Mark Zuckerberg-led Meta Platforms, Inc. (NASDAQ:META) has introduced Llama 3.3 70B, a new AI model that outperforms competitors like Alphabet Inc.'s (NASDAQ:GOOG) (NASDAQ:GOOGL) Google, OpenAI, and Amazon.com, Inc. (NASDAQ:AMZN).

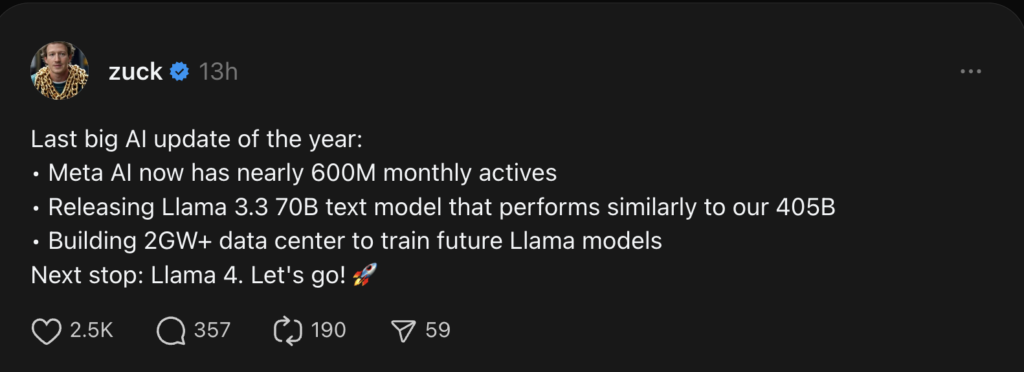

What Happened: Announced on Friday, the model offers the performance of Meta’s largest Llama model, Llama 3.1 405B, but at a reduced cost.

According to Ahmad Al-Dahle, Meta’s VP of generative AI, Llama 3.3 70B leverages advanced post-training techniques to enhance core performance efficiently.

Taking to X, formerly Twitter, he shared a chart demonstrating the model’s superiority over Google’s Gemini 1.5 Pro, OpenAI’s GPT-4o, and Amazon’s Nova Pro on various benchmarks, including MMLU.

The model is available for download on platforms like Hugging Face and the official Llama website.

In a post on Threads, Zuckerberg noted that Meta AI, powered by Llama models, now has nearly 600 million monthly active users. The company is also building a $10 billion AI data center in Louisiana to support future Llama models.

Subscribe to the Benzinga Tech Trends newsletter to get all the latest tech developments delivered to your inbox.

Why It Matters: Earlier in October it was reported that Meta plans to develop an AI-powered search engine to reduce its dependence on major tech players like Alphabet and Microsoft Corporation.

Meta has also made a shift toward nuclear power to support its AI ambitions. The company is seeking proposals for nuclear energy projects to power its AI initiatives, aiming for 1-4 gigawatts of new nuclear generation capacity in the U.S. by the early 2030s.

In its third-quarter earnings report, Meta reported a revenue beat of $40.59 billion, surpassing analyst expectations. The company also highlighted the strong momentum in AI.

Price Action: Meta’s stock rose 2.44% on Friday to close at $623.77 but dipped slightly by 0.08% in after-hours trading. So far this year, Meta shares have surged 80.13%, far outpacing the Nasdaq 100 index's 30.7% gain during the same timeframe, according to Benzinga Pro data.

The consensus price target for Meta, based on evaluations from 41 analysts, stands at $639.05, with Rosenblatt setting the highest target at $811 on Oct. 31. Latest ratings from Raymond James, Wells Fargo, and Citigroup average $673.67, pointing to a potential upside of 8%.

Check out more of Benzinga's Consumer Tech coverage by following this link.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock