Yesterday it was Nvidia (NVDA) and today it’s Micron (MU).

Both chipmakers are moving lower on Tuesday following bearish news this week.

Shortly before the open on Monday, Nvidia warned that its revenue results in the current quarter were well below expectations. The company said it generated $6.7 billion in sales last quarter.

Keep in mind: This was just an update from management, not the company’s quarterly results, which are due on Aug. 24.

The $6.7 billion in sales misses analysts’ expectations of $8.1 billion in sales and are down 19% year over year. Management pegged the miss to its gaming segment.

Noteworthy: Cathie Wood was buying the dip.

As for Micron, the company said it expected fiscal-fourth-quarter revenue to come in at or below the $6.8 billion to $7.6 billion range it provided on June 30. Further, it expects a difficult fiscal fourth quarter for 2022 and fiscal first quarter for 2023 due to supply-chain constraints.

All this follows Advanced Micro Devices (AMD) earnings report from last week, which was largely viewed as a positive by Wall Street even though guidance was a tad light.

Let’s look at the charts.

Trading Nvidia Stock

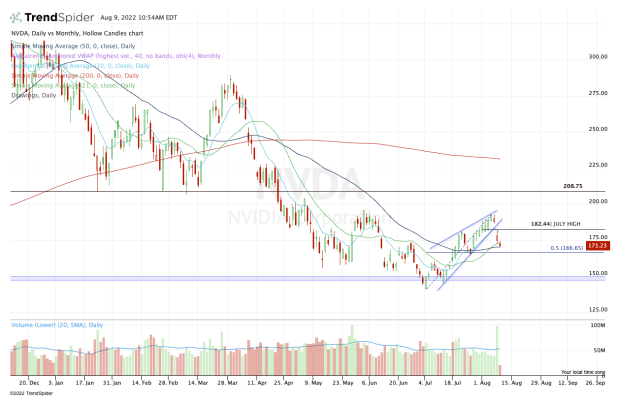

Chart courtesy of TrendSpider.com

Nvidia's chart looks vulnerable right now.

Traders are looking at a rising wedge formation that has now broken to the downside. The stock is back below the July high and is struggling to hold its short-term moving averages (like the 10-day and 21-day).

There is a clear line in the sand, though, and that’s $164.75.

If Nvidia stock breaks below that measure, it will put the stock below its 50-day moving average and 50% retracement. It will also put it below the July 26 low, a level that stock rallied hard off of and pushed to this month's high.

If the stock breaks and closes below $164.75, it would not be surprising if it went on to retest $150. Below $150 leaves the 2022 low vulnerable to near $140.50.

If the 50-day holds, $182.50 becomes a key focus in the short term.

Not only is this level the July high, but it’s also near where we find the 10-day moving average. If Nvidia can shake off the bad news and clear this level, the $186.66 gap-fill is in sight, followed by a push back into the $190s.

Trading Micron Stock

Chart courtesy of TrendSpider.com

Like Nvidia, Micron stock doesn't look all that encouraging.

The stock was trying to hold the 10-day, 21-day and 50-day moving averages following Nvidia’s news on Monday.

But Micron’s news on Tuesday forced the stock to break support. The shares tried to rally off the open but were rejected by the $60 level.

For now, the 50% retracement is holding as support. But the $56.50 to $58.20 range is key. That’s the 61.8% to 50% retracement zone.

If we lose the 50% retracement near the latter level — $58.20 — then it puts the $55 to $56.50 level in play. There we have the 61.8% retracement, the monthly VWAP and the breakout level from 2020.

Below that zone opens the door down to the 2022 low at $51.50.

On the upside, the bulls need to see Micron get back above its three key moving averages: the 10-day, 21-day and 50-day.

Currently, that’s a move above $62. If it can do so, the bulls can regain momentum. Until then, the shares may be stuck in no-man’s land.