What you need to know

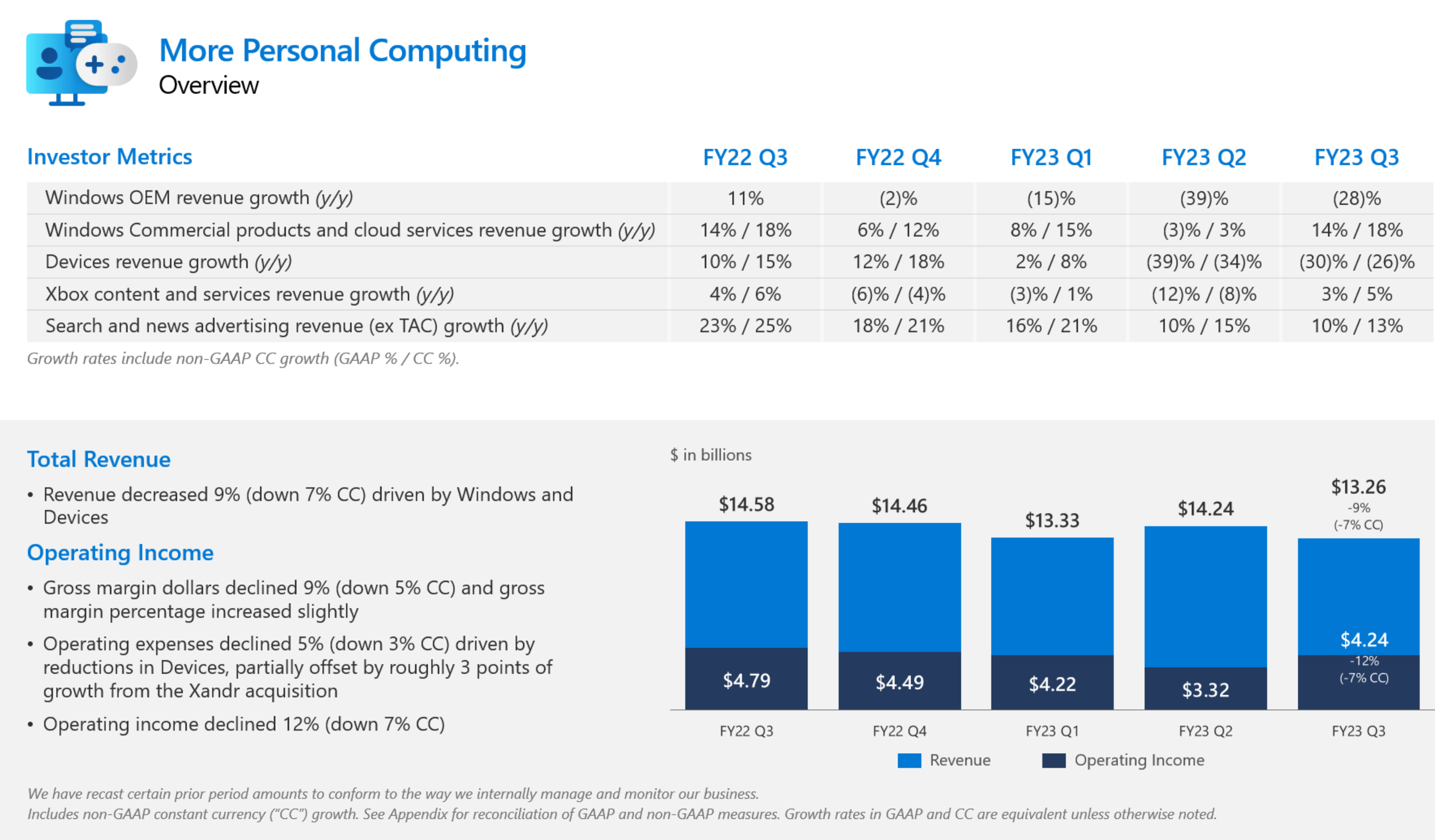

- Microsoft revenue was down 9% year-over-year in its More Personal Computing division.

- Windows OEM revenue declined by 28%, while Surface was down 30%.

- A weak PC market, driven by external economic headwinds and too much inventory, is hurting the Surface division.

Microsoft’s FY23 Q3 results are out today, and while overall, the company is doing well with $52.9 billion in revenue (up 7%), the gains were primarily driven by cloud, LinkedIn, servers, and commercial products. That $52.9 billion surprised Wall Street, which expected $51 billion. As a result, Microsoft's stock is up 5% in after-hours trading.

Turning to the consumer angle with some enterprise crossover is the More Personal Computing division, which includes Windows, Surface (“devices), Xbox and gaming, and search. Unfortunately, that part of Microsoft is not doing great, with a decline of 9% year-over-year, due to the waning demand for Surface and Windows.

Windows OEM revenue declined by 28% due to “elevated channel inventory levels,” which is corporate speak for too many in-stock products (from its OEM partners) and not enough people buying them. Microsoft notes that this is “beyond declining PC demand,” which suggests it is doing a bit worse than the market.

Not all is bad, however, as commercial Windows OEM products and cloud services grew 14%, driven by “strong renewal execution and an increase in agreements that carry higher in-period revenue recognition.”

Turning to Microsoft Surface, which the company calls “devices,” revenue is down 30%, again related to “elevated channel inventory levels” and a weak PC market.

Last quarter was worse for Microsoft as Surface saw a steeper 39% drop in revenue, but compounded with today's 30% report, and Microsoft is losing quite a bit compared to previous quarters with no end in sight.

Search (Bing) and news advertising (MSN) are up 10%, excluding traffic acquisition costs driven by “higher search volume and the Xandr acquisition.”

Finally, Xbox and gaming revenue was down 4%, but content and services, driven by Xbox Game Pass, grew by 3%, suggesting Microsoft is still onto a long-term winning formula for gamers. Xbox hardware revenue, however, was also down by 30%, which again means consumers are not spending as much as they did a year ago due to inflation and recession concerns.

Windows Central’s Take

Unfortunately, none of this news is too surprising. We recently reported how even Apple, with its highly touted M1 and M2 processors, saw a 40% decline in shipments, according to IDC. It is unclear how that translates into Apple’s revenue, but the company tends to have high-profit margins on its hardware. Indeed, one report said things were so bad Apple halted M-processor manufacturing in January and February to prevent “elevated channel inventory levels.” Apple resumed chip production in March, but only at half the previous level.

But, besides the apparent decline in the overall consumer market for new expensive purchases, Microsoft may have some other lingering issues tied to an aging and arguably less-interesting product lineup. For example, Surface Laptop 5 and Surface Pro 9, while generally well-reviewed, seemed to have landed with a thump. Likewise, Surface Duo 2 is discontinued and has no replacement until sometime in 2024.

Indeed, we’ve heard through our reporting that due to “elevated channel inventory levels,” Microsoft has pushed back devices like Surface Go 4 and Surface Laptop Studio 2 until the fall instead of its initially planned spring release. The company reportedly has too much on-hand stock of older hardware to clear out first, and launching in a weak PC market wouldn’t help.

The PC market may not return to more robust levels until 2024, assuming a recession doesn’t grip the world’s economy. But it also remains to be seen if Microsoft can renew consumer interest in its usually exciting Surface hardware.