/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)

Microsoft Corp. (MSFT) stock has been trading in a range for the last 2 months. Shorting out-of-the-money (OTM) put options has been one of the best plays. Right now, a one-month 4% OTM put provides a 1.5% income yield.

MSFT is trading at $475.35 in morning trading on Friday, Jan. 9. This represents a decrease from $492.02 one month ago, on Dec. 9, and from $496.82 on Nov. 7.

I've been recommending shorting out-of-the-money (OTM) put options in MSFT stock. For example, a month ago, on Dec. 9, I wrote a Barchart article, “How to Make a 1.1% Yield Shorting One-Month Microsoft Puts.”

I suggested selling short the $475.00 put option expiring today. At the time, MSFT was at $491.00, so this strike price was over 3% below the trading price.

However, the investor received $5.63 for each contract (multiplied by 100 shares, or $563 for an investment of $47,500). That worked out to a one-month 1.185% income yield.

Today, that put option could expire worthless. It makes sense for the investor to do a new one-month short-put play.

High Price Targets

I showed in my Nov. 4, 2025, Barchart article that MSFT stock could be worth as much as $682.55 per share over the next 12 months (NTM). That was based on its strong FY 26 Q1 results with 33% FCF margins.

Since then, analysts have raised their revenue forecasts for the next two years. So, theoretically, I should hike my FCF-based price target (PT), which was based on a 30% FCF margin assumption.

Moreover, analysts have been maintaining their high price targets (PTs). For example, Yahoo! Finance reports that 57 analysts have hiked their PTs to $622.51. That is close to where it was two months ago ($626.71).

Similarly, Barchart's mean PT is $630.07, compared to $632.77 two months ago.

The bottom line is that analysts still see MSFT stock as undervalued.

Shorting One-Month MSFT Puts

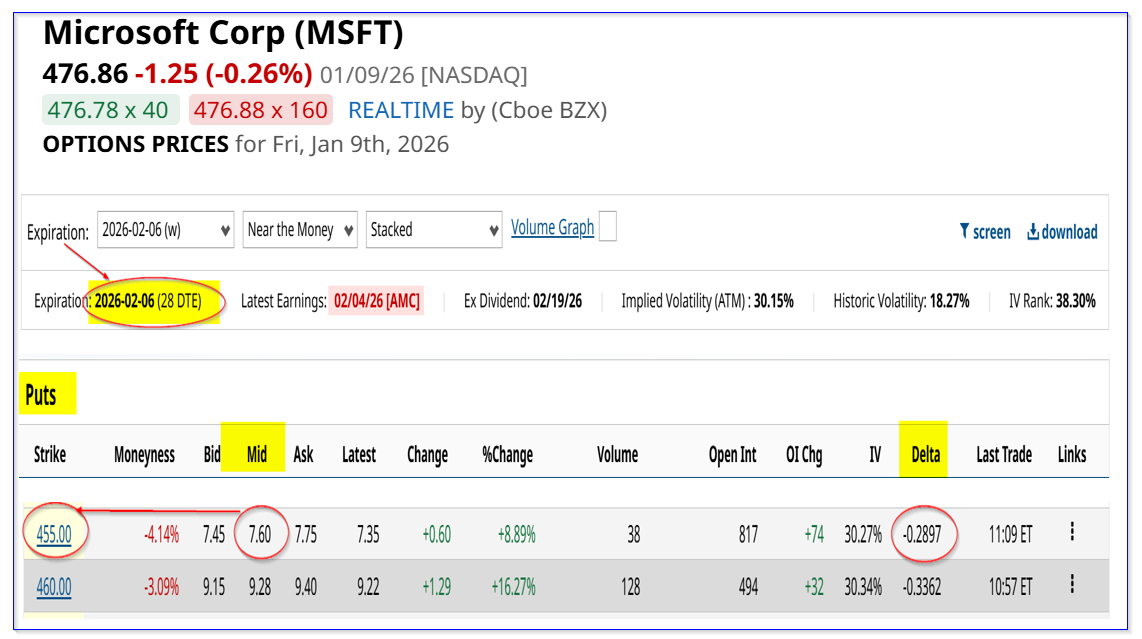

Today, the Feb. 6, 2026, expiry period shows that the $455.00 strike price put contract has a $7.60 midpoint premium. That provides an immediate yield of 1.67% for a put exercise price that is 4% below today's trading price.

This means that an investor who secures $45,500 in cash or buying power with their brokerage firm can enter an order to “Sell to Open” 1 put contract.

Their account will immediately receive $760.00, or 1.67% of the cash secured as collateral to buy 100 shares at $455.00.

The point is that if MSFT stays flat or rises closer to its higher PT over the next month, the investor has no obligation to buy 100 shares at $455.00.

Moreover, don't forget that the cumulative income over the past two months from these two short-put plays has been $13.23, or $1,323 for an average investment of $46,500, or 2.845%.

That works out to an annualized return of 17% if this type of income play can be repeated.

In other words, this is a great way to both set a potential lower buy-in point and also gain extra income.

Moreover, some less risk-averse investors can use that income to buy in-the-money (ITM) call options further out. That way, they can benefit from any upside in MSFT stock with less risk.