/Merck%20%26%20Co%20Inc%20HQ%20-by%20Sundry%20Photography%20via%20iStock.jpg)

Merck & Co., Inc. (MRK), based in Rahway, New Jersey, is a healthcare company. Valued at $264.2 billion by market cap, the company delivers health solutions through its prescription medicines, vaccines, biologic therapies, animal health, and consumer care products, which it markets directly and through its joint ventures. The pharmaceutical giant is expected to announce its fiscal fourth-quarter earnings for 2025 before the market opens on Tuesday, Feb. 3.

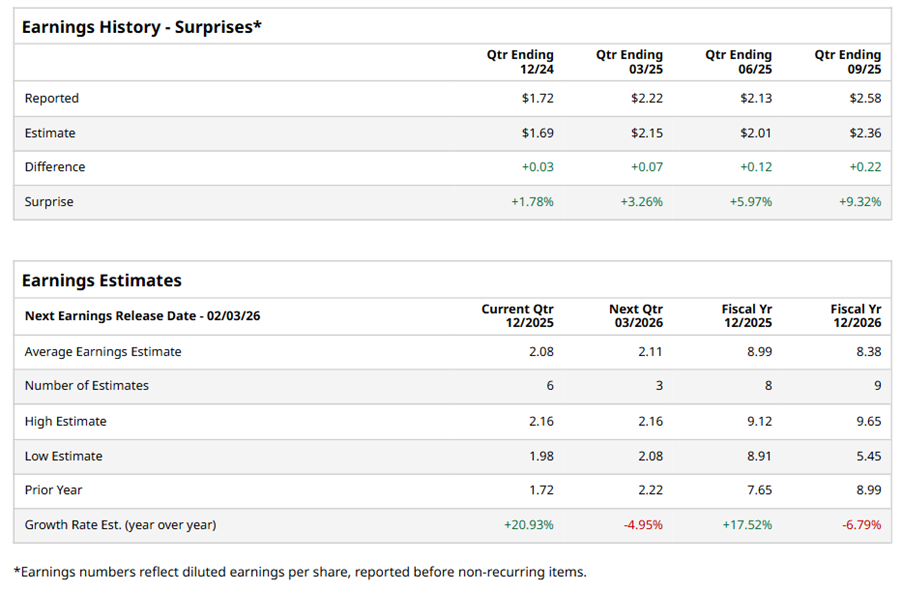

Ahead of the event, analysts expect MRK to report a profit of $2.08 per share on a diluted basis, up 20.9% from $1.72 per share in the year-ago quarter. The company has consistently surpassed Wall Street’s EPS estimates in its last four quarterly reports.

For the full year, analysts expect MRK to report EPS of $8.99, up 17.5% from $7.65 in fiscal 2024. However, its EPS is expected to decline 6.8% year over year to $8.38 in fiscal 2026.

MRK stock has underperformed the S&P 500 Index’s ($SPX) 16.2% gains over the past 52 weeks, with shares up 8.4% during this period. Similarly, it underperformed the Health Care Select Sector SPDR Fund’s (XLV) 11.6% returns over the same time frame.

MRK is underperforming due to heightened regulatory scrutiny, pricing pressures, and looming patent cliffs for key drugs, which face generic competition. Moreover, slowing Keytruda growth, weak Winrevair sales, and declining Gardasil sales in China are also weighing on sentiment.

On Oct. 30, 2025, MRK shares closed down marginally after reporting its Q3 results. Its adjusted EPS of $2.58 topped Wall Street expectations of $2.36. The company’s revenue was $17.3 billion, topping Wall Street forecasts of $17.1 billion. MRK expects full-year adjusted EPS in the range of $8.93 to $8.98, and expects revenue in the range of $64.5 billion to $65 billion.

Analysts’ consensus opinion on MRK stock is moderately bullish, with a “Moderate Buy” rating overall. Out of 26 analysts covering the stock, 14 advise a “Strong Buy” rating, one suggests a “Moderate Buy,” and 11 give a “Hold.” MRK’s average analyst price target is $111.35, indicating a potential upside of 3.6% from the current levels.