Microsoft posted stronger-than-expected fourth-quarter earnings Tuesday, but a modestly weaker growth rate in its flagship cloud division and a big jump in AI spending sent shares sharply lower in after-hours trading.

Microsoft (MSFT) said earnings for the three months ending in June, the group's fiscal fourth quarter, rose 9.7% from last year to $2.95 per share, topping Street forecasts of $2.94 per share.

Group revenues, Microsoft said, rose 15.1% to $64.7 billion, above analysts' forecasts of $64.4 billion.

Revenues for Microsoft's Azure cloud division, its biggest growth driver, were up 29%, just shy of the Street's 30% forecast. Overall Intelligent Cloud revenues rose 19% to $28.52 billion, just missing the Street's $25.8 billion forecast.

Microsoft noted, however, that around 8 percentage points of Azure growth came from AI investments, a larger figure than the 7 percentage point boost from the prior quarter.

Capital spending for the quarter rose 77.6% from last year to $19 billion, well ahead of the $14 billion tallied over the three months ending in March.

TheStreet/Shutterstock/Justin Sullivan/Getty Images

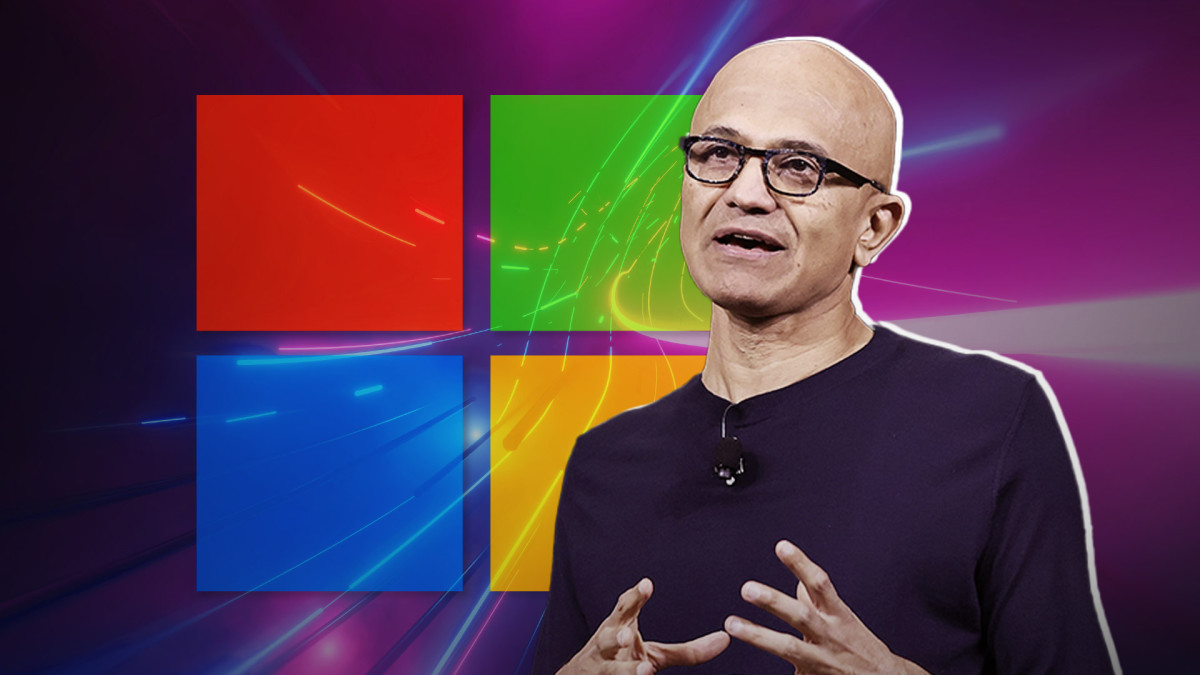

“Our strong performance this fiscal year speaks both to our innovation and to the trust customers continue to place in Microsoft," said CEO Satya Nadella.

“As a platform company, we are focused on meeting the mission-critical needs of our customers across our at-scale platforms today while also ensuring we lead the AI era," he added.

Related: Microsoft earnings: Azure growth, AI spending key as big tech wavers

Microsoft shares were marked 5.9% lower in after-hours trading immediately following the earnings release, indicating a Wednesday opening bell price of $397.99 each.

$MSFT earnings reaction 🩸 pic.twitter.com/qsBJwFCyJw

— Javier 🤘 (@JaviCharts) July 30, 2024

"I do think we could see an 'air pocket' in Microsoft's ability to monetize AI investments and their capital spending is going to ramp up faster than the revenue will follow," said Rishi Jaluria of RBC Capital Markets during an interview on CNBC.

"It's going to take time to play out, but Microsoft has had experience with this kind of capex build-out, including expansions of Azure, Office, and X-Box, and I have faith in (CEO Nadella)," he added.

In other divisions, Productivity and business revenues, which includes Office 365, were up 11% from last year to $20.3 billion, Microsoft said, while More Personal Computing revenues, which includes Windows, were up 14% to $15.9 billion.

Related: Veteran fund manager sees world of pain coming for stocks