylor said the enterprise-software company, better known as the largest publicly traded holder of Bitcoin, may at some point consider dabbling in futures contracts on CME Group’s marketplace to generate yield.

In the past, MicroStrategy had considered but decided against lending out its Bitcoin through other companies, some of which went bankrupt last year, Saylor said in a Bloomberg TV interview on Monday. Crypto lenders Celsius Network and BlockFi filed for protection against creditors in 2022, as did broker Voyager Digital; lender Genesis Global Holdco LLC filed for bankruptcy in January.

“In the future we will always consider forward yields,” Saylor said. “We may find a way to generate yield this way.”

MicroStrategy began investing in Bitcoin in August 2020. By the end of December, the company held a cache of about 132,500 tokens, worth about $2.2 billion, according to data compiled by Bloomberg. The value of the holdings has increased with the recent rally in crypto.

Saylor also said he doesn’t plan to separate MicroStrategy’s enterprise-software and Bitcoin businesses, as one feeds into the other.

Last week, the Tysons Corner, Virginia-based firm reported a net loss of $249.7 million in the fourth quarter. Revenue fell 1.5% to $132.6 million, a less-than-forecast drop. The company took an impairment charge, due to a decline in the value of its Bitcoin holdings and net of gains on sales, of $197.6 million in the three months ended in December.

Last year, Saylor relinquished the chief executive role of the company he co-founded to focus on advancing his strategy of holding Bitcoin on the company’s balance sheet instead of conventional assets like cash.

Bitcoin tumbled 64% in 2021, helping to send the company’s shares down 74%. The world’s biggest cryptocurrency is up 40% so far this year, while MicroStrategy’s shares have surged 99% year to date. They’re still down more than 27% in the past year. The stock dropped less than 1% to $279.89 as of 9:50 a.m. in New York.

©2023 Bloomberg L.P.